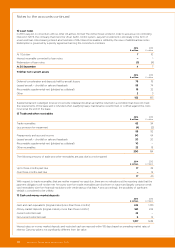

EasyJet 2014 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2014 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

116 easyJet plc Annual report and accounts 2014

Notes to the accounts continued

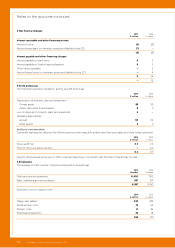

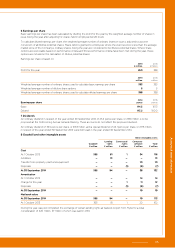

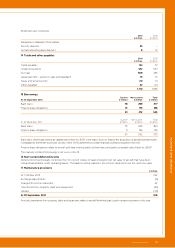

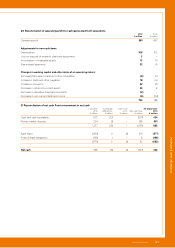

10 Loan notes

In 2001, easyJet, in consortium with six other UK airlines, formed The Airline Group Limited in order to acquire a non-controlling

interest in NATS, the company that owns the UK air traffic control system. easyJet's investment is principally in the form of

unsecured loan notes bearing interest at a fixed rate of 8%. Interest receivable is settled by the issue of additional loan notes.

Redemption is governed by a priority agreement among the consortium members.

2014

£ million

2013

£ million

At 1 October 7 10

Interest receivable converted to loan notes – 1

Redemption of loan notes (3) (4)

At 30 September 4 7

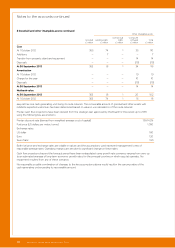

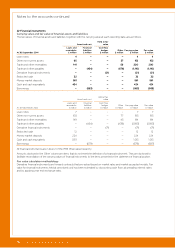

11 Other non-current assets

2014

£ million

2013

£ million

Deferred consideration and deposits held by aircraft lessors 76 76

Leased aircraft – shortfall on sale and leaseback 55 74

Recoverable supplemental rent (pledged as collateral) 19 32

Other 2 3

152 185

Supplemental rent is pledged to lessors to provide collateral should an aircraft be returned in a condition that does not meet

the requirements of the lease and is refunded when qualifying heavy maintenance is performed, or is offset against the costs

incurred at the end of the lease.

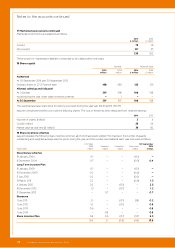

12 Trade and other receivables

2014

£ million

2013

£ million

Trade receivables 62 94

Less provision for impairment (4) (2)

58 92

Prepayments and accrued income 90 64

Leased aircraft – shortfall on sale and leaseback 20 20

Recoverable supplemental rent (pledged as collateral) 10 –

Other receivables 22 18

200 194

The following amounts of trade and other receivables are past due but not impaired:

2014

£ million

2013

£ million

Up to three months past due 17 29

Over three months past due – 14

17 43

With respect to trade receivables that are neither impaired nor past due, there are no indications at the reporting date that the

payment obligations will not be met. Amounts due from trade receivables are short-term in nature and largely comprise credit

card receivables due from financial institutions with credit ratings of at least A and, accordingly, the possibility of significant

default is considered to be unlikely.

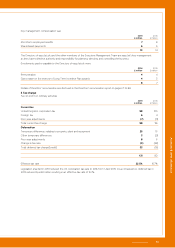

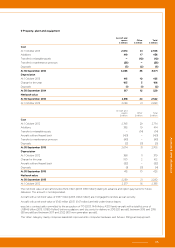

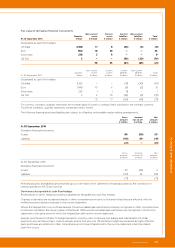

13 Cash and money market deposits

2014

£ million

2013

£ million

Cash and cash equivalents (original maturity less than three months) 424 1,013

Money market deposits (original maturity more than three months) 561 224

Current restricted cash 23 –

Non-current restricted cash 9 12

1,017 1,249

Interest rates on money market deposits and restricted cash are repriced within 185 days based on prevailing market rates of

interest. Carrying value is not significantly different from fair value.