EasyJet 2014 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2014 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

www.easyJet.com 73

Governance

The Committee also considers developments in institutional

investors’ best practice expectations and the views

expressed by shareholders during any dialogue.

How do we take into account the views of shareholders

when we determine the remuneration policy?

easyJet remains committed to shareholder dialogue and

takes an active interest in voting outcomes. We consult

extensively with our major shareholders when setting our

remuneration policy. If any of these shareholders were to

be opposed to our policy, we would endeavour to meet

with them, as appropriate, to understand and respond to

any issues they may have.

What changes are we proposing to make to the

remuneration policy approved by shareholders at

the 2014 AGM and why?

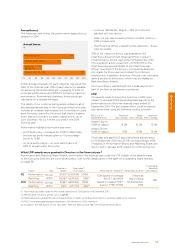

As a result of the upcoming expiry of the Company’s LTIP

in September 2015, the Committee undertook a review

of the existing remuneration policy against the Company’s

principles and in light of developments in the executive

pay environment. Since the Company’s overall policy is

considered to be aligned with easyJet’s principles, and is

considered to be serving the Company well, the primary

change proposed relates to simplifying the LTIP structure

in light of general encouragement in this regard from

institutional shareholders and the leading shareholder

advisory bodies. In summary, the proposed changes to

policy include:

• simplification of the current long-term incentive

arrangements, with a lower maximum total annual

award potential for the Chief Executive, when compared

against the current long-term incentive structure, to

apply from the financial year commencing on 1 October

2015. Subject to shareholder approval at the February

2015 AGM, for the simplified LTIP, only Performance Share

Awards will be granted in respect of the 2016 financial

year onwards, as opposed to Performance Share Awards

in tandem with Matching Share Awards, as per the policy

shareholders approved at the 2014 AGM;

• the 2015 financial year will see the final operation of the

current LTIP (i.e. with Performance Share Awards and

Matching Share Awards granted at the same time) since

this was the policy communicated to both shareholders

and executives at the start of the financial year, and so

bonuses earned in respect of the 2014 financial year will

be eligible for a Matching Share Award for the final time,

in line with our existing policy;

• from the 2016 financial year, the maximum normal annual

award limit of Performance Shares will be restricted to

250% of salary, which is lower than the combined award

potential for the Chief Executive under the current plan

of 300% of salary (200% of salary in Performance

Shares plus 100% of salary in Matching Shares);

• for completeness, subject to the new LTIP being

approved by shareholders at the 2015 AGM, the intention

is to set ongoing annual award policy at 250% of salary

for the Chief Executive and 200% of salary for the Chief

Financial Officer. The revised award level for the Chief

Executive has been set so as to retain a similar expected

value to the current remuneration policy, with the

Matching Share Award included at 50% of the 100%

of salary maximum level (i.e. assuming that, on average,

half the maximum Matching Share Award would be

granted each year). The revised award level for the

Chief Financial Officer incorporates the maximum

Matching Share Award, at 50% of salary, in order to

position his remuneration closer to comparable roles

in companies of a similar size and complexity. Awards

under the new LTIP will be granted for the first time,

subject to shareholder approval of the new plan and

revised remuneration policy at the 2015 AGM, following

the results announcement for the year ending 30

September 2015 (i.e. in the 2016 financial year); and

• in addition, the Committee will be introducing a

holding period for shares vesting under the new LTIP,

during which Executive Directors will be required to retain

the after-tax value of shares for 24 months from the

vesting date.

To address the below market total remuneration

positioning of the Chief Financial Officer, his annual bonus

opportunity is to increase to 175% of salary from 150%.

The change to the Chief Financial Officer’s bonus

opportunity takes effect from 1 October 2014 (subject

to the policy that follows being approved by shareholders

at the 2015 AGM), and takes account of the fact that

the Chief Financial Officer has fallen well behind

appropriate comparative benchmarks from a total

remuneration perspective.

This approach ensures that his revised remuneration

structure remains aligned with easyJet’s remuneration

philosophy of operating a relatively lean approach to

fixed pay levels versus comparative market benchmarks,

with the opportunity to earn above-market levels of total

remuneration subject to successful execution of the

Board’s strategy.

In setting the 2015 financial year annual bonus targets,

the higher quantum for the Chief Financial Officer was

considered by the Committee. A higher year-on-year profit

growth target has been set for the 2015 financial year

and is considered appropriately challenging for the new

bonus arrangement.

A higher share ownership guideline will be introduced

for the Chief Executive at 200% of salary (from 175%

of salary). A 175% of salary share ownership guideline

will continue to operate for the Chief Financial Officer.