Classmates.com 2003 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2003 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

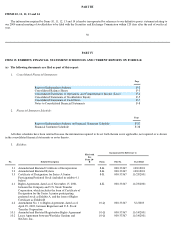

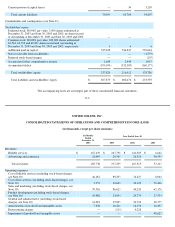

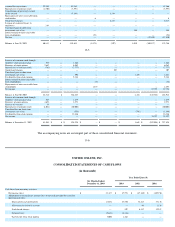

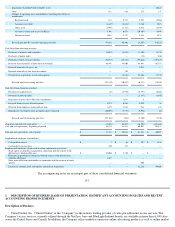

The accompanying notes are an integral part of these consolidated financial statements.

F-7

1. DESCRIPTION OF BUSINESS, BASIS OF PRESENTATION, SIGNIFICANT ACCOUNTING POLICIES AND RECENT

ACCOUNTING PRONOUNCEMENTS

Description of Business

United Online, Inc. ("United Online" or the "Company") is the nation's leading provider of value-priced Internet access services. The

Company's access services, currently offered through the NetZero, Juno and BlueLight Internet brands, are available in more than 6,500 cities

across the United States and Canada. In addition, the Company offers marketers numerous online advertising products as well as online market

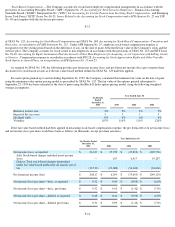

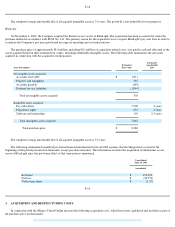

Impairment of goodwill and intangible assets — — —

48,622

Other

621

866

275

151

Changes in operating assets and liabilities (excluding the effects of

acquisitions):

Restricted cash

811

5,374

9,592

(5,861

)

Accounts receivable

(1,645

)

(2,832

)

3,730

5,671

Other assets

(3,991

)

(1,324

)

6,948

(4,555

)

Accounts payable and accrued liabilities

5,302

6,678

(20,103

)

6,460

Deferred revenue

1,023

3,757

3,885

3,534

Net cash provided by (used for) operating activities

47,892

65,106

(4,553

)

(98,217

)

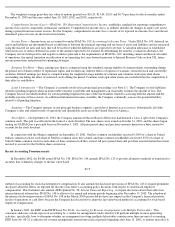

Cash flows from investing activities:

Purchases of property and equipment

(5,075

)

(5,983

)

(1,465

)

(5,276

)

Purchases of patent rights — — (

18

)

(486

)

Purchases of short-term investments

(74,982

)

(45,522

)

(97,026

)

(163,229

)

Proceeds from maturities of short

-

term investments

46,947

38,600

58,491

141,353

Proceeds from sales of assets, net

—

—

1,011

—

Proceeds from sale of cost-basis investment —

750

— —

Cash paid for acquisitions, net of cash acquired — (

8,388

)

32,496

(7,721

)

Net cash used for investing activities

(33,110

)

(20,543

)

(6,511

)

(35,359

)

Cash flows from financing activities:

Payments on capital leases

(34

)

(2,968

)

(5,197

)

(6,662

)

Payments on notes payable — — (

2,143

)

(1,641

)

Repayment of notes receivable from stockholders —

1,653

6

—

Proceeds from exercises of stock options

8,971

6,962

2,930

84

Proceeds from employee stock purchase plan

1,679

1,862

516

431

Repurchases of common stock and option shares exercised

(40,002

)

(7,777

)

(3,592

)

(61

)

Net cash used for financing activities

(29,386

)

(268

)

(7,480

)

(7,849

)

Change in cash and cash equivalents

(14,604

)

44,295

(18,544

)

(141,425

)

Cash and cash equivalents, beginning of period

85,838

41,543

60,087

201,512

Cash and cash equivalents, end of period $

71,234

$

85,838

$

41,543

$

60,087

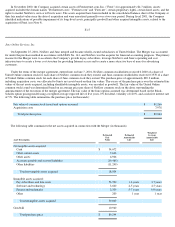

Supplemental disclosure of cash flows:

Cash paid for interest $

1

$

86

$

547

$

1,416

Cash paid for income taxes

250

225

— —

Supplemental disclosure of non

-

cash investing and financing activities:

Stock option tax benefits recognized in connection with the release of the

deferred tax valuation allowance $

15,006

$

3,720

$ — $ —

Reduction in goodwill in connection with the release of the deferred tax

valuation allowance

1,399

— — —

Notes receivable from stockholders in connection with the exercise of stock

options

—

—

700

—

Issuance of common stock and options assumed for acquisitions

—

—

81,266

49,802