Classmates.com 2003 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2003 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

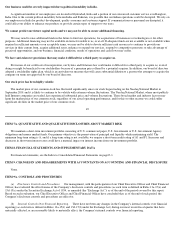

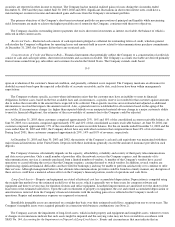

research and measurement services. The Company is headquartered in Westlake Village, California, with additional offices in New York, New

York; San Francisco, California; San Jose, California; and Hyderabad, India.

United Online was incorporated in Delaware in June 2001 and was formed in connection with the merger of NetZero, Inc. ("NetZero")

and Juno Online Services, Inc. ("Juno") into two of United Online's wholly-owned subsidiaries, which was consummated on September 25,

2001 (the "Merger"). The Merger was accounted for under the purchase method of accounting, and NetZero was the acquirer for financial

accounting purposes and the Company's predecessor for financial reporting purposes. As a result of the Merger, NetZero and Juno each became

wholly-owned subsidiaries of United Online. On November 4, 2002, the Company, through its wholly-owned subsidiary NetBrands, Inc.,

acquired the Internet access assets of BlueLight.com LLC ("BlueLight").

Juno started offering pay access services in 1998, and NetZero began offering pay access services in January 2001. The NetZero and Juno

pay access services differ from their respective free access services in that the hourly and certain other limitations set for the free services do

not apply. In addition, the free access services incorporate a number of advertising initiatives, including a persistent on-screen advertising

banner, which are not included on the pay access services. United Online does not currently offer free access services under the BlueLight

Internet brand. United Online's standard pay access services are offered through various pricing plans, generally $9.95 per month. The

Company also offers accelerated dial-up services for an additional monthly charge of $5.00, or a total charge of $14.95, per month. The

Company's accelerated services utilize compression, caching and other technologies that reduce the time for certain Web pages to download to

users' computers when compared to its standard dial-up services. Recently, NetZero and Juno began offering two premium email services with

expanded features and storage capabilities for $9.95 or $24.95 per year.

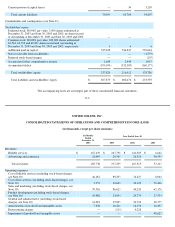

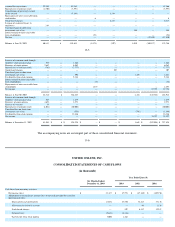

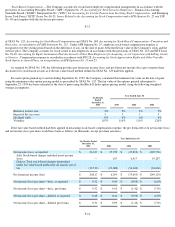

From inception through the fiscal year ending June 30, 2002, the Company and NetZero, as the Company's predecessor, incurred

operating losses and reported negative operating cash flows. In the year ended June 30, 2003, the Company reported operating income and

positive cash flows from operations. For the six months ended December 31, 2003, the Company reported operating income and cash flows

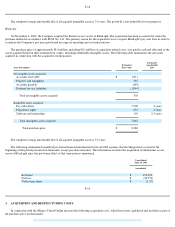

from operations of $32.6 million and $47.9 million, respectively. At December 31, 2003, the Company had cash and cash equivalents of

$71.2 million and short-term investments of $132.5 million. The Company has no material long-term financial commitments other than for

operating leases and telecommunications agreements (see Note 11). The Company believes that its existing cash, cash equivalents and short-

term investments, and cash generated from operations will be sufficient to fund its working capital requirements, capital expenditures and other

obligations through at least the next twelve months. However, additional capital may be needed in order to fund the Company's operations,

expand marketing activities, develop new or enhance existing services or products, respond to competitive pressures or acquire complementary

services, businesses or technologies.

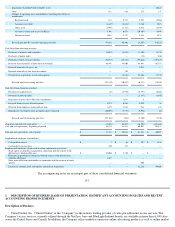

Basis of Presentation

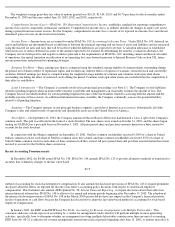

On December 18, 2003, the Company's Board of Directors approved a change in the Company's fiscal year from June 30 to December 31.

The accompanying consolidated financial statements for the

F-8

six months ended December 31, 2003 and the year ended June 30, 2003 include United Online and its wholly-owned subsidiaries. The

consolidated financial statements for the year ended June 30, 2002 reflect the historical consolidated financial results of NetZero, as

predecessor to United Online, prior to the Merger and the consolidated results of United Online subsequent to the Merger. As a result, the

results of operations presented for the years ended June 30, 2002 and 2001 do not include the results of Juno prior to September 25, 2001. All

significant intercompany accounts and transactions have been eliminated in consolidation. The consolidated financial statements, in the opinion

of management, reflect all adjustments (consisting only of normal recurring adjustments) that are necessary for a fair presentation of the results

for the periods shown. The results of operations for such periods are not necessarily indicative of the results expected for any future periods.

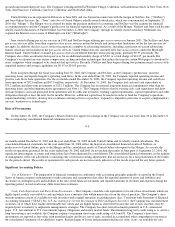

Significant Accounting Policies

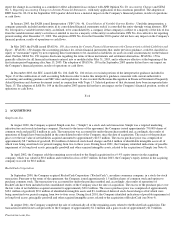

Use of Estimates— The preparation of financial statements in conformity with accounting principles generally accepted in the United

States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities at the date of the financial statements and reported amounts of revenues and expenses during the

reporting period. Actual results may differ from those estimates.

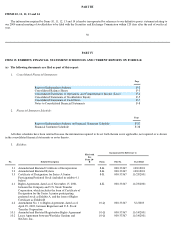

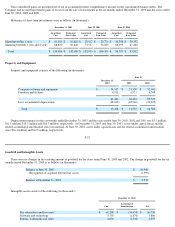

Cash, Cash Equivalents and Short-Term Investments— The Company considers cash equivalents to be only those investments which are

highly liquid, readily convertible to cash and which have a maturity date within ninety days from the date of purchase. The Company's short-

term investments consist of available-for-sale securities with original maturities exceeding ninety days. Consistent with Statement of Financial

Accounting Standards ("SFAS") No. 115, Accounting for Certain Investments in Debt and Equity Securities, the Company has classified these

securities, all of which have readily determinable fair values and are highly liquid, as short term because the sale of such securities may be

required prior to maturity to implement management's strategies. The Company has short-term investments primarily in U.S. commercial

paper, U.S. Government or U.S. Government Agency obligations and money market funds. The minimum long-term credit rating is A, and if a

long-term rating is not available, the Company requires a minimum short-term credit rating of A1 and P1. The Company's short-term

investments are reported at fair value, with unrealized gains and losses, net of taxes, recorded in accumulated other comprehensive income in

the consolidated statements of stockholders' equity. Realized gains or losses and permanent declines in value, if any, on available

-

for

-

sale