EasyJet 2014 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2014 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

www.easyJet.com 9

Strategic report

Highlights

£581m

Profit before tax

(2013: £478m)

20.5%

ROCE

(2013: 17.4%)

45.4

pence per share

Proposed ordinary dividend

(2013: 33.5 pence per share)

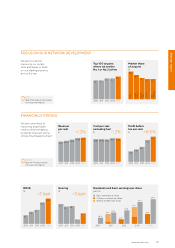

FINANCIAL PERFORMANCE

easyJet delivered record profit before tax of £581

million, an increase of £103 million from 2013 with

a profit before tax margin of 12.8%. Profit before

tax per seat rose by £1.09 year-on-year to £8.12.

Return on capital employed grew by 3.1 percentage

points to 20.5%(1). In light of the continued strong financial

performance and confidence in the future, the Board

has decided to increase the ordinary dividend pay-out

ratio from one third of profit after tax to 40% of profit after

tax, which has resulted in a 35.5% increase in the ordinary

dividend from 33.5 pence per share to 45.4 pence per share.

The performance in the year was driven by:

• continued revenue per seat growth in a higher

capacity environment;

• a 1.3 percentage point improvement in the load factor;

• continued digital and data initiatives;

• better than expected cost performance driven by the

easyJet lean programme, one-off benefits of the CFM

engine selection and the continued scale advantages

of increasing the proportion of A320 aircraft in the fleet;

and

• rigorous focus on capital allocation and returns with

continued strategy of allocating aircraft to highest

returning parts of the network.

Chief Executive’s review

A year of strong performance

Carolyn McCall OBE

Chief Executive

MARKET OVERVIEW

Competitive landscape

The European short-haul aviation market can be divided

into legacy carriers and low-cost carriers. The legacy

carriers include for example Air France-KLM, IAG and

Lufthansa. Legacy carriers operate short and long-haul

networks. The short-haul operations are partly used to

provide connectivity for passengers to transfer onto the

more profitable long-haul. Low-cost carriers, like easyJet,

typically operate point-to-point business models with

no (or limited) connectivity to other flights. Due to a

less complicated business model, and cost advantage,

low-cost airlines have consistently generated higher levels

of profitability compared to the legacy carriers.

After several years of low market capacity growth

the European short-haul market has returned to more

normal levels of capacity growth. In the 12 months to

30 September 2014 the total number of European short-

haul seats increased by 4.3%(2) and by 3.0%(2) on easyJet’s

markets. easyJet grew slightly ahead of the market with

seat growth of 5.1% in the 2014 financial year. easyJet

expects that capacity and demand will be broadly

aligned over the next five-year period. This is based on

confirmed short-haul European fleet orders, conservative

assumptions on aircraft retirements and GDP growth

in easyJet’s main markets.

Several airlines have launched initiatives to improve

profitability, rationalise capacity and reduce costs. In some

cases these airlines have also been dependent on external

(1) Return on capital employed shown adjusted for leases with leases capitalised at 7 times.

(2) Capacity and market share figures from OAG. Size of European market based on internal easyJet definition. Historical data based

on 12 month period from October 2013 to September 2014.