Classmates.com 2003 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2003 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

$1.0 million and Juno claiming less than $0.3 million. On April 25, 2003, Juno, the Committee of Unsecured Creditors, WorldCom and

UUNET (allegedly the largest secured creditor) entered into a Stipulation of Settlement. The Stipulation of Settlement provides for the payment

by Juno of $5.5 million in final settlement of all claims against Juno, and we have reserved $5.5 million in connection with this proceeding. On

September 11, 2003, the court issued an order approving the Stipulation of Settlement. On September 12, 2003, the Debtor filed a Notice of

Appeal of the order approving the Stipulation of Settlement.

The pending lawsuits involve complex questions of fact and law and may require the expenditure of significant funds and the diversion of

other resources to defend. Although we do not believe the outcome of the above outstanding legal proceedings, claims and litigation will have a

material adverse effect on our business, financial condition, results of operations or cash flows, the results of litigation are inherently uncertain

and we cannot assure you that we will not be materially and adversely impacted by the results of such proceedings. Other than with respect to

the Consolidated Cases, we have established reserves for the matters discussed above and such reserves are reflected in our consolidated

financial statements. We cannot assure you, however, that the reserves that have been established are sufficient to cover the possible losses

from outstanding litigation.

11

We are subject to various other legal proceedings and claims that arise in the ordinary course of business. We believe the amount, and

ultimate liability, if any, with respect to these actions will not materially affect our business, financial condition, results of operations or cash

flows. We cannot assure you, however, that such actions will not be material and will not adversely affect our business, financial condition,

results of operations or cash flows.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

We did not submit any matters to a vote of security holders during the quarter ended December 31, 2003.

12

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

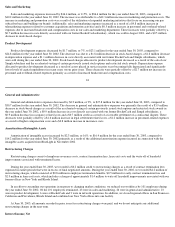

Our common stock has been quoted on the Nasdaq National Market ("NASDAQ") under the symbol "UNTD" since September 26, 2001.

Prior to that, NetZero common stock had been quoted on the NASDAQ under the symbol "NZRO" since September 23, 1999. The following

table sets forth, for the quarters indicated, the high and low prices per share of our common stock since September 26, 2001 and NetZero

common stock (adjusted to reflect the 0.20 shares of our common stock exchanged for each share of NetZero common stock in connection with

the Merger) prior to September 26, 2001 as reported on the NASDAQ. Prices have been adjusted to reflect the 3-for-2 stock dividend that

occurred on October 31, 2003:

On January 31, 2004, there were 870 holders of record of our common stock.

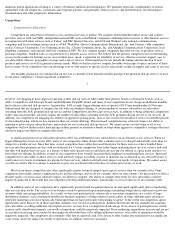

High

Low

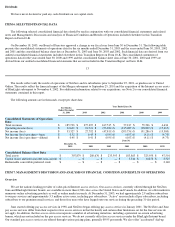

Year Ended June 30, 2002

Quarter ended September 30, 2001

$

3.07

$

1.13

Quarter ended December 31, 2001

3.45

1.44

Quarter ended March 31, 2002

5.83

2.67

Quarter ended June 30, 2002

8.47

5.12

Year Ended June 30, 2003

Quarter ended September 30, 2002

9.19

4.75

Quarter ended December 31, 2002

11.69

6.01

Quarter ended March 31, 2003

12.77

8.47

Quarter ended June 30, 2003

18.57

11.41

Six Months Ended December 31, 2003

Quarter ended September 30, 2003

29.09

16.59

Quarter ended December 31, 2003

24.10

15.71

Period from January 1, 2004 through January 31, 2004

20.97

16.94