Classmates.com 2003 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2003 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Product development expenses include expenses for the maintenance of existing software and the development of new or improved

software and technology, including personnel-related expenses for the software engineering department and the costs associated with operating

our facility in India. Costs incurred by us to develop, enhance, manage, monitor and operate our services are generally expensed as incurred,

except for certain costs relating to the acquisition and development of internal-use software, which are capitalized and depreciated over their

estimated useful lives, generally three years or less.

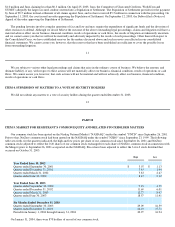

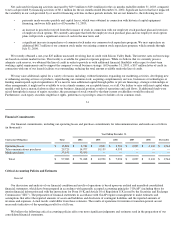

Product development expenses decreased by $1.2 million, or 10%, to $10.5 million for the six months ended December 31, 2003,

compared to $11.7 million for the six months ended December 31, 2002. The decrease was primarily the result of a $2.1 million decrease in

depreciation, partially offset by a $0.7 million increase in personnel-

related expenses as a result of increased headcount and compensation costs

and a $0.2 million increase in overhead-related costs. Depreciation expense allocated to product development decreased as a result of assets

placed in service in prior years becoming fully depreciated and significantly lower levels of capital expenditures in recent years versus prior

years. We intend to increase headcount in our software engineering department and at our facility in India in the near term, and as a result, we

expect to incur higher compensation costs in future periods related to product development.

General and Administrative

General and administrative expenses include personnel-related expenses for executive, finance, legal, human resources and internal

customer support personnel. In addition, general and administrative expenses include fees for professional legal and accounting services, non-

income taxes, insurance, and occupancy and other overhead-related costs, as well as the expenses incurred and credits received as a result of

certain legal settlements.

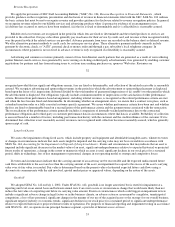

General and administrative expenses increased by $1.3 million, or 10%, to $14.0 million for the six months ended December 31, 2003,

compared to $12.7 million for the six months ended December 31, 2002. The increase in general and administrative expenses was primarily the

result of a $1.2 million increase in personnel-related expenses as a result of higher compensation costs, a $0.5 million increase in consulting

and professional services and a $0.3 million net increase in legal settlement expenses, including the recognition of a $0.7 million credit as a

result of a one-time favorable settlement of a contractual dispute in the September 2002 quarter. These increases were partially offset by a

$0.6 million decrease in overhead-related costs.

We anticipate that we will require additional office space in the near term in order to expand our operations and as a result we intend to

relocate our Westlake Village headquarters. We expect to incur significant lease termination fees and other facility exit-related costs including

increased depreciation expense related to certain furniture, fixtures and leasehold improvements primarily in the March 2004 and June 2004

quarters as a result of the relocation. In addition, we will likely incur increased rent expense in future periods.

20

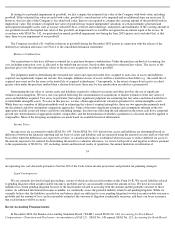

Amortization of Intangible Assets

Amortization of intangible assets includes amortization of acquired pay subscribers and free users, purchased technologies and other

identifiable intangible assets. At December 31, 2003, we had approximately $30.7 million in net identifiable intangible assets primarily

resulting from the Merger and the acquisition of the Internet access assets of BlueLight. At December 31, 2003, we had approximately

$9.5 million in goodwill resulting from the Merger. In accordance with the provisions set forth in Statement of Financial Accounting Standards

("SFAS") No. 142, Goodwill and Other Intangible Assets

, goodwill acquired in connection with the Merger is not being amortized but is tested

for impairment at a reporting unit level on an annual basis and between annual tests if an event occurs or circumstances change that would

more likely than not reduce the fair value of a reporting unit below its carrying value amount.

Amortization of intangible assets decreased by $0.6 million, or 7%, to $7.9 million for the six months ended December 31, 2003,

compared to $8.5 million for the six months ended December 31, 2002 primarily as a result of certain acquired intangible assets from the

Merger being fully amortized at September 30, 2002, partially offset by an increase in amortization expense incurred in connection with the

intangible assets acquired from BlueLight in November 2002.

During the six months ended December 31, 2003, based upon our assessment of all available evidence, we released a portion of our

deferred tax asset valuation allowance. The release of valuation allowance during the period ended December 31, 2003 in part related to the

realization of a benefit for certain acquired deferred tax assets, which resulted in a decrease in a portion of goodwill recorded in connection

with the Merger. To the extent we continue to meet our financial projections and continue to improve our results of operations, or if

circumstances otherwise change, it is reasonably possible that we may release all, or a portion, of the remaining valuation allowance in the near

term. Any further release of our valuation allowance will result in a reduction of any remaining goodwill and intangible assets related to the

Merger to the extent the valuation allowance relates to any acquired deferred tax assets. Future amortization expense would decrease

substantially to the extent any future release of the valuation allowance reduces the intangible assets acquired in connection with the Merger.

Interest Income, Net

Interest income consists of earnings on our cash, cash equivalents and short

-

term investments. Interest expense consists of interest expense