EasyJet 2014 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2014 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Accounts & other information

www.easyJet.com 111

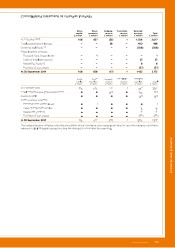

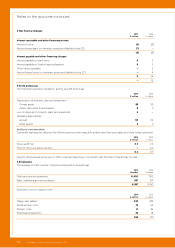

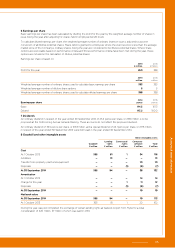

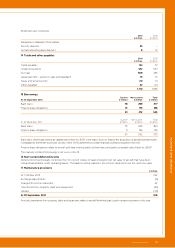

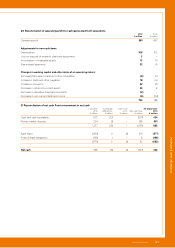

Key management compensation was:

2014

£ million

2013

£ million

Short-term employee benefits 7 8

Share-based payments 6 6

13 14

The Directors of easyJet plc and the other members of the Executive Management Team are easyJet's key management

as they have collective authority and responsibility for planning, directing and controlling the business.

Emoluments paid or payable to the Directors of easyJet plc were:

2014

£ million

2013

£ million

Remuneration 4 4

Gains made on the exercise of Long Term Incentive Plan awards 4 3

8 7

Details of Directors' remuneration are disclosed in the Directors' remuneration report on pages 71 to 88.

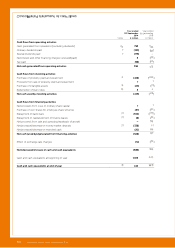

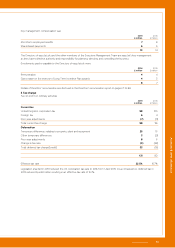

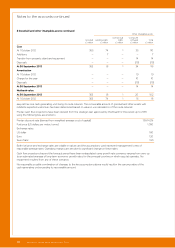

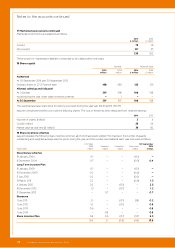

5 Tax charge

Tax on profit on ordinary activities

2014

£ million

2013

£ million

Current tax

United Kingdom corporation tax 99 103

Foreign tax 6 4

Prior year adjustments (7) (11)

Total current tax charge 98 96

Deferred tax

Temporary differences relating to property, plant and equipment 25 15

Other temporary differences 3 (9)

Prior year adjustments 8 6

Change in tax rate (3) (28)

Total deferred tax charge/(credit) 33 (16)

131 80

Effective tax rate 22.5% 16.7%

Legislation enacted in 2013 reduced the UK corporation tax rate to 20% from 1 April 2015. As a consequence, deferred tax in

2013 reduced by £28 million resulting in an effective tax rate of 16.7%.