EasyJet 2014 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2014 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Accounts & other information

www.easyJet.com 109

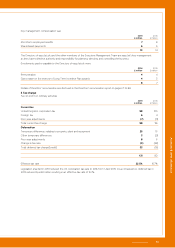

Impact of new standards and interpretations

The following standards and interpretations issued by the International Accounting Standards Board have been implemented

for the year ended 30 September 2014:

IFRS 1 First-time Adoption of International Financial Reporting Standards – Government Loans

IFRS 7 Financial Instruments: Disclosure – Offsetting Financial Assets and Financial Liabilities

IAS 19 Employee benefits – Amended standard resulting from the post-employment benefits and termination benefits projects

IAS 27 Separate Financial Statements

IAS 28 Investments in Associates and Joint Ventures

Impact of Annual Improvements to IFRS 2009 – 2011 Cycle

IFRS 10 Consolidated Financial Statements

IFRS 11 Joint Arrangements

IFRS 12 Disclosure of interests in other entities

IFRS 13 Fair Value Measurement

The adoption of these standards and interpretations has not led to any changes in accounting policies, or had a material impact

on easyJet’s accounts.

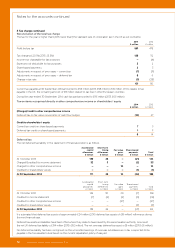

New and revised standards and interpretations not applied

The following new or revised standards and interpretations issued by the International Accounting Standards Board have not

been applied in preparing these accounts as their effective dates fall in periods beginning on or after 1 October 2014.

30 15

IAS 32 Financial Instruments Presentation – Amendments relating to the offsetting of Financial Assets and Financial Liabilities

IAS 36 Impairment of Assets – Amendments arising from Recoverable Amount Disclosure for Non-Financial Assets

IAS 39 Amendments relating to Novation of Derivatives and Continuation of Hedge Accounting

IFRIC 21 Levies

Annual Improvements to IFRS 2010-2012 Cycle

Annual Improvements to IFRS 2011-2013 Cycle

30 17

IAS 16 and IAS 38 Amendments relating to Clarification of Acceptable Methods of Depreciation and Amortisation

IAS 27 Amendments relating to Equity Method in Separate Financial Statements

IFRS 10 and IAS 28 Amendments relating to Sale or Contribution of Assets between an Investor and its Associate or Joint Venture

IFRS 11 Amendments relating to Acquisitions of Interests in Joint Operations

Effective for the year ending 30 September 2018

IFRS 15 Revenue from Contracts with Customers

Effective for the year ending 30 September 2019

IFRS 9 Financial Instruments – Finalised version, incorporating requirements for classification and measurement, impairment,

general hedge accounting and derecognition

The Directors do not anticipate that the adoption of these standards and interpretations will have a material impact on easyJet's

accounts. Certain of these standards and interpretations will, when adopted, require addition to or amendment of disclosures in

the accounts.