Classmates.com 2003 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2003 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

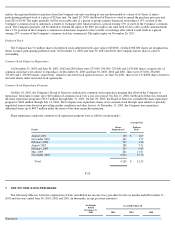

The diluted per share computations exclude options, unvested common stock and warrants, which are antidilutive. The number of

antidilutive shares at December 31, 2003 and June 30, 2003, 2002 and 2001 was 1.1 million, 4.8 million, 15.2 million and 4.5 million,

respectively.

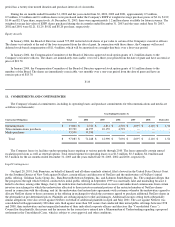

8. EMPLOYEE BENEFIT PLANS

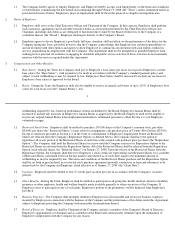

The Company has a savings plan (the "Savings Plan") that qualifies as a defined contribution plan under Section 401(k) of the Internal

Revenue Code. Under the Savings Plan, participating employees may defer a percentage (not to exceed 40%) of their eligible pretax earnings

up to the Internal Revenue Service annual contribution limit. All full-time employees on the payroll of the Company are eligible to participate

in the Plan. The Company is not required to contribute to the Savings Plan and has made no contributions since the inception of the Savings

Plan.

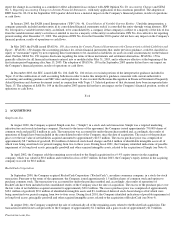

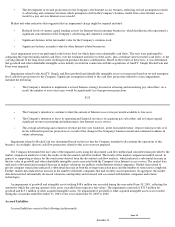

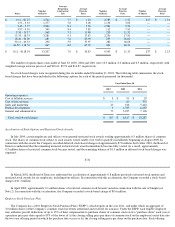

9. INCOME TAXES

For the six months ended December 31, 2003, the Company recorded a tax provision of $1.7 million on pre-tax income of $35.0 million,

resulting in an effective tax rate of 4.9%. The effective tax rate differs from the statutory tax rate primarily due to the release of valuation

allowance attributable to the expected utilization of net operating loss and tax credit carryforwards in the years ending December 31, 2004 and

2005, offset by state income taxes. In September 2002, the State of California enacted legislation that suspends the utilization of net operating

loss carryforwards to offset current taxable income for a two-year period beginning in the year ended June 30, 2003. As a result, the Company

recorded a California state income tax provision for the period.

F-27

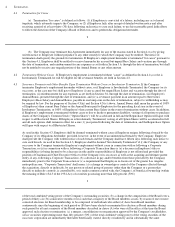

For the year ended June 30, 2003, the Company recorded a tax benefit of $1.8 million on pre-tax income of $26 million for an effective

tax rate benefit of 6.9%. The effective tax rate benefit differs from the statutory tax rate primarily due to the release of valuation allowance

attributable to the actual utilization of net operating loss carryforwards, the benefit of which had not been previously recognized, as well as the

expected utilization of net operating loss and tax credit carryforwards in the period ended June 30, 2004, offset by state income taxes.

In the years ended June 30, 2002 and 2001, the Company generated pre-tax losses of $47.8 million and $205.8 million, respectively, and

as a result, did not record a provision or benefit for income taxes.

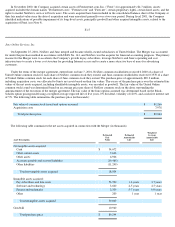

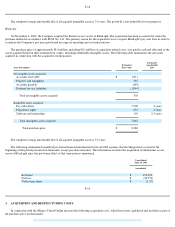

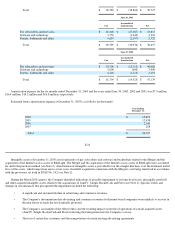

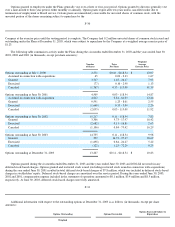

The provision (benefit) for income taxes for the six months ended December 31, 2003 and the year ended June 30, 2003 is comprised of

the following (in thousands):

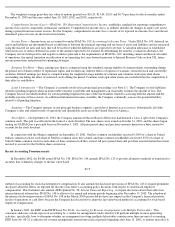

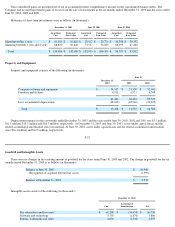

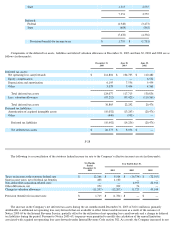

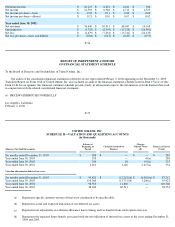

Net income (loss)

$

33,327

$

27,792

$

(47,810

)

$

(205,756

)

Denominator:

Weighted average common shares

—

basic

64,419

62,148

54,841

37,122

Adjustment to weighted average for common shares

subject to repurchase

(256

)

(460

)

(1,532

)

(3,010

)

Adjusted weighted average common shares

—

basic

64,163

61,688

53,309

34,112

Effect of dilutive securities:

Stock options, restricted shares, warrants and employee

stock purchase plan shares

5,341

5,386

—

—

Weighted average common shares

—

diluted

69,504

67,074

53,309

34,112

Net income (loss) per share

—

basic

$

0.52

$

0.45

$

(0.90

)

$

(6.03

)

Net income (loss) per share

—

diluted

$

0.48

$

0.41

$

(0.90

)

$

(6.03

)

Six Months

Ended

December 31,

2003

Year Ended

June 30,

2003

Current:

Federal $

6,038

$ —