Classmates.com 2003 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2003 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

evidence of an arrangement exists, (ii) delivery has occurred or services have been rendered, (iii) the fee is fixed or determinable and

(iv) collectibility is reasonably assured.

Billable services revenues are recognized in the period in which fees are fixed or determinable and the related products or services are

provided to the user. The Company's pay subscribers generally pay in advance for their service by credit card, and revenue is then recognized

ratably over the period in which the related services are provided. Advance payments from users are recorded on the balance sheet as deferred

revenue. The Company offers alternative payment methods to credit cards for certain pay service plans. These alternative payment methods

currently include electronic check payment, payment by personal check or money order or through a local telephone company. In

circumstances where payment is not received in advance, revenue is only recognized if collectibility is reasonably assured.

Advertising and commerce revenues primarily consist of fees from Internet search partners that are generated as a result of users utilizing

partner Internet search services, fees generated by users viewing and clicking on third-party Web site banners and text-

link advertisements, fees

generated by enabling customer registrations for partners and fees from referring users to, or from users making purchases on, sponsors' Web

sites. Revenues are recognized provided that no significant obligations remain, fees are fixed or determinable, and collection of the related

receivable is reasonably assured. The Company recognizes banner advertising and sponsorship revenues in the periods in which the

advertisement or sponsorship placement is displayed, based upon the lesser of (i) impressions delivered divided by the total number of

guaranteed impressions or (ii) ratably over the period in which the advertisement is displayed. The Company's obligations typically include a

minimum number of impressions or the satisfaction of other performance criteria. Revenue from performance-based arrangements, including

referral revenues, is recognized as the related performance criteria are met. In determining whether an arrangement exists, the Company

ensures that a binding contract is in place, such as a standard insertion order or a fully executed customer-specific agreement. The Company

assesses whether performance criteria have been met and whether the fees are fixed or determinable based on a reconciliation of the

performance criteria and the payment terms associated with the transaction. The reconciliation of the performance criteria generally includes a

comparison of internally tracked performance data to the contractual performance obligation and to third-party or customer

F-12

performance data in circumstances where that data is available. Probability of collection is assessed based on a number of factors, including

past transaction history with the customer and the creditworthiness of the customer. If it is determined that collection is not reasonably assured,

revenue is not recognized until collection becomes reasonably assured, which is generally upon receipt of cash.

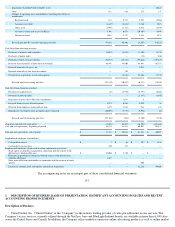

Cost of Billable Services —Cost of billable services includes direct costs of billable services and costs that have been allocated to billable

services based on the aggregate hourly usage of pay subscribers as a percentage of total hours used by active users. Direct costs consist of costs

related to providing technical support, customer billing and billing support to pay subscribers. Allocated costs consist primarily of

telecommunications and data center costs, personnel and overhead-related costs associated with operating the Company's network and data

centers, and depreciation of network computers and equipment.

Cost of Free Services —

Cost of free services includes direct costs incurred in providing certain technical and customer support services to

free access users as well as costs that have been allocated to free services based on the aggregate hourly usage of free access users as a

percentage of total hours used by the Company's active access users. Allocated costs consist primarily of telecommunications and data center

costs, personnel and overhead-related costs associated with operating the Company's network and data centers, and depreciation of network

computers and equipment.

Sales and Marketing —Sales and marketing expenses include advertising and promotion expenses, fees paid to distribution partners to

acquire new pay subscribers, personnel-related expenses for sales and marketing personnel and telemarketing costs incurred to acquire pay

subscribers, retain pay subscribers and up sell pay subscribers to add-on services, such as our accelerated dial-up services. The Company has

expended significant amounts on sales and marketing, including national branding campaigns comprised of television, Internet, sponsorships,

radio, print and outdoor advertising. Marketing and advertising costs to promote the Company's products and services are expensed in the

period incurred. Advertising and promotion expenses include media, agency and promotion expenses. Media production costs are expensed the

first time the advertisement is run. Media and agency costs are expensed over the period the advertising runs. Advertising and promotion

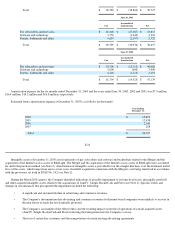

expense for the six months ended December 31, 2003 and the years ended June 30, 2003, 2002 and 2001 was $57.6 million, $67.7 million,

$25.4 million and $40.3 million, respectively.

Product Development Costs —Product development expenses include expenses for the maintenance of existing software and the

development of new or improved software and technology, including personnel-related expenses for the software engineering department and

the costs associated with operating the Company's facility in India. Costs incurred by the Company to develop, enhance, manage, monitor and

operate the Company's services are generally expensed as incurred, except for certain costs relating to the acquisition and development of

internal-use software that are capitalized and depreciated over their estimated useful lives, generally three years or less.

General and Administrative —General and administrative expenses include personnel-related expenses for executive, finance, legal,

human resources and internal customer support personnel. In addition, general and administrative expenses include fees for professional legal

and accounting services, non-income taxes, insurance, and occupancy and other overhead-related costs, as well as the expenses incurred and

credits received as a result of certain legal settlements.