EasyJet 2014 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2014 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

www.easyJet.com 79

Governance

under the plan rules. Under the Deferred Annual Bonus

Plan, the shares for a good leaver will normally vest in full

on the normal vesting date (or on cessation of employment

in the case of death) and if the award is in the form of

an option, there is a 12 month window in which the award

can be exercised. Awards structured as options which have

vested prior to cessation can be exercised within 12 months

of cessation of office or employment.

Under the LTIP, a good leaver’s unvested awards will vest

(either on the normal vesting date or the relevant date

of cessation, as determined by the Committee) subject

to achievement of any relevant performance conditions,

with a pro-rata reduction to reflect the proportion of the

vesting period served. The Committee has the discretion

to disapply time pro-rating if it considers it appropriate

to do so. A good leaver may exercise their vested awards

structured as options for a period of 12 months following

the individual’s cessation of office or employment, whereas

unvested awards may be exercised within 12 months

of vesting.

In determining whether an Executive Director should be

treated as a good leaver, and the extent to which their

award may vest, the Committee will take into account the

circumstances of an individual’s departure. In the event of

a takeover or winding-up of easyJet plc (which is not

part of an internal reorganisation of the easyJet Group in

circumstances where equivalent replacement awards are

not granted) all awards will vest subject to, in the case of

LTIP awards, the achievement of any relevant performance

conditions with a pro-rata reduction to reflect the

proportion of the vesting period served. The Committee

has discretion to disapply time pro-rating if it considers

it appropriate to do so. In the event of a takeover, the

Committee may determine, with the agreement of the

acquiring company, that awards will be exchanged for

equivalent awards in another company.

What is the policy on Executive Directors holding

external appointments?

Executive Directors are permitted to accept one

appointment on an external board or committee so long

as this is not thought to interfere with the business of the

Group. Any fees received in respect of these appointments

are retained directly by the relevant Executive Director.

What would the remuneration policy be if a new

Director was appointed?

Base salary levels will be set in accordance with easyJet’s

remuneration policy, taking into account the experience

and calibre of the individual (e.g. typically up to market

median levels but salaries above or below this level may

be set dependent upon the level of the individual). Where

it is appropriate to offer a lower salary initially, a series of

increases to achieve the desired salary positioning may

be given over the following few years subject to individual

performance. Benefits will be provided in line with those

offered to other employees, with relocation expenses/

arrangements provided if necessary. easyJet may offer a

cash amount on recruitment, payment of which may be

staggered, to reflect the value of benefits a new recruit

may have received from a former employer.

Should it be appropriate to recruit a Director from overseas,

flexibility is retained to provide benefits that take account of

those typically provided in their country of residence (e.g. it

may be appropriate to provide benefits that are tailored to

the unique circumstances of such an appointment).

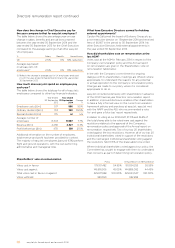

The maximum level of variable pay that may be offered on

an ongoing basis and the structure of remuneration will be

in accordance with the approved policy detailed above (i.e.

at an aggregate maximum of up to 500% of salary in the

financial year ending 30 September 2015 (200% annual

bonus, 200% Performance Shares and 100% Matching

Shares under the LTIP) and 450% of salary in the financial

year ending 30 September 2016 onwards (200% annual

bonus and 250% Performance Shares under the LTIP), taking

into account annual and long-term variable pay. This limit

does not include the value of any buyout arrangements.

Different performance measures may be set initially for

the annual bonus, taking into account the responsibilities

of the individual, and the point in the financial year that

they joined. Any incentive offered above this limit would be

contingent on the Company receiving shareholder approval

for an amendment to its approved policy at its next

General Meeting.

The above policy applies to both an internal promotion

to the Board or an external hire.

In the case of an external hire, if it is necessary to buy

out incentive pay or benefit arrangements (which would

be forfeited on leaving the previous employer), this

would be provided for taking into account the form

(cash or shares), timing and expected value (i.e. likelihood

of meeting any existing performance criteria) of the

remuneration being forfeited. Replacement share awards,

if used, will be granted using easyJet’s share plans to the

extent possible, although awards may also be granted

outside of these schemes if necessary and as permitted

under the Listing Rules.

In the case of an internal promotion, any outstanding

variable pay awarded in relation to the previous role

will be paid according to its terms of grant (adjusted as

relevant to take into account the Board appointment).

On the appointment of a new Chairman or Non-Executive

Director, fees will be set taking into account the experience

and calibre of the individual. Where specific cash or share

arrangements are delivered to Non-Executive Directors,

these will not include share options or other performance-

related elements.