Classmates.com 2003 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2003 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The number of U.S. households using broadband has grown significantly over the last few years and is expected to continue to grow.

Many industry analysts estimate that, as a result of broadband adoption, the total number of dial-up accounts in the U.S. has declined and will

continue to decline. While our pay access subscriber base has grown significantly, a number of the major ISPs that offer premium-priced

services have recently experienced declines in their dial-up subscriber bases. We believe that the rate of segmentation of the Internet access

market among premium-priced dial-up, value-priced dial-up and broadband services will depend upon a variety of factors, including

(i) broadband providers' ability to maintain or further reduce pricing, bundle communications and content services and expand geographic

coverage, (ii) future consumer demand for applications that require more bandwidth, such as video and audio downloads, which are not as

quickly downloaded through dial-up services and (iii) consumer price sensitivity in a maturing Internet access market.

We believe that continued consumer price sensitivity could result from the commoditization of Internet access as the market matures as

well as from potential changes in the demographics of Internet users. We believe the majority of future growth in the number of U.S. consumer

households accessing the Internet may be driven by an increase in lower-income households accessing the Internet, where penetration rates

have historically been lowest. For these reasons, we believe that value-priced Internet services, like those we offer, are positioned to grow and

increase their share of the U.S. Internet access market, at least in the near term.

In 2003, a number of ISPs, including NetZero and Juno, began offering accelerated dial-

up Internet access services. These services operate

using a standard dial-up Internet connection and enable users to download certain Web pages faster than standard dial-up services. While these

services are relatively new and their adoption rate is difficult to estimate, these services may be attractive to many consumers as an alternative

to more expensive broadband offerings. However, these services do not

3

provide certain of the benefits of broadband services, such as continuous connections and faster downloads of audio and video files, and result

in some degradation of image quality. Several companies also offer software to accelerate a dial-up connection, regardless of the ISP. Pricing

of these accelerated dial-up products and services varies among ISPs and software providers. Our accelerated services are currently priced at

$14.95 per month, which includes our standard Internet access service. A number of ISPs, including AOL, MSN and EarthLink, recently began

offering accelerated services as part of their premium-priced dial-up services at no additional monthly charge, which may result in pressure on

us and other providers to reduce or eliminate the pricing of these accelerated services.

We believe that the business of providing Internet access services is affected somewhat by seasonality. Internet usage generally is highest

during the March quarter. Historically, we have experienced relatively more new subscriber sign-ups and increased usage in the winter months

compared to the summer months.

Sources of Revenue

We generate revenue from billable services and advertising and commerce transactions.

Billable Services Revenues

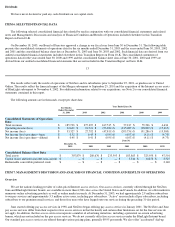

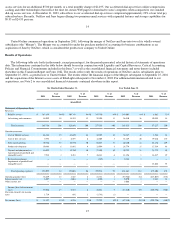

Billable services revenues were $167.6 million, or 90% of total revenues, for the six months ended December 31, 2003, compared to

$109.3 million, or 88% of total revenues, for the six months ended December 31, 2002. Billable services revenues consist primarily of monthly

fees charged to subscribers for Internet access and, to a lesser extent, fees charged to users for live telephone technical support and premium

email.

Our pay services have been offered under a number of pricing plans. Currently, our most common pricing plan for our standard dial-up

Internet access service is $9.95 per month. We currently charge an additional $5.00 per month, or a total monthly charge of $14.95, for our

accelerated dial-up access service. We generally charge our users $1.95 per minute for live telephone technical support. We currently charge

$0.89 and $2.08 per month for our two premium email services, which are billed on an annual basis. In general, we charge our subscribers in

advance of providing the service, which results in the deferral of billable services revenue to the period in which the services are provided. We

have experimented with a variety of pricing plans both in connection with offers extended to some of our existing subscribers and through

external marketing channels. We may continue testing a variety of pricing plans in the future to determine their impact on profitability,

subscriber acquisition, conversion rates of free users to pay subscribers and subscriber retention rates. We intend to regularly evaluate the

desirability and effectiveness of our pricing plans and may, in the future, make changes to these plans. We may also offer additional fee-based

products and services, such as our recently launched premium email services, as well as a wide range of discounted metered plans and

promotions, such as one or more free months of service or discounted rates for an initial or prepaid period.

Advertising and Commerce Revenues

Advertising and commerce revenues were $18.1 million, or 10% of total revenues, for the six months ended December 31, 2003,

compared to $14.5 million, or 12% of total revenues, for the six months ended December 31, 2002. Our advertising and commerce revenues are

generated from both our pay subscribers and free users.