EasyJet 2014 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2014 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

122 easyJet plc Annual report and accounts 2014

Notes to the accounts continued

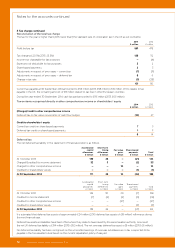

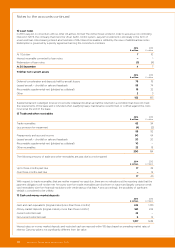

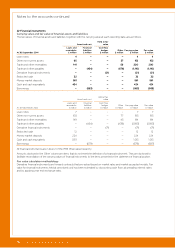

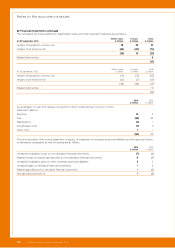

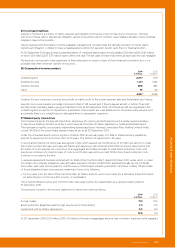

22 Financial instruments

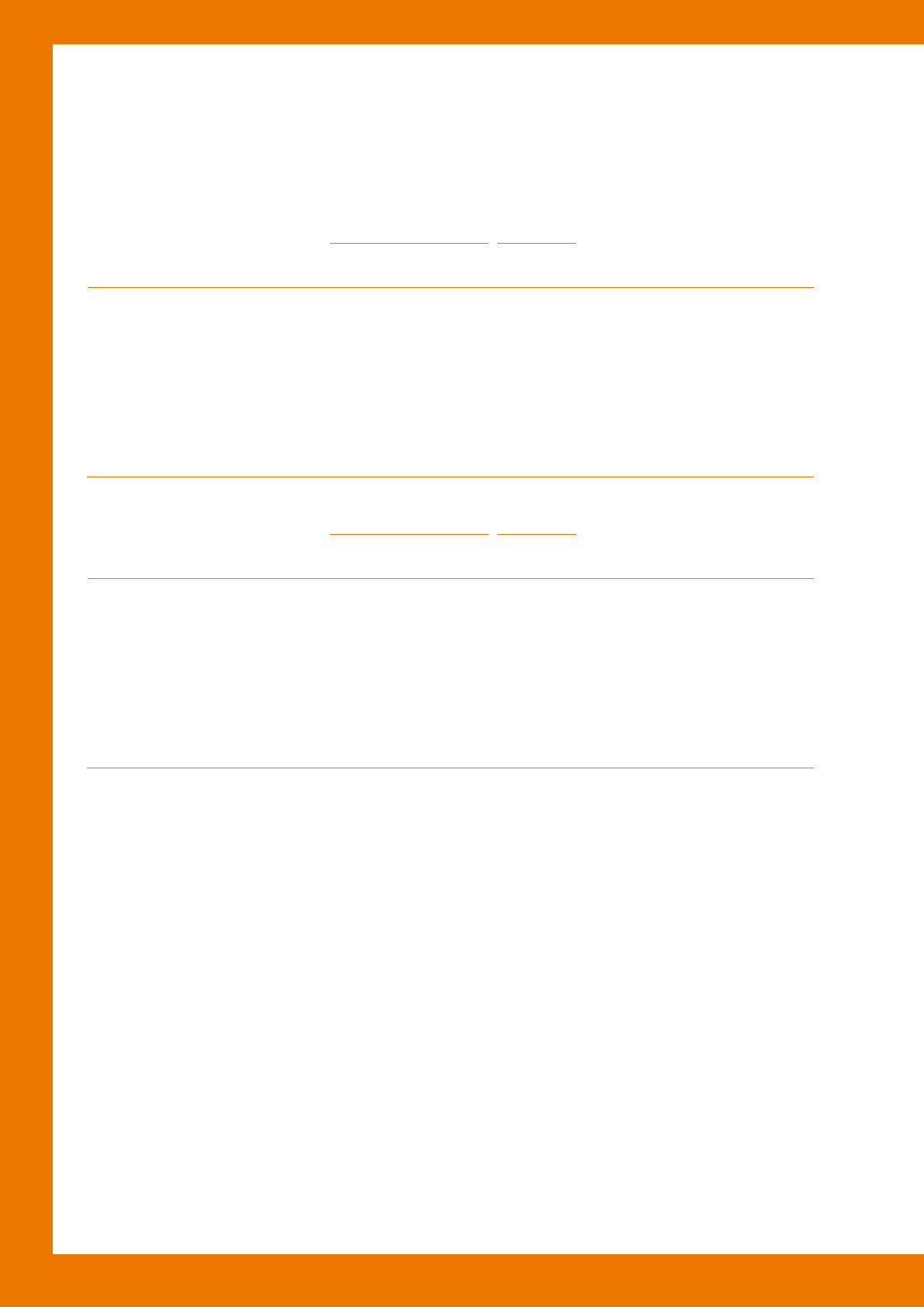

Carrying value and fair value of financial assets and liabilities

The fair values of financial assets and liabilities, together with the carrying value at each reporting date, are as follows:

Amortised cost

Held at fair

value

At 30 September 2014

Loans and

receivables

£ million

Financial

liabilities

£ million

Cash flow

hedges

£ million

Other

£ million

Carrying value

£ million

Fair value

£ million

Loan notes 4 – – – 4 4

Other non-current assets 95 – – 57 152 152

Trade and other receivables 141 – – 59 200 200

Trade and other payables – (434) – (676) (1,110) (1,110)

Derivative financial instruments – – (21) – (21) (21)

Restricted cash 32 – – – 32 32

Money market deposits 561 – – – 561 561

Cash and cash equivalents 424 – – – 424 424

Borrowings – (563) – – (563) (568)

Amortised cost

Held at fair

value

At 30 September 2013

Loans and

receivables

£ million

Financial

liabilities

£ million

Cash flow

hedges

£ million

Other

£ million

Carrying value

£ million

Fair value

£ million

Loan notes 7 – – – 7 7

Other non-current assets 108 – – 77 185 185

Trade and other receivables 149 – – 45 194 194

Trade and other payables – (454) – (639) (1,093) (1,093)

Derivative financial instruments – – (71) – (71) (71)

Restricted cash 12 – – – 12 12

Money market deposits 224 – – – 224 224

Cash and cash equivalents 1,013 – – – 1,013 1,013

Borrowings – (679) – – (679) (687)

All financial instruments are in level 2 of the IFRS 13 fair value hierarchy.

Amounts disclosed in the ‘Other’ column are items that do not meet the definition of a financial instrument. They are disclosed to

facilitate reconciliation of the carrying values of financial instruments to line items presented in the statement of financial position.

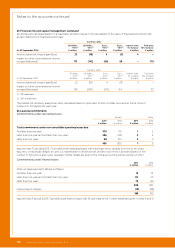

Fair value calculation methodology

Derivative financial instruments are forward contracts that are valued based on market rates and market-accepted models. Fair

value for financial instruments held at amortised cost has been estimated by discounting cash flows at prevailing interest rates

and by applying year end exchange rates.