EasyJet 2014 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2014 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120 easyJet plc Annual report and accounts 2014

Notes to the accounts continued

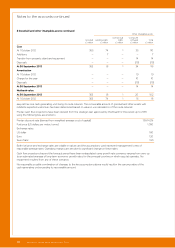

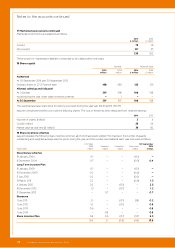

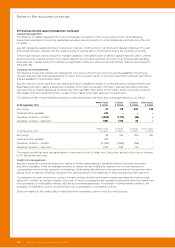

19 Share incentive schemes continued

Subject to company performance, easyJet also issues free shares under the approved share incentive plan of up to £3,000 in

value. There is a similar unapproved scheme for international employees.

The fair value of grants under the Discretionary and Sharesave schemes are estimated by applying the Binomial Lattice option

pricing model. The fair value of grants under the TSR based Long Term Incentive Plan is estimated under the Stochastic model

(also known as the Monte Carlo model). The fair value of grants under all other schemes is the share price on the date of grant.

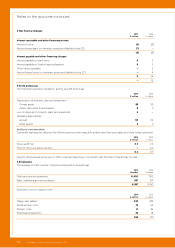

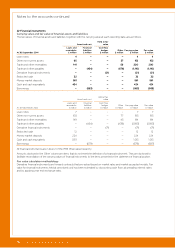

The following assumptions are used:

Grant date

Share

price

£

Exercise

price

£

Expected

volatility

%

Option life

years

Risk-free

interest rate

%

Fair value

£

Discretionary schemes

8 December 2004 1.81 1.84 42 6.5 4.45 0.88

Long Term Incentive Plan

31 March 2011 3.41 – – – – 3.41

4 January 2012 3.92 – – – – 3.92

18 December 2012 – ROCE 7.37 – – – – 6.92

18 December 2012 – TSR 7.37 – 33 3.0 0.44 5.16

17 December 2013 – ROCE 14.99 – – – – 14.99

17 December 2013 – TSR 14.99 – 31 3.0 0.76 9.83

Sharesave

1 July 2011 3.60 2.88 46 3.5 1.45 1.37

1 July 2012 5.23 4.18 35 3.5 0.24 1.77

1 July 2013 12.11 9.69 34 3.5 0.32 3.54

1 July 2014 16.62 13.30 33 3.5 1.64 5.03

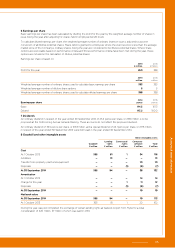

Share price is the closing share price from the last working day prior to the date of grant.

Exercise price for the discretionary schemes was determined using a five-day weighted average price. For the Sharesave

scheme, exercise price is set at a 20% discount from share price.

Expected volatility is based on historical volatility over a period comparable to the expected life of each type of option.

Levels of early exercises and forfeitures are estimated using historical averages.

The weighted average fair value of matching shares granted under the Share Incentive Plan during the year was £14.61 (2013: £9.77).

For grants under the Sharesave scheme after 30 September 2011, the dividend yield assumption is calculated based on the

actual yield at the date the options are granted. For the options granted on 1 July 2012, 1 July 2013 and 1 July 2014, the dividend

yield assumption was 2%.