Classmates.com 2003 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2003 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-18

The weighted average amortizable life of all acquired intangible assets is 3.9 years. The goodwill is not deductible for tax purposes.

BlueLight

On November 4, 2002, the Company acquired the Internet access assets of BlueLight. The acquisition has been accounted for under the

purchase method in accordance with SFAS No. 141. The primary reason for the acquisition was to acquire BlueLight's pay user base in order to

accelerate the Company's pay user growth and leverage its operating and cost infrastructure.

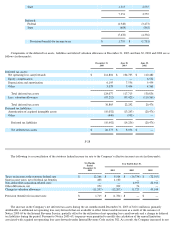

The purchase price of approximately $8.4 million, including $0.1 million of acquisition-

related costs, was paid in cash and allocated to the

assets acquired based on their estimated fair values, including identifiable intangible assets. The following table summarizes the net assets

acquired in connection with the acquisition (in thousands):

The weighted average amortizable life of all acquired intangible assets is 3.9 years.

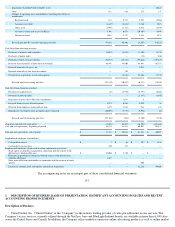

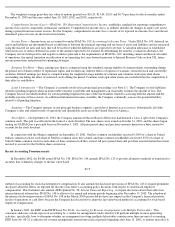

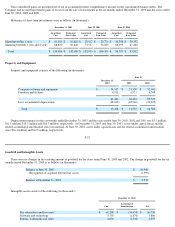

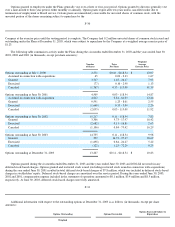

The following summarized unaudited pro forma financial information for fiscal 2002 assumes that the Merger had occurred at the

beginning of the period presented (in thousands, except per share amounts). The information excludes the acquisition of the Internet access

assets of BlueLight since the pro forma effect of that transaction is immaterial.

F-19

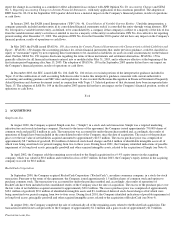

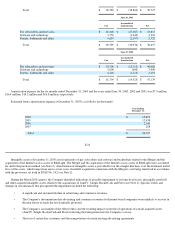

3. ACQUISITION AND RESTRUCTURING COSTS

In connection with the Merger, United Online incurred the following acquisition costs, which have been capitalized and included as part of

the purchase price (in thousands):

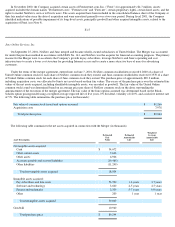

Asset Description

Estimated

Fair Value

Estimated

Amortizable

Life

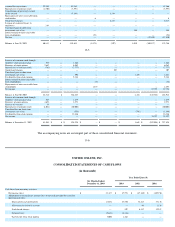

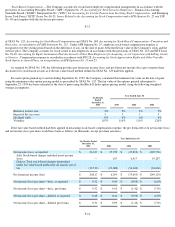

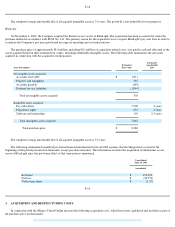

Net tangible assets acquired:

Accounts receivable $

1,611

Property and equipment

585

Accounts payable

(649

)

Deferred service liabilities

(1,044

)

Total net tangible assets acquired

503

Intangible assets acquired:

Pay subscribers

7,500

4 years

Proprietary rights

235

3 years

Software and technology

150

2.5 years

Total intangible assets acquired

7,885

Total purchase price $

8,388

Year Ended

June 30, 2002

(unaudited)

Revenues

$

195,423

Net loss

$

(49,553

)

Net loss per share

$

(1.27

)