Classmates.com 2003 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2003 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

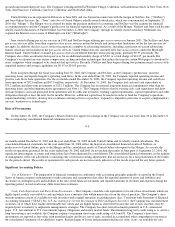

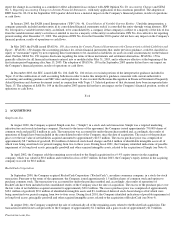

Gross unrealized gains are presented net of tax in accumulated other comprehensive income on the consolidated balance sheets. The

Company had no material realized gains or losses from the sale of investments in the six months ended December 31, 2003 and the years ended

June 30, 2003, 2002 and 2001.

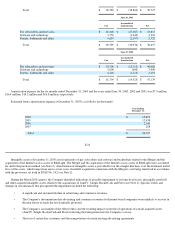

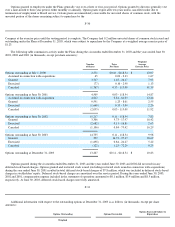

Maturities of short-term investments were as follows (in thousands):

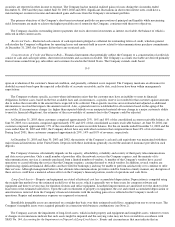

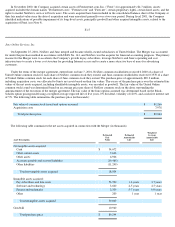

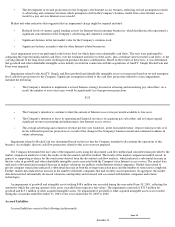

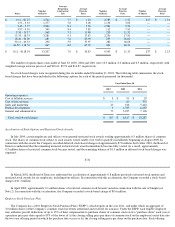

Property and Equipment

Property and equipment consists of the following (in thousands):

Depreciation expense for the six months ended December 31, 2003 and the years ended June 30, 2003, 2002 and 2001 was $3.1 million,

$11.1 million, $18.3 million and $16.3 million, respectively. At December 31, 2003 and June 30, 2003, assets under capital leases and the

related accumulated amortization were not material. At June 30, 2002, assets under capital leases and the related accumulated amortization

were $16.1 million and $12.9 million, respectively.

F-21

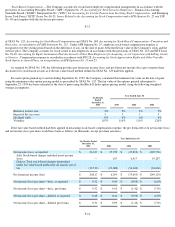

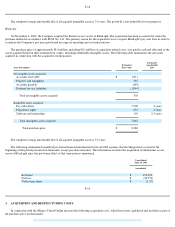

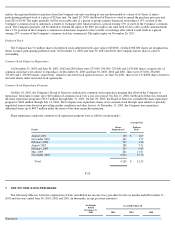

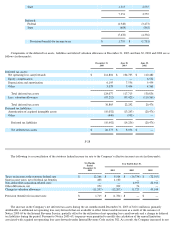

Goodwill and Intangible Assets

There were no changes in the carrying amount of goodwill for the years ended June 30, 2003 and 2002. The change in goodwill for the six

months ended December 31, 2003 is as follows (in thousands):

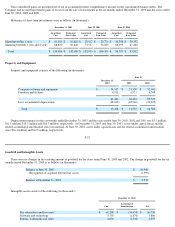

Intangible assets consist of the following (in thousands):

December 31, 2003

June 30, 2003

June 30, 2002

Amortized

Cost

Estimated

Fair Value

Amortized

Cost

Estimated

Fair Value

Amortized

Cost

Estimated

Fair Value

Maturing within 1 year

$

41,581

$

41,861

$

29,417

$

29,770

$

30,398

$

30,552

Maturing between 1 year and 4 years

88,823

90,628

73,537

76,620

66,399

67,260

Total

$

130,404

$

132,489

$

102,954

$

106,390

$

96,797

$

97,812

June 30,

December 31,

2003

2003

2002

Computer software and equipment

$

54,535

$

53,530

$

52,961

Furniture and fixtures

6,911

6,951

6,568

61,446

60,481

59,529

Less: accumulated depreciation

(48,018

)

(48,946

)

(43,029

)

Total $

13,428

$

11,535

$

16,500

Balance at June 30, 2003

$

10,940

Recognition of acquired deferred tax assets

(1,399

)

Balance at December 31, 2003

$

9,541

December 31, 2003

Cost

Accumulated

Amortization

Net

Pay subscribers and free users

$

61,200

$

(34,450

)

$

26,750

Software and technology

3,750

(1,870

)

1,880

Patents, trademarks and other

4,639

(2,542

)

2,097