Classmates.com 2003 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2003 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

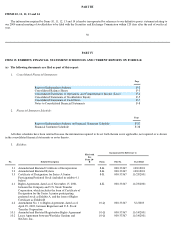

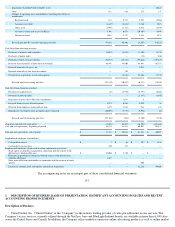

F-5

The accompanying notes are an integral part of these consolidated financial statements.

F-6

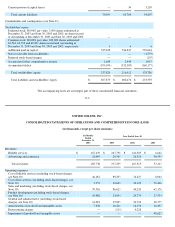

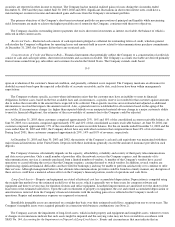

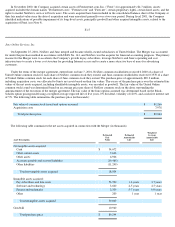

UNITED ONLINE, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

assumed for acquisitions

22,385

2

81,264

— — — —

81,266

Repurchases of common stock

(1,500

)

—

(

3,557

)

—

—

—

—

(

3,557

)

Cancellations of previously issued

equity awards — — (

3,184

) —

3,184

— — —

Repayments of notes receivable from

stockholders — — —

6

— — —

6

Stock-based charges — — — —

6,417

— —

6,417

Issuance of restricted shares to

employees

284

—

—

—

—

—

—

—

Unrealized gain on short-term

investments, net of tax — — — — —

148

—

148

Interest earned on notes receivable

from stockholders — — — (

52

) — — — (

52

)

Net loss

— — — — — — (

47,810

)

(47,810

)

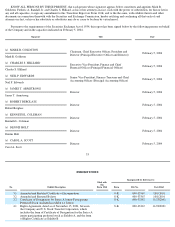

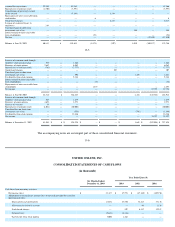

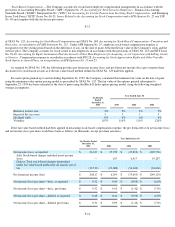

Balance at June 30, 2002

60,851

6

539,624

(1,575

)

(107

)

1,015

(360,177

)

178,786

Issuance of common stock through

employee stock purchase plan

939

—

1,862

— — — —

1,862

Exercises of stock options

2,682

—

6,962

—

—

—

—

6,962

Repurchases of common stock

(762

) — (

7,777

) — — — — (

7,777

)

Stock-based charges — — — —

107

— —

107

Unrealized gain on short-term

investments, net of tax — —

992

— —

1,429

—

2,421

Tax benefits from stock options — —

5,184

— — — —

5,184

Interest earned on notes receivable

from stockholders — — — (

78

) — — — (

78

)

Repayments of notes receivable from

stockholders

—

—

—

1,653

—

—

—

1,653

Net income

— — — — — —

27,792

27,792

Balance at June 30, 2003

63,710

6

546,847

— —

2,444

(332,385

)

216,912

Issuance of common stock through

employee stock purchase plan

525

—

1,679

—

—

—

—

1,679

Exercises of stock options

1,698

—

8,971

— — — —

8,971

Exercise of warrants

35

— — — — — — —

Repurchases of common stock

(2,024

)

—

(

40,002

)

—

—

—

—

(

40,002

)

Unrealized loss on short-term

investments, net of tax — — (

553

) — — (

796

) — (

1,349

)

Tax benefits from stock options

—

—

18,286

—

—

—

—

18,286

Net income

— — — — — —

33,327

33,327

Balance at December 31, 2003

63,944

$

6

$

535,228

$ — $ — $

1,648

$

(299,058

) $

237,824

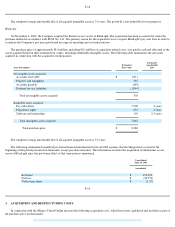

Year Ended June 30,

Six Months Ended

December 31, 2003

2003

2002

2001

Cash flows from operating activities:

Net income (loss)

$

33,327

$

27,792

$

(47,810

)

$

(205,756

)

Adjustments to reconcile net income (loss) to net cash provided by (used for)

operating activities:

Depreciation and amortization

11,076

27,560

32,415

33,110

Allowance for doubtful accounts

—

—

98

1,120

Stock-based charges —

107

6,417

19,287

Deferred taxes

(5,632

)

(4,336

) — —

Tax benefits from stock options

7,000

1,464

— —