EasyJet 2014 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2014 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Accounts & other information

www.easyJet.com 129

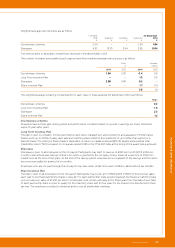

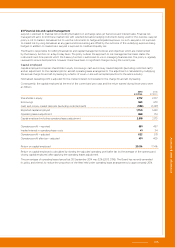

25 Contingent liabilities

easyJet is involved in a number of claims, disputes and litigation which arose in the normal course of business. The likely

outcome of these claims, disputes and litigation cannot be predicted, and in complex cases reliable estimates of any potential

obligation may not be possible.

Having reviewed the information currently available, management considers that the ultimate resolution of these claims,

disputes and litigation is unlikely to have a material adverse effect on easyJet’s results, cash flows or financial position.

At 30 September 2014 easyJet had outstanding letters of credit and performance bonds totalling £39 million (2013: £40 million),

of which £34 million (2013: £37 million) expires within one year. The fair value of these instruments at each year end was negligible.

No amount is recognised on the statement of financial position in respect of any of these financial instruments as it is not

probable that there will be an outflow of resources.

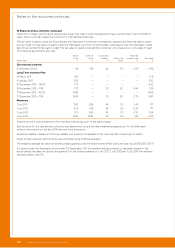

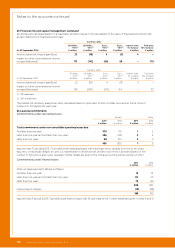

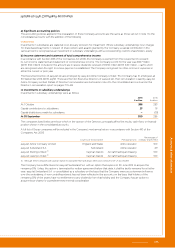

26 Geographical revenue analysis

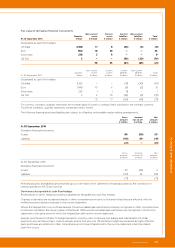

2014

£ million

2013

£ million

United Kingdom 2,077 1,971

Southern Europe 1,471 1,392

Northern Europe 906 835

Other 73 60

4,527 4,258

Southern Europe comprises countries lying wholly or mainly south of the border between Italy and Switzerland, plus France.

easyJet’s non-current assets principally comprise its fleet of 143 owned and 11 finance leased aircraft. A further 72 aircraft

are held under operating leases, giving a total fleet of 226 at 30 September 2014. All of these aircraft are registered in the

United Kingdom except for 23 registered in Switzerland. These assets are used flexibly across the entire route network, and

accordingly there is no suitable basis for allocating them to geographic segments.

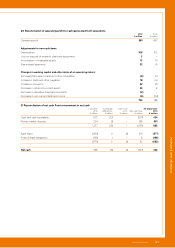

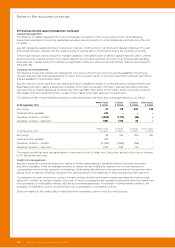

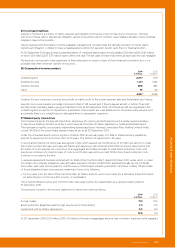

27 Related party transactions

The Company licenses the easyJet brand from easyGroup IP Licensing Limited (‘easyGroup’), a wholly owned subsidiary

of easyGroup Holdings Limited, an entity in which easyJet’s founder, Sir Stelios Haji-Ioannou, holds a beneficial interest.

The Haji-Ioannou family concert party shareholding (being easyGroup Holdings Limited and Polys Holding Limited) holds,

in total, 34.62% of the issued share capital of easyJet plc as at 30 September 2014.

Under the Amended Brand Licence signed in October 2010, an annual royalty of 0.25% of total revenue is payable by

easyJet to easyGroup for a minimum term of 10 years. The full term of agreement is 50 years.

A new brand protection protocol was also agreed, under which easyJet will contribute up to £1 million per annum to meet

the costs to protect the ‘easy’ and ‘easyJet’ brands and easyGroup will contribute £100,000 per annum. Beyond the first

£1.1 million of costs, easyJet can commit up to an aggregate £5.5 million annually to meet brand protection costs, with

easyGroup continuing to meet its share of costs on a 10:1 ratio. easyJet must meet 100% of any brand protection costs

it wishes to incur above this limit.

A separate agreement has been entered with Sir Stelios (‘the Comfort Letter’), dated 9 October 2010, under which, in return

for certain non-compete obligations, easyJet makes payment of a fee of £300,000, adjusted annually per the UK Retail

Price index, each year for five years (or until the expiry of the longest subsisting restriction, whichever is later). Whilst certain

of those obligations have since expired, remaining in force is the following:

for five years from the date of the Comfort Letter, Sir Stelios shall not use his own name (or a derivative thereof) to brand

an airline flying to or from any EEA country, or Switzerland.

The Amended Brand Licence and Comfort Letter were approved by the shareholders at a general meeting held on

10 December 2010.

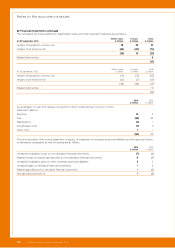

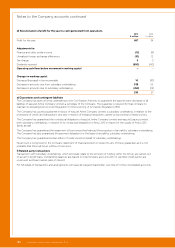

The amounts included in the income statement for these items were as follows:

2014

£ million

2013

£ million

Annual royalty 11.3 10.6

Brand protection (legal fees paid through easyGroup to third parties) 1.0 0.5

Agreement with Sir Stelios Haji-Ioannou 0.3 0.3

12.6 11.4

At 30 September 2014, £0.8 million (2013: £1.1 million) of the above aggregate amount was included in trade and other payables.