EasyJet 2014 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2014 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

126 easyJet plc Annual report and accounts 2014

Notes to the accounts continued

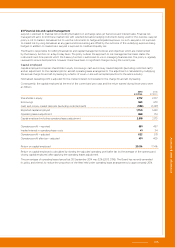

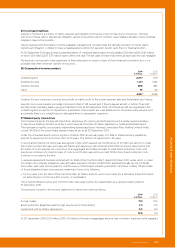

23 Financial risk and capital management continued

Capital management

The objective of capital management is to ensure that easyJet is able to continue as a going concern whilst delivering

shareholder expectations of a strong capital base as well as returning benefits for other stakeholders and optimising the cost

of capital.

easyJet manages its capital structure in response to changes in both economic conditions and strategic objectives. The cash

and net debt position, together with the maturity profile of existing debt, is monitored to ensure the continuity of funding.

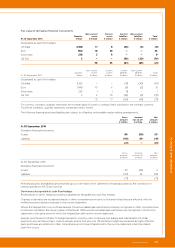

The principal measure used by easyJet to manage capital risk is the gearing ratio of debt to capital employed. Debt is defined

as borrowings less cash (including money market deposits but excluding restricted cash) plus seven times aircraft operating

lease payments. Capital employed is defined as shareholders’ equity plus debt as previously defined. Gearing has increased to

17% (2013: 7%).

Liquidity risk management

The objective of easyJet's liquidity risk management is to ensure sufficient cash resources and the availability of funding as

required. easyJet holds financial assets either for which there is a liquid market or which are expected to generate cash inflows

that are available to meet liquidity needs.

easyJet continues to hold significant cash and liquid funds to mitigate the impact of potential business disruption events with

Board-approved policy stating a target level of liquidity of £4 million per aircraft in the fleet. Total cash (excluding restricted

cash) and money market deposits at 30 September 2014 was £985 million (2013: £1,237 million). Surplus funds are invested in

high-quality short-term liquid instruments, usually money market funds, bank deposits or tri-party repos.

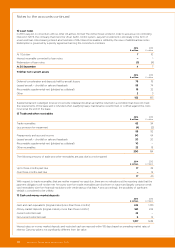

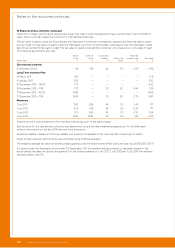

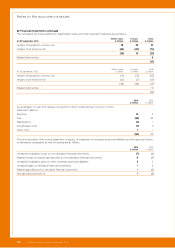

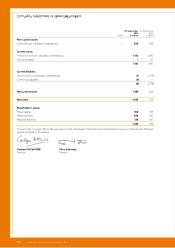

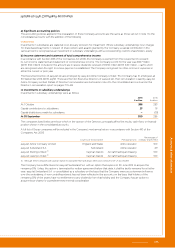

The maturity profile of financial liabilities based on undiscounted gross cash flows and contractual maturities is as follows:

At 30 September 2014

Within 1 year

£ million

1-2 years

£ million

2-5 years

£ million

Over 5 years

£ million

Borrowings 97 178 220 105

Trade and other payables 434 – – –

Derivative contracts – receipts (1,826) (1,173) (69) –

Derivative contracts – payments 1,861 1,159 69 –

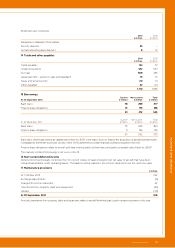

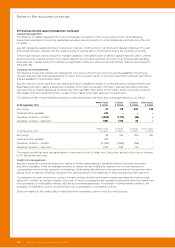

At 30 September 2013

Within 1 year

£ million

1-2 years

£ million

2-5 years

£ million

Over 5 years

£ million

Borrowings 99 102 356 180

Trade and other payables 454 – – –

Derivative contracts – receipts (2,494) (1,885) (128) –

Derivative contracts – payments 2,512 1,878 125 –

The maturity profile has been calculated based on spot rates for the US dollar, euro, Swiss franc and jet fuel at close of business

on 30 September each year.

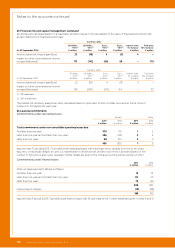

Credit risk management

easyJet is exposed to credit risk arising from cash and money market deposits, derivative financial instruments and trade

and other receivables. Credit risk management aims to reduce the risk of default by setting limits on credit exposure to

counterparties based on their respective credit ratings. Credit ratings also determine the maximum period of investment when

placing funds on deposit. Credit risk is limited to the carrying amount in the statement of financial position at each year end.

Counterparties for cash investments, currency forward contracts and jet fuel forward contracts are required to have a credit

rating of A- or better at contract inception. Exposures to those counterparties are regularly reviewed and, when the market view

of a counterparty’s credit quality changes, adjusted as considered appropriate. Accordingly, in normal market conditions, the

probability of material loss due to non-performance by counterparties is considered to be low.

Disclosure relating to the credit quality of trade and other receivables is given in note 12 to the accounts.