Classmates.com 2003 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2003 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

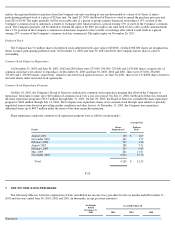

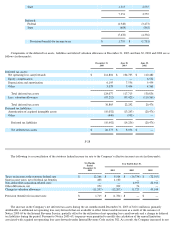

The number of option shares exercisable at June 30, 2003, 2002 and 2001 were 10.3 million, 8.0 million and 0.9 million, respectively with

weighted average exercise prices of and $10.61, $9.53 and $14.87, respectively.

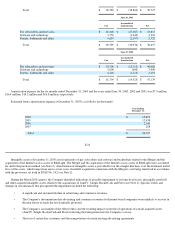

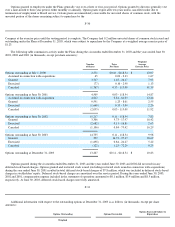

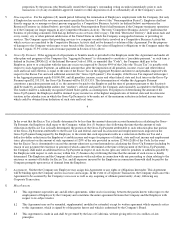

No stock-based charges were recognized during the six months ended December 31, 2003. The following table summarizes the stock-

based charges that have been included in the following captions for each of the periods presented (in thousands):

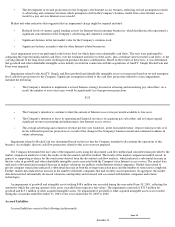

Acceleration of Stock Options and Restricted Stock Awards

In July 2000, certain employees and officers were granted restricted stock awards totaling approximately 0.5 million shares of common

stock. The shares of common stock subject to such awards vested ratably over twelve quarterly installments beginning in August 2000. In

connection with the award, the Company recorded deferred stock-based charges of approximately $7.8 million. In October 2001, the Board of

Directors authorized that the remaining unvested restricted stock awards immediately become fully vested. As a result, approximately

0.3 million shares of restricted common stock became vested, and the remaining balance of $1.5 million in deferred stock-based charges was

expensed.

F-32

In March 2002, the Board of Directors authorized the acceleration of approximately 0.8 million previously unvested stock options and

restricted stock awards for six employees, including four officers. In connection with this acceleration, the Company recorded a stock-based

charge of $1.3 million.

In April 2002, approximately 0.1 million shares of restricted common stock became vested in connection with the sale of Simpli (see

Note 2). In connection with this acceleration, the Company recorded a stock

-based charge of $0.6 million.

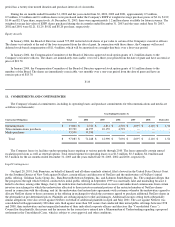

Employee Stock Purchase Plan

The Company has a 2001 Employee Stock Purchase Plan ("ESPP"), which expires in the year 2011, and under which an aggregate of

3.0 million shares of the Company's common stock have been authorized and reserved for issuance. Under the ESPP, each eligible employee

may authorize payroll deductions of up to 15% of their compensation to purchase shares of common stock on two "purchase dates" each year at

a purchase price per share equal to 85% of the lower of (i) the closing selling price per share of common stock on the employee's entry date into

the two

-

year offering period in which the purchase date occurs or (ii) the closing selling price per share on the purchase date. Each offering

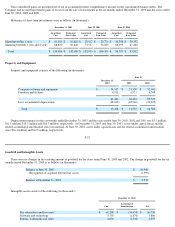

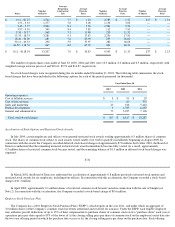

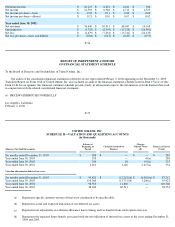

Prices

Number

of Shares

Average

Remaining

Contractual

Life

Average

Exercise

Price

Number

of Shares

Average

Exercise

Price

Number

of Shares

Average

Exercise

Price

$

0.11

-

$

1.27

3,744

7.7

$

1.22

2,785

$

1.22

237

$

1.23

1.53

-

3.33

1,377

7.0

3.00

1,138

3.08

—

—

3.43

-

5.77

2,842

8.1

5.38

1,981

5.56

—

—

5.97

-

9.19

349

8.4

7.89

112

7.85

—

—

9.34

-

13.17

368

7.1

11.40

290

11.32

—

—

13.33

-

18.33

3,281

9.1

17.83

2,230

17.85

—

—

18.40

-

30.00

481

7.6

23.99

253

26.00

—

—

30.11

-

43.33

298

5.9

37.97

282

36.08

—

—

44.59

-

118.54

467

6.0

65.90

432

66.31

—

—

$

0.11

-

$118.54

13,207

7.9

$

10.83

9,503

$

11.35

237

$

1.23

Year Ended June 30,

2003

2002

2001

Operating expenses:

Cost of billable services

$

8

$

99

$

29

Cost of free services

—

60

353

Sales and marketing

20

548

5,442

Product development

6

1,785

6,267

General and administrative

73

3,925

7,196

Total stock-based charges $

107

$

6,417

$

19,287