Classmates.com 2003 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2003 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

materially and adversely affect our ability to operate our business.

If we are unable to successfully integrate acquisitions into our operations, we may not realize the benefits associated with such

acquisitions and our business, financial condition, results of operations and cash flows may be adversely affected.

In September 2001 we completed the Merger and in November 2002 we acquired certain assets of BlueLight's Internet access service.

While the integration of these acquired businesses is substantially complete, additional efforts are ongoing to maximize operating efficiencies

and we cannot assure you that these additional efforts will be completed successfully. We may acquire other companies or undertake other

business combinations that we believe may complement our current or future business activities. Acquisitions may not be available at the times

or on terms acceptable to us, or at all. In addition, acquiring a business involves many risks, including:

• disruption of our ongoing business and diversion of resources and management time;

• unforeseen obligations or liabilities;

• difficulty assimilating the acquired customer bases, technologies, operations and personnel;

• risks of entering markets in which we have little or no direct prior experience;

• potential impairment of relationships with employees or users as a result of changes in management; and

• potential dilutive issuances of equity, large write-offs either at the time of the acquisition or in the future, the incurrence of

restructuring charges, the incurrence of debt, and amortization of identifiable intangible assets.

We cannot assure you that we will make any further acquisitions. If we do, however, we cannot assure you that any such acquisitions

would be successful.

46

We may not realize the benefits associated with our intangible assets and may be required to record a significant charge to earnings if

we must reassess our goodwill or identifiable intangible assets.

We are required, under accounting principles generally accepted in the United States, to review our intangible assets for impairment when

events occur or circumstances change that would more likely than not reduce the fair value of a reporting unit below its carrying value amount.

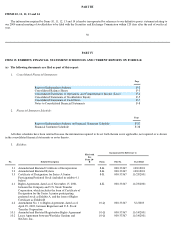

Goodwill is required to be tested for impairment at least annually. In the quarter ended March 31, 2001, we recorded an impairment charge of

$48.6 million reflecting the amount by which the carrying amounts of our goodwill and identifiable intangible assets exceeded their respective

fair values. At December 31, 2003, we had approximately $30.7 million in identifiable intangible assets and $9.5 million of goodwill. We

cannot assure you that we will not experience impairment losses in the future. Any such loss could adversely and materially impact our

business, financial condition and results of operations.

Our ability to operate our business could be seriously harmed if we lose members of our senior management team or other key

employees.

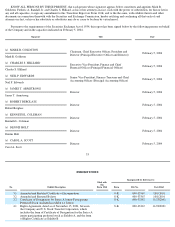

Our business is largely dependent on the efforts and abilities of our senior management, particularly Mark Goldston, our chairman, chief

executive officer and president, and other key personnel. Any of our officers or employees can terminate his or her employment relationship at

any time, although certain officers are party to employment agreements. The loss of these key employees or our inability to attract or retain

other qualified employees could seriously harm our business and prospects. We do not carry key man life insurance on any of our employees.

We will not be able to grow our business if we are not able to retain or hire additional personnel.

Our future success also depends on our ability to attract and retain highly skilled technical, managerial, sales, marketing and

administrative personnel. Competition for such personnel is intense, particularly in the Internet and high technology industry. As a result, we

may be unable to successfully attract, assimilate or retain qualified personnel.

Government regulation or taxation of the provision of Internet access services could decrease our revenues and increase our costs.

Changes in the regulatory environment regarding the Internet could decrease our revenues and increase our costs. Currently ISPs are

considered "information service" providers rather than "telecommunications" providers, and therefore are not directly regulated by the Federal

Communications Commission or any other governmental agency, other than with respect to regulations that govern businesses generally, such

as regulations related to consumer protection. Accordingly, regulations that apply to telephone companies and other telecommunications

common carriers do not apply to us. As information service providers, we also operate under an exemption from the access charges that are

assessed by local telephone companies on their customers for providing access to their network. We are also not required to contribute a