Classmates.com 2003 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2003 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

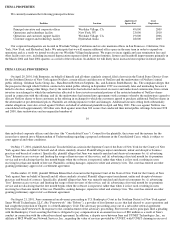

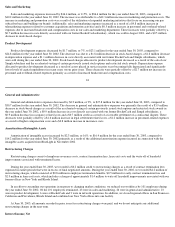

ITEM 2. PROPERTIES

We currently maintain the following principal facilities:

Our corporate headquarters are located in Westlake Village, California and we also maintain offices in San Francisco, California; New

York, New York; and Hyderabad, India. We anticipate that we will require additional office space in the near term in order to expand our

operations and as a result we intend to relocate our Westlake Village headquarters. We expect to incur significant lease termination fees and

other facility exit costs, including increased depreciation expense related to certain furniture, fixtures and leasehold improvements primarily in

the March 2004 and June 2004 quarters as a result of the relocation. In addition we will likely incur increased rent expense in future periods.

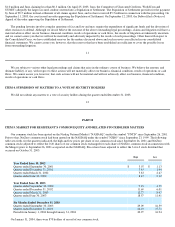

ITEM 3. LEGAL PROCEEDINGS

On April 20, 2001, Jodi Bernstein, on behalf of himself and all others similarly situated, filed a lawsuit in the United States District Court

for the Southern District of New York against NetZero, certain officers and directors of NetZero and the underwriters of NetZero's initial

public offering, Goldman Sachs Group, Inc., BancBoston Robertson Stephens, Inc. and Salomon Smith Barney, Inc. The complaint alleges that

the prospectus through which NetZero conducted its initial public offering in September 1999 was materially false and misleading because it

failed to disclose, among other things, that (i) the underwriters had solicited and received excessive and undisclosed commissions from certain

investors in exchange for which the underwriters allocated to those investors material portions of the restricted number of NetZero shares

issued in connection with the offering; and (ii) the underwriters had entered into agreements with customers whereby the underwriters agreed to

allocate NetZero shares to those customers in the offering in exchange for which the customers agreed to purchase additional NetZero shares in

the aftermarket at pre-determined prices. Plaintiffs are seeking injunctive relief and damages. Additional lawsuits setting forth substantially

similar allegations were also served against NetZero on behalf of additional plaintiffs in April and May 2001. The case against NetZero was

consolidated with approximately 300 other suits filed against more than 300 issuers that conducted their initial public offerings between 1998

and 2000, their underwriters and an unspecified number of

10

their individual corporate officers and directors (the "Consolidated Cases"). Counsel for the plaintiffs, the issuers and the insurers for the

issuers have entered into a Memorandum of Understanding regarding a proposed settlement in the Consolidated Cases, which is subject to

court approval and other conditions.

On May 17, 2001, plaintiff Ann Louise Truschel filed an action in the Supreme Court of the State of New York for the County of New

York against Juno on behalf of herself and all others similarly situated. Plaintiff alleges unjust enrichment, unfair and deceptive business

practices and breach of contract. Specifically, plaintiff alleges that Juno was unjustly enriched and deceived consumers by: (i) advertising

"free" Internet access services and limiting the usage of heavier users of the service, and (ii) advertising a free trial month for its premium

service and not disclosing that the free month begins when the software is requested, rather than when it is first used, resulting in users

receiving less than one month of free use. Plaintiff is seeking damages, injunctive relief and attorneys' fees. The court has entered an order

granting preliminary approval of a settlement agreement.

On December 19, 2002, plaintiff William Kleen filed a lawsuit in the Supreme Court of the State of New York for the County of New

York against Juno on behalf of himself and all others similarly situated. Plaintiff alleges unjust enrichment, unfair and deceptive business

practices and breach of contract. Specifically, plaintiff alleges that Juno was unjustly enriched and deceived consumers by: (i) advertising

"free" Internet access services and limiting the usage of heavier users of the service, and (ii) advertising a free trial month for its premium

service and not disclosing that the free month begins when the software is requested, rather than when it is first used, resulting in users

receiving less than one month of free use. Plaintiff is seeking damages, injunctive relief and attorneys' fees. The court has entered an order

granting preliminary approval of a settlement agreement.

On August 21, 2001, Juno commenced an adversary proceeding in U.S. Bankruptcy Court in the Southern District of New York against

Smart World Technologies, LLC, dba "Freewwweb," (the "Debtor"), a provider of free Internet access that had elected to cease operations and

had sought the protection of Chapter 11 of the Bankruptcy Code. The adversary proceeding arose out of a subscriber referral agreement

between Juno and Freewwweb. In response to the commencement of the adversary proceeding, Freewwweb and its principals filed a pleading

with the Bankruptcy Court asserting that Juno is obligated to pay compensation in an amount in excess of $80 million as a result of Juno's

conduct in connection with the subscriber referral agreement. In addition, a dispute arose between Juno and UUNET Technologies, Inc., an

affiliate of MCI WorldCom Network Services, Inc., regarding the value of services provided by UUNET, with UUNET claiming in excess of

Facilities

Location

Approximate

Square Feet

Lease

Expiration

Principal executive and corporate offices

Westlake Village, CA

49,000

2009

Operations and technology facility

New York, NY

23,000

2010

Operations and customer support facility

Westlake Village, CA

19,000

2006

Customer support and technology facility

Hyderabad, India

28,000

2005