Classmates.com 2003 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2003 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

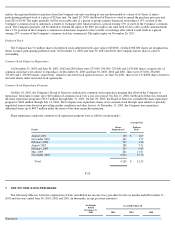

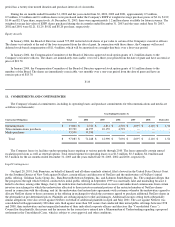

Options granted to employees under the Plans generally vest over a three or four-year period. Options granted to directors generally vest

over a nine-month to three-year period, either monthly or annually. Option grants expire after ten years unless cancelled earlier due to

termination of employment or Board service. Certain grants are immediately exercisable for unvested shares of common stock, with the

unvested portion of the shares remaining subject to repurchase by the

F-30

Company at the exercise price until the vesting period is complete. The Company had 0.2 million unvested shares of common stock issued and

outstanding under the Plans at December 31, 2003, which were subject to repurchase by the Company at a weighted average exercise price of

$1.23.

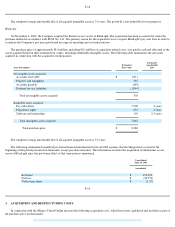

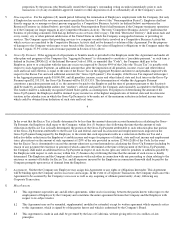

The following table summarizes activity under the Plans during the six months ended December 31, 2003 and the years ended June 30,

2003, 2002 and 2001 (in thousands, except per share amounts):

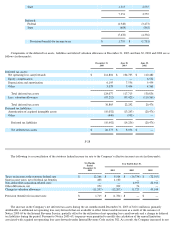

Options granted during the six months ended December 31, 2003 and the years ended June 30, 2003 and 2002 did not result in any

deferred stock-based charges. Options granted and restricted stock issued (excluding restricted stock issued in connection with acquisitions)

during the year ended June 30, 2001 resulted in total deferred stock-based charges of $7.8 million, which was included in deferred stock-based

charges in stockholders' equity. Deferred stock-based charges are amortized over the service period. During the years ended June 30, 2003,

2002 and 2001, compensation expense included in the statement of operations amounted to $0.1 million, $3.4 million and $8.5 million,

respectively. At June 30, 2003, deferred stock-based charges were fully amortized.

F-31

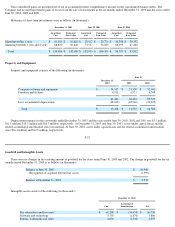

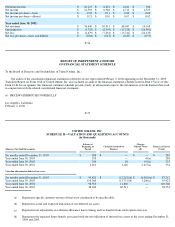

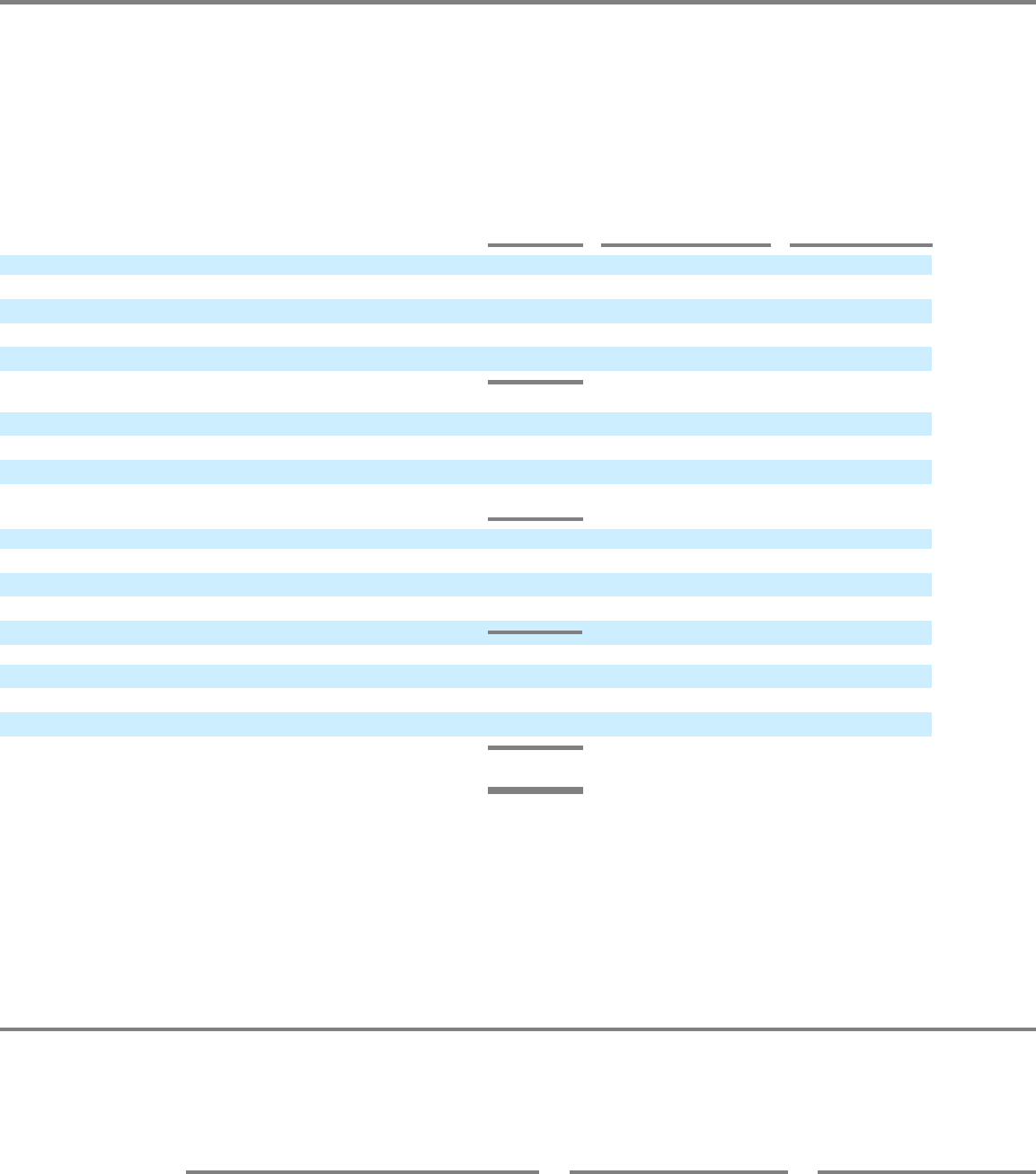

Additional information with respect to the outstanding options at December 31, 2003 is as follows (in thousands, except per share

amounts):

Number

of Shares

Price

Per Share

Weighted

Average

Exercise Price

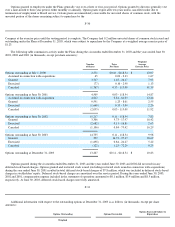

Options outstanding at July 1, 2000

2,571

$0.10

-

$118.54

$

43.07

Assumed in connection with acquisitions

65

0.03 -

2.33

1.67

Granted

3,717

1.67 -

26.47

7.93

Exercised

(77

) 0.10 -

2.90

1.13

Canceled

(1,767

) 0.33 -

115.00

41.39

Options outstanding at June 30, 2001

4,509

0.03

-

118.54

14.87

Assumed in connection with acquisition

4,812

0.84 -

84.03

12.46

Granted

9,591

1.23 -

8.01

2.55

Exercised

(1,640

) 0.33 -

5.04

2.26

Canceled

(2,055

) 0.03 -

115.00

11.92

Options outstanding at June 30, 2002

15,217

0.11

-

118.54

7.83

Granted

3,306

5.73 -

17.97

16.42

Exercised

(2,682

) 0.11 -

16.81

2.63

Canceled

(1,106

) 0.84 -

75.42

16.29

Options outstanding at June 30, 2003

14,735

0.11

-

118.54

9.98

Granted

292

16.73 -

27.47

20.69

Exercised

(1,698

) 0.84 -

24.27

5.22

Canceled

(122

) 1.23 -

72.29

9.25

Options outstanding at December 31, 2003

13,207

$0.11

-

$118.54

$

10.83

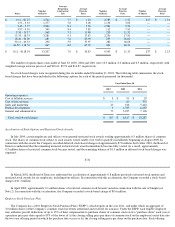

Options Outstanding

Options Exercisable

Options Exercised Subject to

Repurchase

Weighted