Classmates.com 2003 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2003 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• The development of revised projections for the Company's free Internet access business, reflecting revised assumptions related

to advertising and commerce revenues which prompted a shift in the Company's business model from a free Internet access

model to a pay services Internet access model.

Market and other indicators that suggested that an impairment charge might be required included:

• Reduced levels of venture capital funding activity for Internet-based consumer businesses, which had historically represented a

significant concentration of the Company's advertising and commerce customers.

• Significant declines in the fair market value for the Company's common stock.

• Significant declines in market value for other Internet-related businesses.

Asset impairment tests were performed at the lowest level for which there were identifiable cash flows. The tests were performed by

comparing the expected undiscounted cash flows over the estimated useful lives of the assets, plus a terminal value for future cash flows, to the

carrying amount of the long-lived assets resulting from purchase business combinations. Based on the results of these tests, it was determined

that goodwill and other identifiable intangible assets initially recorded in connection with the acquisitions of AimTV, Simpli, RocketCash and

Freei were impaired.

Impairment related to the AimTV, Simpli, and Freei goodwill and identifiable intangible assets was measured based on revised enterprise-

level cash flow projections for the Company. Significant assumptions related to the cash flow projections utilized to assess impairment

included the following:

• The Company's intention to implement a revised business strategy focused on attracting and monetizing pay subscribers. As a

result, the number of active free users would be significantly less than previous projections.

F-23

• The Company's intention to continue to limit the amount of Internet access time per month available to free users.

• The Company's intention to focus its operating and financial resources on acquiring pay subscribers and no longer expend

significant resources promoting and enhancing its free Internet access service.

• The average advertising and commerce revenue per free user would not, in the foreseeable future, return to historic levels or to

levels reflected in previous projections as a result of the change in the Company's business model and continued weakness in

online advertising.

Impairment related to RocketCash was determined based on the fact that the Company intended to discontinue the operations of this

business. Accordingly, discrete cash flow projections related to this asset were not prepared.

The Company determined the fair value of the impaired assets using the discounted cash flow method and considered data provided by the

market comparison method to verify the results of the discounted cash flow method. The results of the market comparison method served, in

general, as supporting evidence for the conclusions derived from the discounted cash flow analysis, which indicated a substantial decrease in

the fair value of goodwill and other identifiable intangible assets associated with the Company's free Internet access service. The market data

indicated a substantial and sustained decrease in market valuations for publicly traded Internet-related companies. Market data related to

private company transactions indicated a substantial decrease in both the average transaction price and the number of transactions completed.

Further, market data indicated an increase in the number of Internet companies that had recently ceased operations. In aggregate, the market

data demonstrated substantially decreased valuations and liquidity and increased risk associated with Internet companies and related

technologies.

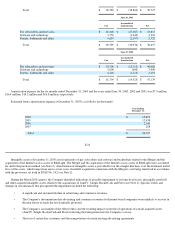

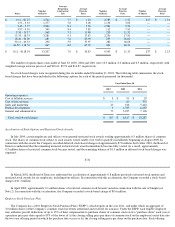

An impairment of goodwill and intangible assets totaling $48.6 million was recorded during the year ended June 30, 2001, reflecting the

amount by which the carrying amount of the assets exceeded their respective fair values. The impairment consisted of $33.5 million for

goodwill and $15.1 million of other acquired intangible assets. No impairment of goodwill or other acquired intangible assets was recorded

during the six months ended December 31, 2003 or the years ended June 30, 2003 or 2002.

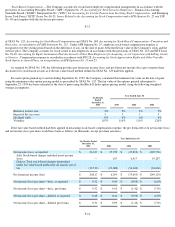

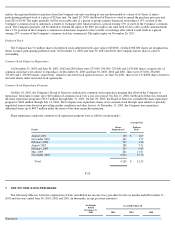

Accrued Liabilities

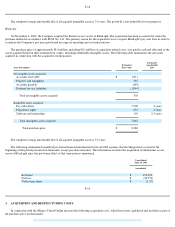

Accrued liabilities consist of the following (in thousands):

June 30,

December 31,