EasyJet 2014 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2014 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

www.easyJet.com 21

Strategic report

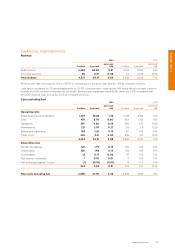

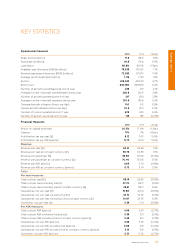

Overall, profit before tax per seat increased by 15.6% to £8.12 per seat.

The tax charge for the year was £131 million. The effective tax rate for the year was 22.5% (2013: 16.7%), slightly higher

than the standard UK rate due to the higher rate applicable to profits taxed in Switzerland. The effective tax rate of

16.7% in the prior year was due to a £28 million reduction in deferred tax resulting from legislation that reduced the UK

corporate tax rate to 20% with effect from 1 April 2015. easyJet made corporation tax payments totalling £96 million

during the 2014 financial year.

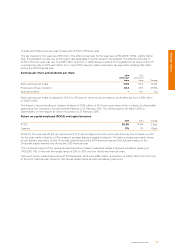

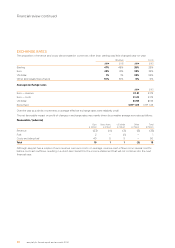

Earnings per share and dividends per share

2014

pence per

share

2013

pence per

share Change

Basic earnings per share 114.5 101.3 13.0%

Proposed ordinary dividend 45.4 33.5 35.5%

Special dividend –44.1 n/a

Basic earnings per share increased by 13.0% to 114.5 pence, driven by the increase in profit after tax from £398 million

to £450 million.

The Board is recommending an ordinary dividend of £180 million or 45.4 pence per share which is subject to shareholder

approval at the Company’s Annual General Meeting on 12 February 2015. This will be paid on 20 March 2015 to

shareholders on the register at close of business on 27 February 2015.

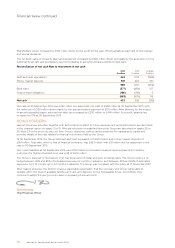

Return on capital employed (ROCE) and capital structure

2014 2013 Change

ROCE 20.5% 17.4% 3.1ppt

Gearing 17% 7% 10ppt

ROCE for the year was 20.5%, an improvement of 3.1 percentage points from prior year driven by the increase in profit

for the year, partly offset by a 2% increase in average adjusted capital employed. This latter increase was mainly driven

by pre-delivery payments on the 35 aircraft ordered during the 2014 financial year and the full year impact of the

24 aircraft leases entered into during the 2013 financial year.

The combined impact of the special dividend and the increase in adjusted capital employed resulted in gearing of

17% (2013: 7%), in line with the target range of 15% to 30% over the next three financial years.

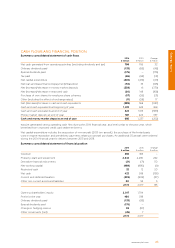

Cash and money market deposits as at 30 September 2014 were £985 million, a reduction of £252 million from the end

of the prior financial year, driven by the special dividend and aircraft pre-delivery payments.