Classmates.com 2003 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2003 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

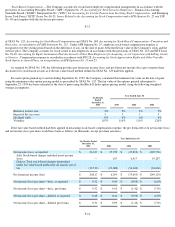

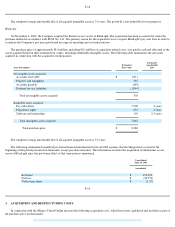

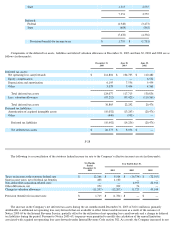

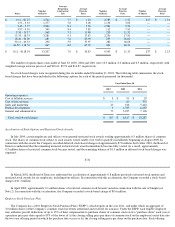

Amortization expense for the six months ended December 31, 2003 and the years ended June 30, 2003, 2002 and 2001 was $7.9 million,

$16.4 million, $14.2 million and $16.8 million, respectively.

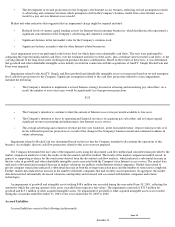

Estimated future amortization expense at December 31, 2003 is as follows (in thousands):

F-22

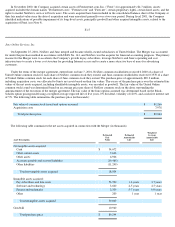

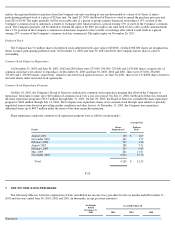

Intangible assets at December 31, 2003 consist primarily of pay subscribers and software and technology related to the Merger and the

acquisition of the Internet access assets of BlueLight. The Merger and the acquisition of the Internet access assets of BlueLight were accounted

for under the purchase method (see Note 2). Amortization of intangible assets is provided for on the straight-

line basis over the estimated useful

lives of the assets, which range from one to seven years. Goodwill acquired in connection with the Merger is not being amortized in accordance

with the provisions set forth in SFAS No. 142 (see Note 2).

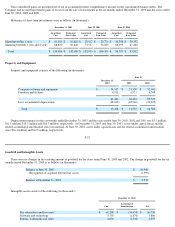

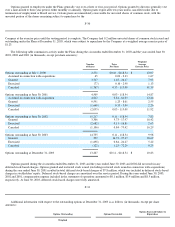

During the March 2001 quarter, the Company identified indications of possible impairment of its long-lived assets, principally goodwill

and other acquired intangible assets related to the acquisitions of AimTV, Simpli, RocketCash and Freei (see Note 2). Specific events and

changes in circumstances that precipitated the impairment included the following:

•

Total $

69,589

$

(38,862

) $

30,727

June 30, 2003

Cost

Accumulated

Amortization

Net

Pay subscribers and free users

$

61,200

$

(27,387

)

$

33,813

Software and technology

3,750

(1,440

)

2,310

Patents, trademarks and other

4,639

(2,107

)

2,532

Total $

69,589

$

(30,934

) $

38,655

June 30, 2002

Cost

Accumulated

Amortization

Net

Pay subscribers and free users

$

53,700

$

(12,712

)

$

40,988

Software and technology

3,600

(600

)

3,000

Patents, trademarks and other

4,404

(1,213

)

3,191

Total $

61,704

$

(14,525

) $

47,179

Year Ending

December 31,

2004

$

15,855

2005

12,438

2006

2,146

2007

288

Total $

30,727

A significant and sustained decline in advertising and commerce revenues.

• The Company's determination that advertising and commerce revenues for Internet-based companies were unlikely to recover in

the near future or reach the levels initially projected.

• The Company's assessment of the effectiveness and the resulting impact on results of operations of certain acquired assets

(AimTV, Simpli, RocketCash and Freei) following their integration into the Company's service.

•

The loss of certain key customers and the renegotiation of certain existing advertising agreements.