EasyJet 2014 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2014 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OPERATIONAL EXCELLENCE CONTINUED

Risk description and potential impact Current mitigation

Senior management succession and reliance

on key personnel

easyJet’s current and future success is reliant on

having the right people with the right capabilities in

key leadership positions.

Failure to develop and grow the capabilities and behaviours

required of senior management to ensure that all key

business roles have clear successors, could adversely

affect easyJet’s ability to deliver its strategic objectives.

Key business roles within easyJet, and succession plans

for these, have been identified.

easyJet’s aim is to develop talent from within. There

are several talent development programmes in place

for individuals who have been identified for fast-tracking

into more senior roles as vacancies arise. In addition,

a management development programme is in place

to develop people management and senior leadership

capabilities. These programmes operate at various levels

within the organisation.

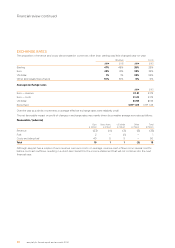

EFFICIENT ASSET UTILISATION

Risk description and potential impact Current mitigation

Asset allocation

easyJet has a leading presence on the top 100 routes

in Europe and positions at primary airports that are

attractive to time-sensitive consumers. easyJet manages

the performance of its network by careful allocation of

aircraft to routes and optimisation of its flying schedules.

The competitive environment is highly dynamic and if

easyJet does not continue to optimise its network and

aircraft allocation, its competitive advantage could be

weakened and its ability to sustain earnings growth would

be threatened.

A portfolio management strategy is in place which

takes a balanced approach to the routes that easyJet

flies, balancing short-term returns with longer-term

sustainable growth.

Route performance is monitored on a regular basis and

operating decisions are made to improve performance

where required.

The fleet framework arrangements in place, together with

the Group’s leasing policy, provide easyJet with significant

flexibility in respect of scaling the fleet according to

business requirements.

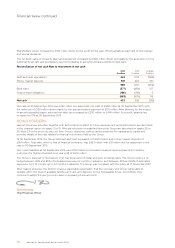

STRONG BALANCE SHEET

Risk description and potential impact Current mitigation

Exposure to fuel price fluctuations and other

macroeconomic shifts

Sudden and significant increases in jet fuel price and/or

a weakening in the exchange rate relative to the US

dollar would significantly impact fuel costs. Increases in

fuel costs would have an adverse effect on the financial

performance of easyJet if not protected against.

easyJet’s business can also be affected by macroeconomic

issues outside of its control such as weakening consumer

confidence, inflationary pressure or instability of the euro.

This could give rise to adverse pressure on revenue, load

factors and residual values of aircraft.

A Board-approved hedging policy (fuel and currency) is

in place that is consistently applied. The policy is to hedge

within a percentage band for a rolling 24-month period.

To provide protection, easyJet uses a limited range of

hedging instruments traded in the over-the-counter

markets. These are principally forward purchases with

a number of approved counterparties.

A strong balance sheet supports the business through

fluctuations in the economic conditions for the sector.

Regular monitoring of markets and route performance

is undertaken by easyJet’s network and fleet

management teams.

Risk continued

32 easyJet plc Annual report and accounts 2014