EasyJet 2014 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2014 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

114 easyJet plc Annual report and accounts 2014

Notes to the accounts continued

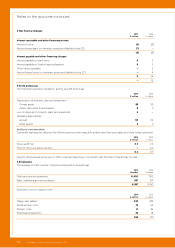

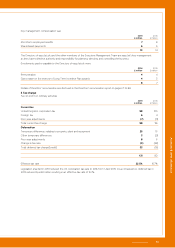

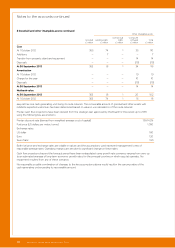

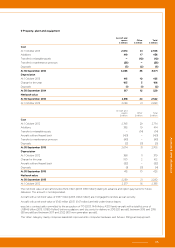

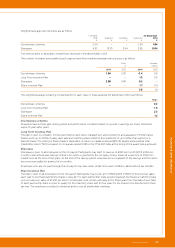

8 Goodwill and other intangible assets continued

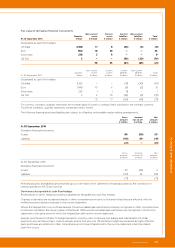

Other intangible assets

Goodwill

£ million

Landing rights

£ million

Contractual

rights

£ million

Computer

software

£ million

Total

£ million

Cost

At 1 October 2012 365 74 1 35 110

Additions – 7 – – 7

Transfer from property, plant and equipment – – – 14 14

Disposals – – – (15) (15)

At 30 September 2013 365 81 1 34 116

Amortisation

At 1 October 2012 – – – 19 19

Charge for the year – – – 10 10

Disposals – – – (15) (15)

At 30 September 2013 – – – 14 14

Net book value

At 30 September 2013 365 81 1 20 102

At 1 October 2012 365 74 1 16 91

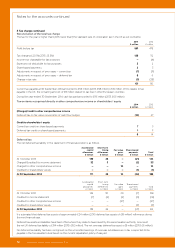

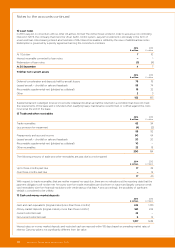

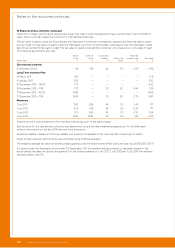

easyJet has one cash-generating unit, being its route network. The recoverable amount of goodwill and other assets with

indefinite expected useful lives has been determined based on value in use calculations of the route network.

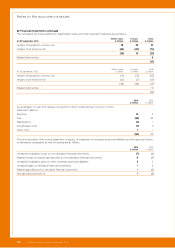

Pre-tax cash flow projections have been derived from the strategic plan approved by the Board for the period up to 2019,

using the following key assumptions:

Pre-tax discount rate (derived from weighted average cost of capital) 13.6-14.2%

Fuel price (US dollars per metric tonne) 1,050

Exchange rates:

US dollar 1.60

Euro 1.20

Swiss franc 1.53

Both fuel price and exchange rates are volatile in nature, and the assumptions used represent management's view of

reasonable average rates. Operating margins are sensitive to significant changes in these rates.

Cash flow projections beyond the forecast period have been extrapolated using growth rate scenarios ranging from zero up

to an estimated average of long-term economic growth rates for the principal countries in which easyJet operates. No

impairment resulted from any of these scenarios.

No reasonably possible combination of changes to the key assumptions above would result in the carrying value of the

cash-generating unit exceeding its recoverable amount.