EasyJet 2014 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2014 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

www.easyJet.com 85

Governance

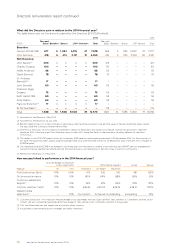

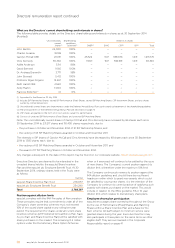

Note 1: The number of shares are calculated according to the scheme rules of individual plans based on the middle-market closing share price

of the day prior to grant. As is usual market practice, the option price for SAYE awards is determined by the Committee in advance of the award

by reference to the share price following announcement of results.

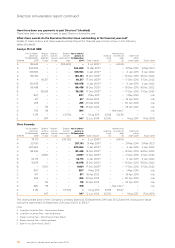

Note 2: For LTIP awards made in July 2010, vesting was based on ROE performance in the financial year ended 30 September 2012, according to

the following targets:

Threshold

(25% vesting)

Target

(50% vesting)

Maximum

(100% vesting)

Award 1 (up to 100% of salary) 9.0% 12.0% 15.0%

Award 2 (over 100% of salary) 11.0% 13.0% 15.0%

As disclosed in last year’s remuneration report, ROE in the year to 30 September 2012 was 14.6% (compared to 5.5% in the year prior to grant).

Correspondingly 93.3% of award one and 90.0% of award two (or 91.7% of the overall award) vested in July 2013.

Note 3: For LTIP awards made in March 2011, vesting was based on ROCE (excluding operating leases adjustment) performance for the year to

30 September 2013. Actual ROCE for the year was 23% and therefore 100% of the awards vested in March 2014.

Threshold

(25% vesting)

Target

(50% vesting)

Maximum

(100% vesting)

Award 1 (up to 100% of salary) 7.0% 8.5% 12.0%

Award 2 (over 100% of salary) 10.0% 12.0% 13.0%

Note 4: For LTIP awards made in January 2012, vesting is based on three year average ROCE performance (excluding lease adjustment) for the

three financial years ended 30 September 2014, which averaged 22.0%. Correspondingly 100% of these awards will vest. The following targets apply

for these awards:

Threshold

(25% vesting)

Target

(50% vesting)

Maximum

(100% vesting)

Award 1 (up to 100% of salary) 8.0% 10.0% 12.0%

Award 2 (over 100% of salary) 11.5% 12.5% 13.0%

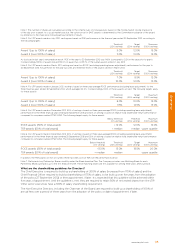

Note 5: For LTIP awards made in December 2012, 50% of vesting is based on three year average ROCE (including operating lease adjustment)

performance for the three financial years ending 30 September 2015 and 50% of vesting is based on relative total shareholder return performance

compared to companies ranked FTSE 51-150. The following targets apply for these awards:

Below threshold

(0% vesting)

Threshold

(25% vesting)

Maximum

(100% vesting)

ROCE awards (50% of total award) < 12.0% 12.0% 16.0%

TSR awards (50% of total award) < median median upper quartile

Note 6: For LTIP awards made in December 2013, 50% of vesting is based on three year average ROCE (including operating lease adjustment)

performance for the three financial years ending 30 September 2016 and 50% of vesting is based on relative total shareholder return performance

compared to companies ranked FTSE 51-150. The following targets apply for these awards:

Below threshold

(0% vesting)

Threshold

(25% vesting)

Target

(40% vesting)

Maximum

(100% vesting)

ROCE awards (50% of total award) <15.0% 15.0% 18.5% 20.0%

TSR awards (50% of total award) < median median upper quartile

In addition, the TSR awards will not vest unless there has been positive TSR over the performance period.

Note 7: Participants buy Partnership Shares monthly under the Share Incentive Plan. The Company provides one Matching Share for each

Partnership Share purchased, up to the first £125 per month. These matching shares are first available for vesting three years after purchase.

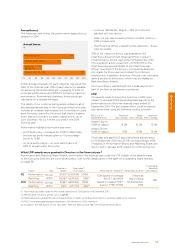

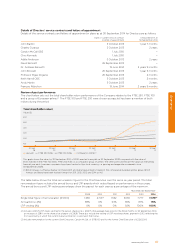

What are the shareholding guidelines for Directors?

The Chief Executive is required to build up a shareholding of 200% of salary (increased from 175% of salary) and the

Chief Financial Officer required to build a shareholding of 175% of salary, to be built up over five years from the adoption

of the policy (27 September 2012) or their appointment, if later. It is expected that this guideline will be achieved within

five years of appointment. Until the guideline is met, they are required to retain 50% of net vested shares from the LTIP.

Other senior executives have a 100% of salary shareholding requirement.

The Non-Executive Directors, including the Chairman of the Board, are required to build up a shareholding of 100% of

annual fees over a period of three years from the adoption of the policy or date of appointment, if later.