Classmates.com 2003 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2003 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

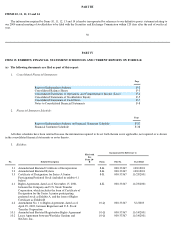

The accompanying notes are an integral part of these consolidated financial statements.

F-4

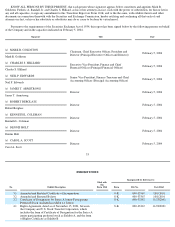

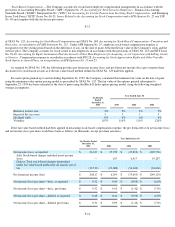

UNITED ONLINE, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

(in thousands)

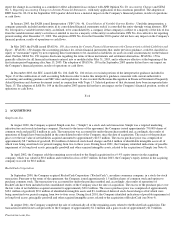

Total operating expenses

153,099

255,574

221,461

272,304

Operating income (loss)

32,639

21,721

(53,946

)

(215,087

)

Interest income, net

2,407

4,290

5,070

9,331

Other income, net

—

—

1,066

—

Income (loss) before income taxes

35,046

26,011

(47,810

)

(205,756

)

Provision (benefit) for income taxes

1,719

(1,781

)

—

—

Net income (loss)

$

33,327

$

27,792

$

(47,810

)

$

(205,756

)

Unrealized gain (loss) on short-term investments, net of

tax

(796

)

1,429

148

867

Comprehensive income (loss)

$

32,531

$

29,221

$

(47,662

)

$

(204,889

)

Net income (loss) per share

—

basic

$

0.52

$

0.45

$

(0.90

)

$

(6.03

)

Net income (loss) per share

—

diluted

$

0.48

$

0.41

$

(0.90

)

$

(6.03

)

Shares used to calculate basic net income (loss) per share

64,163

61,688

53,309

34,112

Shares used to calculate diluted net income (loss) per share

69,504

67,074

53,309

34,112

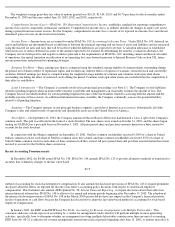

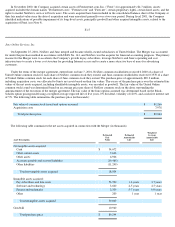

Common Stock

Notes

Receivable

From

Stockholders

Accumulated

Other

Comprehensive

Income

Additional

Paid-In

Capital

Deferred

Stock-Based

Charges

Accumulated

Deficit

Total

Stockholders'

Equity

Shares

Amount

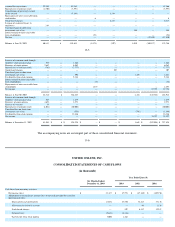

Balance at July 1, 2000

35,015

$

4

$

405,961

$

(799

)

$

(12,821

)

$

—

$

(

106,611

)

$

285,734

Issuance of common stock and

warrants for marketing agreements

150

—

2,954

— (

2,873

) — —

81

Issuance of common stock through

employee stock purchase plan

147

—

431

—

—

—

—

431

Exercises of stock options

76

—

84

— — — —

84

Repurchases of option shares exercised

(74

) — (

61

) — — — — (

61

)

Issuance of common stock for

acquisitions

1,821

—

38,320

— — — —

38,320

Issuance of restricted common stock

for acquisition

440

—

11,482

—

(

11,482

)

—

—

—

Deferred stock-based charges — —

7,828

— (

7,828

) — — —

Issuance of restricted shares to

employees

144

—

—

—

—

—

—

—

Stock-based charges — — — —

19,287

— —

19,287

Cancellation of previously issued

equity awards — — (

6,009

) —

6,009

— — —

Unrealized gain on short-term

investments, net of tax — — — — —

867

—

867

Interest earned on notes receivable

from stockholders

—

—

—

(

30

)

—

—

—

(

30

)

Net loss

— — — — — — (

205,756

)

(205,756

)

Balance at June 30, 2001

37,719

4

460,990

(829

)

(9,708

)

867

(312,367

)

138,957

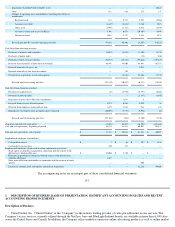

Issuance of common stock through

employee stock purchase plan

358

—

516

— — — —

516

Exercises of stock options

1,640

—

3,630

(700

) — — —

2,930

Repurchases of option shares exercised

(35

)

—

(

35

)

—

—

—

—

(

35

)

Issuance of common stock and options