Classmates.com 2003 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2003 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

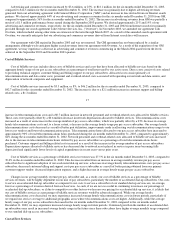

General and administrative expenses increased by $1.9 million, or 7%, to $30.7 million for the year ended June 30, 2002, compared to

$28.8 million for the year ended June 30, 2001 due to a $2.2 million increase in personnel-related expenses, a $2.4 million increase in rent and

other occupancy-related expenses, a $1.0 million increase in insurance expenses, a $0.9 million increase in professional fees and a $0.6 million

increase in other administrative and overhead-related costs. These increases were primarily a result of the Merger. These increases were

partially offset by a $3.3 million decrease in stock-based charges, a $1.0 million decrease in bad debt expense and a $0.9 million decrease in

expenses directly related to our former RocketCash subsidiary. Stock-based charges decreased as a result of the cancellation or forfeiture of

issued securities that were previously being amortized over their vesting period, which were partially offset by increased stock-based charges

incurred as a result of the accelerated vesting of certain previously granted stock options and restricted stock awards that occurred in

October 2001 and March 2002.

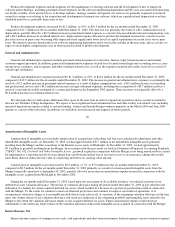

Amortization of Goodwill and Intangible Assets

Amortization of goodwill and intangible assets decreased by $2.7 million, or 16%, to $14.2 million for the year ended June 30, 2002,

compared to $16.8 million for the year ended June 30, 2001 as a result of the write down of goodwill and intangible assets totaling

$48.6 million that was recorded during the March 2001 quarter, which reflected the amount by which the carrying amounts of the intangible

assets exceeded their respective fair values. The write down consisted of $33.5 million of goodwill and $15.1 million of other identifiable

intangible assets and other assets. The decrease was partially offset by an increase in amortization of intangible assets resulting from the

Merger. In connection with the Merger, we recorded $59.8 million of identifiable intangible assets and $10.9 million of goodwill. The

intangible assets are being amortized over periods ranging from one to

28

seven years. Since the Merger was completed after June 30, 2001, we are not amortizing the goodwill acquired as a result of the Merger in

accordance with SFAS No. 142. Under SFAS No. 142, goodwill is no longer amortized but is reviewed annually (or more frequently if

impairment indicators arise) for impairment.

Restructuring Charges

During the year ended June 30, 2002, we recorded $4.2 million of restructuring charges, which consisted of $0.8 million in employee

termination benefits, $0.5 million for early contractual termination fees and $2.9 million in lease exit-related costs, which included a charge of

approximately $1.4 million to write off leasehold improvements associated with our former offices in New York and Rhode Island.

In an effort to streamline our operations in response to changing market conditions, we reduced our workforce by 101 employees during

the year ended June 30, 2002. Of the 101 employees terminated, 43 were in sales and marketing, 26 were in general and administrative, 23

were in product development, 6 employees were at our former RocketCash subsidiary, and 3 were in network operations. In addition, we closed

our offices in San Francisco, California and Providence, Rhode Island and combined our New York offices into one facility. At June 30, 2002,

accrued liabilities associated with restructuring costs were $0.6 million. We did not record any restructuring costs in the year ended June 30,

2001.

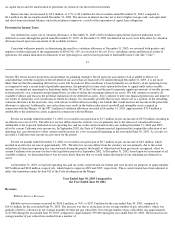

Interest Income, Net

Interest income, net decreased by $4.2 million, or 45%, to $5.1 million for the year ended June 30, 2002, compared to $9.3 million for the

year ended June 30, 2001. The decrease in interest income, net was a result of lower average cash balances and lower interest rates, partially

offset by reduced interest expense as a result of decreases in capital lease and notes payable balances.

Other Income (Expense), Net

Other income (expense), net for the year ended June 30, 2002 was $1.1 million. During the quarter ended September 30, 2001, we sold

substantially all of the assets of our RocketCash subsidiary and recognized a gain of approximately $1.0 million.

Income Taxes

As a result of operating losses and our inability to recognize a benefit from our deferred tax assets, we did not record a benefit for income

taxes for the years ended June 30, 2002 and 2001.

Liquidity and Capital Resources

From inception through June 30, 2002, our business was financed primarily through the sale of equity securities. However, during the year

ended June 30, 2003 and the six months ended December 31, 2003, our business generated positive cash flows from operations. Our total cash,

cash equivalent and short-

term investment balances increased by approximately $43.9 million, or 28%, to $203.7 million at December 31, 2003

compared to $159.8 million at December 31, 2002.