EasyJet 2014 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2014 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

www.easyJet.com 81

Governance

What bonus will be awarded in respect of

performance in the 2015 financial year?

The annual bonus for the 2015 financial year will operate

on the same basis as for the 2014 financial year and will

be consistent with the policy detailed in the remuneration

policy section of this report in terms of deferral and

clawback provisions. The maximum bonus opportunity

remains at 200% of salary for the Chief Executive and

increases from 150% to 175% for the Chief Financial Officer.

The measures have been selected to reflect a range of

financial and operational goals that support the key

strategic objectives of the Company.

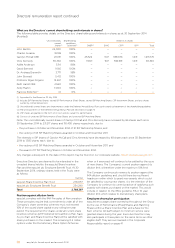

The performance measures and weightings will be as follows:

As a percentage of

maximum bonus opportunity

Measure CE CFO

Profit before tax 70% 60%

On-time performance 10% 10%

Customer satisfaction targets 10% 10%

Operating costs (excluding fuel)

per seat at constant currency 10% 10%

Departmental objectives – 10%

The proposed target levels for the 2015 financial year have

been set to be challenging relative to the business plan.

In setting the targets, the Committee was mindful that the

maximum opportunity has been increased for the Chief

Financial Officer. A higher year-on-year profit growth target

has been set for the 2015 financial year and is considered

appropriately challenging for the new bonus arrangement.

The targets relating to on-time performance, cost per seat

and customer satisfaction are also considered demanding.

Therefore, overall, the Committee is comfortable that the

bonus targets for both Executive Directors are appropriately

demanding in light of their respective bonus opportunities.

The targets themselves, as they relate to the 2015 financial

year, are deemed to be commercially sensitive. However,

retrospective disclosure of the targets and performance

against them will be provided in next year’s remuneration

report to the extent that they do not remain commercially

sensitive at that time. The safety of our customers and

people underpins all of the operational activities of the

Group and the bonus plan includes an underpin that

enables the Remuneration Committee to scale back the

bonus earned in the event that there is a safety event that

occurs that it considers warrants the use of such discretion.

How will the LTIP be operated in relation to the 2015

financial year awards?

The award levels of Performance Shares for the Executive

Directors in the 2015 financial year are as per the policy

approved by shareholders at the 2014 AGM at 200% of

salary for the Chief Executive and 150% of salary for the

Chief Financial Officer.

The annual bonus plan operated in 2014 was the last

opportunity for voluntary deferral of part of the bonus into

shares for the purposes of receiving Matching Share Awards.

The Awards will operate for the final time in the financial year

ending 30 September 2015. Accordingly, where Executive

Directors have elected to voluntarily defer more of their bonus

into shares beyond the compulsory deferral element, Matching

Share Awards will be granted. The amount voluntarily deferred

may be eligible for a 1:1 match dependent on the delivery of

performance goals, with awards vesting over a three year

period. The Chief Executive could have voluntarily deferred

up to 50% of the annual bonus earned and the Chief

Financial Officer up to two-thirds of the bonus earned. The

Chief Executive deferred the maximum amount of her 2014

financial year bonus and the Chief Financial Officer deferred

two-thirds of the maximum amount. Both amounts will be

eligible for Matching Share Awards.

The 2015 financial year LTIP awards (Performance and

Matching Share Awards) will be subject to the following

performance conditions:

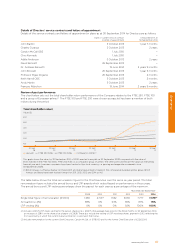

Below

threshold

(0% vesting)

Threshold

(25%

vesting)

On-target

(40%

vesting)

Maximum

(100%

vesting)

ROCE (50% of

total award) <15.0% 15.0% 18.2% 20.0%

Below threshold

(0% vesting)

Threshold

(25%

vesting)

Maximum

(100%

vesting)

TSR

(50% of total award) < median median

upper

quartile

Awards vest on a straight-line basis between these

points. As with the awards granted in the 2014 financial

year, ROCE targets are based on average ROCE

(including operating lease adjustments) over a three year

performance period, commencing on 1 October 2014. TSR

targets are based on relative TSR compared to companies

ranked FTSE 31-130 at the date of grant, where the average

share price is calculated over three months at the start and

end of the period. In addition, in order for the TSR-based

awards to vest, easyJet must have achieved positive

absolute TSR performance over the performance period.

These targets will require management to deliver strong,

sustainable performance over the period. The Committee

considers the range of ROCE targets set to be demanding,

given that the level of return required to be created for vesting

to take place will be calculated from a materially higher capital

base reflecting the growth in the Company’s fleet numbers

during the period through to 30 September 2017.

As detailed in the policy report, Matching Share Awards will no

longer operate with effect from the financial year commencing

on 1 October 2015 with the revised award levels detailed in the

policy report applying at the time of grant. Similarly challenging

performance targets to those described above will apply to

awards granted under the revised policy with any substantial

change the subject of appropriate dialogue with the

Company’s major shareholders.

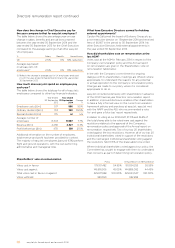

How will the Non-Executive Directors be paid in the

2015 financial year?

The fees for the Chairman and Non-Executive Directors

will be as follows:

Chairman £300,000

Basic fee for other Non-Executive Directors £60,000

Fees for Deputy Chairman and SID role(1) £25,000

Chair of the Audit, Safety and Remuneration

Committees(1) £15,000

Chair of the Finance Committee(1) £10,000

(1) Supplementary fees.

There are no changes to basic fees, which were last

reviewed and increased on 1 October 2013.