EasyJet 2014 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2014 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76 easyJet plc Annual report and accounts 2014

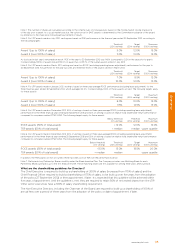

What discretion is retained by the Committee

in operating its incentive plans?

The Committee will operate the annual bonus plan,

LTIP and Deferred Annual Bonus Plan according to their

respective rules (or relevant documents) and in accordance

with the Listing Rules where relevant. The Committee

retains discretion, consistent with market practice, in a

number of regards to the operation and administration

of these plans. These include, but are not limited to,

the following in relation to the LTIP and Deferred Annual

Bonus Plan:

• the participants;

• the timing of grant of an award;

• the size of an award;

• the determination of vesting;

• discretion required when dealing with a change of

control or restructuring of the Group;

• determination of the treatment of leavers based on the

rules of the plan and the appropriate treatment chosen;

• adjustments required in certain circumstances

(e.g. rights issues, corporate restructuring events

and special dividends); and

• the annual review of performance measures and

weighting, and targets for the LTIP from year to year.

In relation to the annual bonus plan, the Committee

retains discretion over:

• the participants;

• the timing of grant of a payment;

• the determination of the bonus payment;

• dealing with a change of control;

• determination of the treatment of leavers based on

the rules of the plan and the appropriate treatment

chosen; and

• the annual review of performance measures and

weighting, and targets for the annual bonus plan

from year to year.

In relation to both the Company’s LTIP and annual bonus

plan, the Committee retains the ability to adjust the

targets and/or set different measures if events occur

which cause it to determine that the conditions are no

longer appropriate (e.g. material acquisition and/or

divestment of a Group business), and the amendment is

required so that the conditions achieve their original

purpose and are not materially less difficult to satisfy.

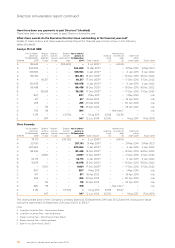

Directors’ remuneration report continued

Element, purpose

and link to strategy Operation (including maximum levels where applicable)

Framework used to

assess performance

and provisions for the

recovery of sums paid

LTIP Performance

Share Award

Awards will be delivered

under the 2005 LTIP

in the year ending

30 September 2015 and

under a replacement

LTIP for the year ending

30 September 2016.

To incentivise and

recognise execution

of the business strategy

over the longer term.

Rewards strong financial

performance and

sustained increase

in shareholder value.

Each year Performance Shares may be granted subject to the achievement

of performance targets. Awards normally vest over a three year period.

Policy for the financial year ending 30 September 2015

The maximum opportunity contained within the plan rules for Performance

Share Awards is 200% of salary.

The maximum face value of annual awards will be 200% of salary for

the Chief Executive and 150% of salary for other Executive Directors.

Policy for the financial year ending 30 September 2016

The maximum opportunity contained within the plan rules for Performance

Share Awards is 250% of salary (with awards up to 300% of salary eligible

to be made in exceptional circumstances, such as recruitment).

The normal maximum face value of annual awards will be 250% of salary

for the Chief Executive and 200% of salary for other Executive Directors.

For clarity, there will be no matching share awards for the financial year

ending 30 September 2016.

A dividend equivalent provision exists which allows the Committee to pay

dividends on vested shares (in cash or shares) at the time of vesting and

may assume the reinvestment of dividends. A holding period will apply to

share awards granted in the financial year ending 30 September 2015 and

beyond. The holding period will require the Executive Directors to retain

the after-tax value of shares for 24 months from the vesting date.

The performance

targets are as

described on

page 75 for

the Matching

Share Award.

The recovery

(clawback)

and withholding

(malus) provisions

are as described

on page 75

in relation

to Matching

Share Awards.

Share ownership

To ensure alignment

between the interests

of Executive Directors

and shareholders.

175% of salary (rising to 200% from financial year ending 30 September

2016) holding required for the Chief Executive and 175% of salary for the

Chief Financial Officer which is expected to be reached within five years

of appointment.

Executive Directors are required to retain half of the post-tax shares vesting

under the LTIP until the guideline is met.

Not applicable.