Classmates.com 2003 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2003 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Net cash used for financing activities increased by $29.5 million to $29.4 million for the six months ended December 31, 2003, compared

to net cash provided by financing activities of $0.1 million for the six months ended December 31, 2002. Significant factors that have impacted

the variability in our cash provided by or used for financing activities in these periods include, but are not limited to, the following factors:

• payments made on notes payable and capital leases, which were obtained in connection with historical capital equipment

financing, and were fully paid as of December 31, 2003;

• an increase in proceeds received from the issuance of stock in connection with our employee stock purchase plan and exercises

of employee stock options. We currently anticipate that both the employee stock purchase plan and our employee stock option

plans will provide a significant source of cash in the near term; and

• a significant increase in repurchases of common stock under our common stock repurchase program. We may repurchase an

additional $48.7 million of our common stock under our existing common stock repurchase program, which extends through

July 31, 2004.

We recently obtained a one-

year $25 million unsecured revolving line of credit with Silicon Valley Bank. The interest rates on borrowings

are based on current market factors. This facility is available for general corporate purposes. While we believe that we currently possess

adequate cash reserves, we obtained the line of credit in order to provide us with additional financial flexibility with respect to short-term

working capital requirements and to support the company's overall business strategy. At December 31, 2003, a $0.7 million letter of credit in

connection with one of our leased facilities was outstanding, reducing the total amount available under the line of credit.

We may raise additional capital for a variety of reasons including, without limitation, expanding our marketing activities, developing new

or enhancing existing services or products, repurchasing our common stock, acquiring complementary services, businesses or technologies or

funding unanticipated capital expenditures. If we need to raise additional capital through public or private financings, strategic relationships or

other arrangements, it might not be available to us in a timely manner, on acceptable terms, or at all. Our failure to raise sufficient capital when

needed could have a material adverse effect on our business, financial position, results of operations and cash flows. If additional funds were

raised through the issuance of equity securities, the percentage of stock owned by the then-current stockholders would be reduced.

Furthermore, such equity securities might have rights, preferences or privileges senior to holders of our common stock.

31

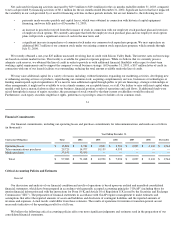

Financial Commitments

Our financial commitments, including our operating leases and purchase commitments for telecommunications and media are as follows

(in thousands):

Critical Accounting Policies and Estimates

General

Our discussion and analysis of our financial condition and results of operations is based upon our audited and unaudited consolidated

financial statements, which have been prepared in accordance with generally accepted accounting principles ("GAAP") including those for

interim financial information and with the instructions for Form 10-K and Article 10 of Regulation S-X issued by the Securities and Exchange

Commission ("SEC"). The preparation of financial statements in accordance with GAAP requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent liabilities and the reported amounts of

revenues and expenses. Actual results could differ from those estimates. The results of operations for interim or transition periods are not

necessarily indicative of the operating results for a full year.

We believe the following critical accounting policies affect our more significant judgments and estimates used in the preparation of our

consolidated financial statements.

Year Ending December 31,

Contractual Obligations

Total

2004

2005

2006

2007

2008

Thereafter

Operating leases

$

13,804

$

2,721

$

2,831

$

2,501

$

2,097

$

2,110

$

1,544

Telecommunications purchases

29,729

14,977

10,159

4,593

—

—

—

Media purchases

53,550

53,550

—

—

—

—

—

Total $

97,083

$

71,248

$

12,990

$

7,094

$

2,097

$

2,110

$

1,544