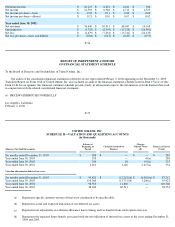

Classmates.com 2003 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2003 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

proportion, by the persons who beneficially owned the Company's outstanding voting securities immediately prior to such

transaction; or (d) any stockholder-approved transfer or other disposition of all or substantially all of the Company's assets.

5. Noncompetition

. For the eighteen (18) month period following the termination of Employee's employment with the Company (but only

if Employee has received the severance payments specified in Section 4.3 above) (the "Noncompetition Period"), Employee shall not

directly engage in, or manage or direct persons engaged in, a Competitive Business Activity (as defined below) anywhere in the

Restricted Territory (as defined below); provided, that the Noncompetition Period shall terminate if the Company terminates operations

or if the Company no longer engages in any Competitive Business Activity. The term "Competitive Business Activity" shall mean the

business of providing consumers with dial-

up Internet access services (free or pay). The term "Restricted Territory" shall mean each and

every county, city or other political subdivision of the United States in which the Company is engaged in business or providing its

services. The Company agrees that providing services to a company or entity that is involved in a Competitive Business Activity but

which services are unrelated to the Competitive Business Activity shall not be deemed a violation of this Agreement. For the purposes

of damages to the Company with respect to any breach of this Section 5, the value of Employee's obligations to the Company under this

Section 5 equals 37.5% of the cash severance payment in Section 4.3(iv) above.

6. Gross-Up Payment . If the aggregate of all payments or benefits made or provided to the Employee under this Agreement and under all

other plans and programs of the Company (the "Aggregate Payment") is determined to constitute a "parachute payment," as such term is

defined in Section 280G(b)(2) of the Internal Revenue Code of 1986, as amended (the "Code"), the Company shall pay to the

Employee, prior to or coincident with the time any excise tax imposed by Section 4999 of the Code (the "Excise Tax") is payable with

respect to such Aggregate Payment, an additional amount that, after the imposition of all penalties, income, excise and other federal,

state and local taxes thereon, is equal to the sum of the Excise Tax on the Aggregate Payment and interest and penalties imposed with

respect to the Excise Tax and such additional amount (the "Gross-Up Payment"). For example, if the Excise Tax imposed with respect

to the Aggregate payment equals $1,000,000, and all penalties, income, excise and other federal, state and local taxes on the Gross-Up

Payment equal $2,333,333, the Gross-Up Payment will be $3,333,333. The determination of whether the Aggregate Payment

constitutes a parachute payment and, if so, the amount to be paid to the Employee and the time of payment pursuant to this Section 6

shall be made by an independent auditor (the "Auditor") selected and paid by the Company and reasonably acceptable to the Employee.

The Auditor shall be a nationally recognized United States public accounting firm. For purposes of determining the amount of the

Gross-Up Payment, the Employee shall be deemed to pay income tax at the highest marginal rates of federal, state and local income

taxation in the calendar year in which the Gross-Up Payment is to be made, net of the maximum reduction in federal income taxes

which could be obtained from deduction of such state and local taxes.

4

In the event that the Excise Tax is finally determined to be less than the amount taken into account hereunder in calculating the Gross-

Up Payment, the Employee shall repay to the Company, within five (5) business days following the time that the amount of such

reduction in the Excise Tax is finally determined, the portion of the Gross-Up Payment attributable to such reduction plus that portion

of the Gross-Up Payment attributable to the Excise Tax and federal, state and local income and employment taxes imposed on the

Gross-Up Payment being repaid by the Employee, to the extent that such repayment results in a reduction in the Excise Tax and a

dollar-for-dollar reduction in the Employee's taxable income and wages for purposes of federal, state and local income and employment

taxes, plus interest on the amount of such repayment at 120% of the rate provided in section 1274(b)(2)(B) of the Code. In the event

that the Excise Tax is determined to exceed the amount taken into account hereunder in calculating the Gross-

Up Payment (including by

reason of any payment the existence or amount of which cannot be determined at the time of the payment of the Gross-Up Payment),

the Company shall make an additional Gross-Up Payment in respect of such excess (plus any interest, penalties or additions payable by

the Employee with respect to such excess) within five (5) business days following the time that the amount of such excess is finally

determined. The Employee and the Company shall cooperate with each other in connection with any proceeding or claim relating to the

existence or amount of liability for Excise Tax, and all expenses incurred by the Employee in connection therewith shall be paid by the

Company promptly upon notice of demand from the Employee.

7. Assignment . Neither the Company nor Employee may assign this Agreement or any rights or obligations hereunder. This Agreement

will be binding upon the Company and its successors and assigns. In the event of a Corporate Transaction, the Company shall cause this

Agreement to be assumed by the Company's successor as well as any acquiring or ultimate parent entity, if any, following any

Corporate Transaction.

8. Miscellaneous .

8.1 This Agreement supersedes any and all other agreements, either oral or in writing, between the parties hereto with respect to the

employment of Employee by the Company and constitutes the entire agreement between the Company and the Employee with

respect to its subject matter.

8.2 This Agreement may not be amended, supplemented, modified or extended, except by written agreement which expressly refers

to this Agreement, which is signed by of the parties hereto and which is authorized by the Company's Board.

8.3 This Agreement is made in and shall be governed by the laws of California, without giving effect to its conflicts-of-law

principles.