EasyJet 2014 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2014 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16 easyJet plc Annual report and accounts 2014

Chief Executive’s review continued

easyJet allocates its aircraft and capacity to optimise the

returns across its network and it discontinued 36 routes

during the financial year.

easyJet maintains a strong balance sheet with low gearing

and therefore derives a competitive advantage through

access to funding at a lower cost. Over the cycle, easyJet

is committed to earning returns in excess of its cost of

capital, and intends to fund both aircraft purchases and

dividends from the cash generated from the business.

During the year easyJet revised its financial objectives

and metrics to provide a clear capital structure framework.

This framework allows easyJet to withstand external shocks

such as an extended closure of airspace, significant fuel price

increases or a sustained period of low yields whilst being in a

position to drive growth and returns for shareholders.

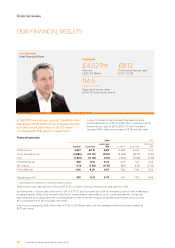

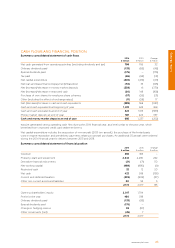

As at 30 September 2014, easyJet had cash and money

market deposits of £985 million, a decrease of £252 million on

30 September 2013 which reflects the payment of £308 million

in dividends to shareholders in the year, pre-delivery payments

for new aircraft and repayment of borrowings. easyJet finished

the year with net cash of £422 million against net cash of £558

million at the same time last year. Adjusted net debt, including

leases at seven times at 30 September 2014 was £446 million

against £156 million at 30 September 2013.

easyJet is focused on driving returns for shareholders and,

consistent with this, the Board increased the pay-out ratio

on the ordinary dividend from one third of profit after tax

to 40% of profit after tax. In addition the Board will

continue to keep the balance sheet under review and

intends to make further returns of capital in the coming

years when appropriate.

Therefore the Board is recommending an ordinary dividend

of 45.4 pence a share which is subject to shareholder

approval at the Company’s Annual General Meeting on

12 February 2015.

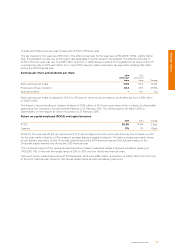

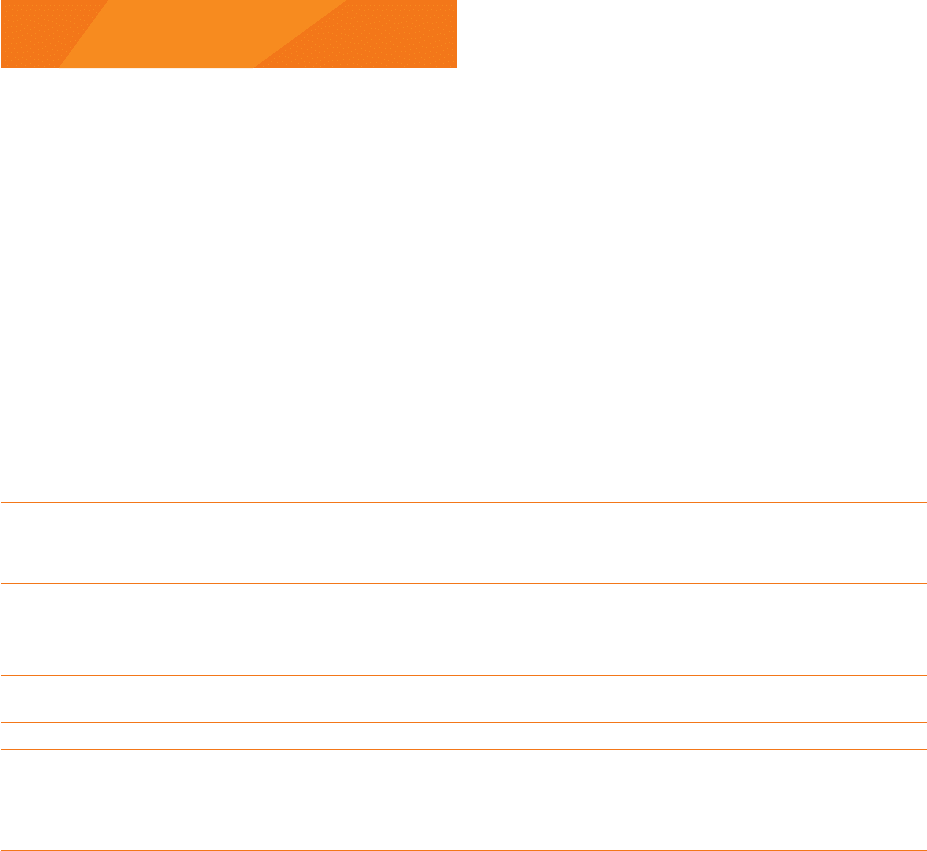

Objective Metric Progress

Capital discipline High asset efficiency

Maintain high level of

fleet flexibility

Fleet size flexibility of between

204 and 316 aircraft by 2019

226 aircraft with 11 hours

per day asset utilisation

Capital structure Ensure robust capital structure

Retain ability to invest in

profitable growth opportunities

Gearing: 15% to 30%

Moving to 80:20 ratio on

owned vs. leased aircraft

Gearing 17%

32% leased

Liquidity Maintain sufficient liquidity to

manage through industry shocks

£4 million cash per aircraft £4.4 million cash per aircraft

Returns Maintain industry-leading returns Top quartile ROCE(8) ROCE of 20.5%

Dividend policy Target consistent and

continuous payments

Return excess capital

to shareholders

40% of profit after tax pay-out

ratio for ordinary dividend

Ordinary dividend payment

increased by 35.5% to

45.4 pence per share

(8) Return on capital employed shown adjusted for leases with leases capitalised at 7 times.

4. DISCIPLINED USE OF CAPITAL