EasyJet 2014 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2014 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

www.easyJet.com 17

Strategic report

LOOKING FORWARD

Hedging positions

easyJet operates under a clear set of treasury policies agreed by the Board. The aim of easyJet’s hedging policy is to

reduce short-term earnings volatility. Therefore, easyJet hedges forward, on a rolling basis, between 65% and 85% of

the next 12 months’ anticipated fuel and currency requirements and between 45% and 65% of the following 12 months’

anticipated requirements.

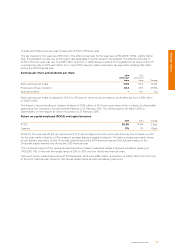

Details of current hedging arrangements are set out below:

Percentage of anticipated requirement hedged Fuel requirement

US Dollar

requirement Euro surplus

Six months to 31 March 2015 91% 91% 84%

Average rate $958/metric tonne $1.60 €1.19

Full year ending 30 September 2015 80% 85% 77%

Average rate $944/metric tonne $1.59 €1.18

Full year ending 30 September 2016 58% 55% 52%

Average rate $921/metric tonne $1.64 €1.21

Sensitivities

• A $10 movement per metric tonne impacts the 2015

financial year fuel bill by $3.5 million.

• A one cent movement in £/$ impacts the 2015 financial

year profit before tax by £1.3 million.

• A one cent movement in £/€ impacts the 2015 financial

year profit before tax by £1.1 million.

Outlook

easyJet expects to grow capacity, measured in seats flown,

by around 3.5% in the first half of the year and by around

5% for the full year. Forward bookings for the first half of

the 2015 financial year are slightly ahead of the prior year.

easyJet continues to invest in its network and in particular

is growing capacity at London Gatwick, driven by the

purchase of the Flybe slots, by around 10% in the first

half of the year. As a result of easyJet continuing to invest

in and grow its network, revenue per seat at constant

currency for the first half of the financial year is expected

to be flat to very slightly up on the prior year.

easyJet expects cost per seat (excluding fuel and

currency) to increase by around 2.5% for the first half of

the year and by around 2% for the full year(9). The cost

per seat increase reflects the prior year’s unusually benign

winter weather and will primarily be driven by increased

crew costs associated with delivering a resilient operation

ahead of new base openings, charges at regulated airports,

particularly in Germany and Italy, increased navigation

charges and increased maintenance costs associated

with the planned ageing of the fleet.

It is estimated that at current exchange rates and with jet

fuel remaining within a $800 metric tonne to $1,000 metric

tonne trading range, easyJet’s unit fuel bill for the first six

months of the 2015 financial year is likely to decrease by

between £12 million(10,11) and £22 million(10,11) compared to

the six months to 31 March 2014. On a full year basis it

is estimated that at current exchange rates and with jet

fuel remaining within a $800 metric tonne to $1,000

metric tonne trading range, easyJet’s unit fuel bill for the

12 months ending 30 September 2015 is likely to decrease

by between £22 million and £70 million(10,11) compared to

the 12 months to 30 September 2014.

In addition, exchange rate movements are likely to have

around a £5 million(10) favourable impact compared to the

six months to 31 March 2014 and are likely to have around

a £20 million(10) adverse impact compared to the 12 months

to 30 September 2014.

easyJet is successfully executing its strategy of offering

its customers low fares to great destinations with friendly

service so that it will continue to win in a more competitive

market. This means easyJet is well placed to continue to

deliver sustainable returns and growth for shareholders.

Carolyn McCall OBE

Chief Executive

(9) Includes anticipated impact from the recent EU261 Huzar judgement.

(10) US $ to £ sterling 1.5633, euro to £ sterling 1.2540. Currency and fuel increases are shown net of hedging impact.

(11) Unit fuel calculated as the difference between latest estimate of FY’15 fuel costs less FY’14 fuel cost per seat multiplied by FY’15 seat capacity.