Classmates.com 2003 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2003 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

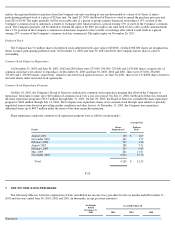

In November 2000, the Company acquired certain assets of Freeinternet.com, Inc. ("Freei") for approximately $4.7 million. Assets

acquired included the domain names "Freeinternet.com", "Freeinet.com" and "Freei.net", certain proprietary rights, certain fixed assets, and the

rights to market NetZero's service to Freei's users. The assets acquired have been included in the consolidated balance sheet of the Company at

their fair market value since the date of acquisition and were amortized generally over a two-year period. During fiscal 2001, the Company

identified indications of possible impairment of its long-lived assets, principally goodwill and other acquired intangible assets, related to the

acquisition of Freei (see Note 4).

F-17

Juno Online Services, Inc.

On September 25, 2001, NetZero and Juno merged and became wholly-owned subsidiaries of United Online. The Merger was accounted

for under the purchase method in accordance with SFAS No. 141, and NetZero was the acquirer for financial accounting purposes. The primary

reasons for the Merger were to accelerate the Company's growth in pay subscribers, leverage NetZero's and Juno's operating and cost

infrastructures to create a lower cost structure for providing Internet access and to create a more attractive base of users for advertising

customers.

Under the terms of the merger agreement, entered into on June 7, 2001, NetZero common stockholders received 0.2000 of a share of

United Online common stock for each share of NetZero common stock they owned, and Juno common stockholders received 0.3570 of a share

of United Online common stock for each share of Juno common stock they owned. The purchase price of approximately $89.2 million,

including acquisition costs, was allocated to Juno's net assets based on their fair values. The excess of the purchase price over the estimated fair

values of the net assets acquired, including identifiable intangible assets, was recorded as goodwill. The fair value of the United Online

common stock issued was determined based on an average price per share of NetZero common stock on the dates surrounding the

announcement of the execution of the merger agreement. The fair value of the Juno options assumed was determined based on the Black-

Scholes option pricing model using a weighted average expected life of five years, 0% dividend, volatility of 120%, and a risk-free interest rate

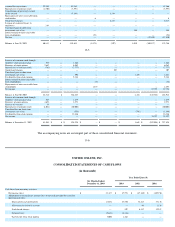

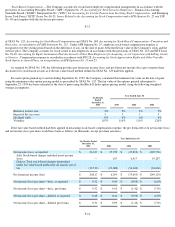

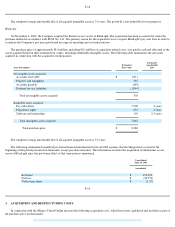

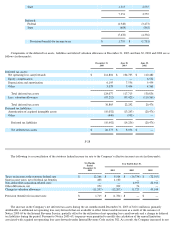

of 5%. The following table summarizes the purchase price (in thousands):

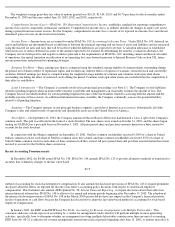

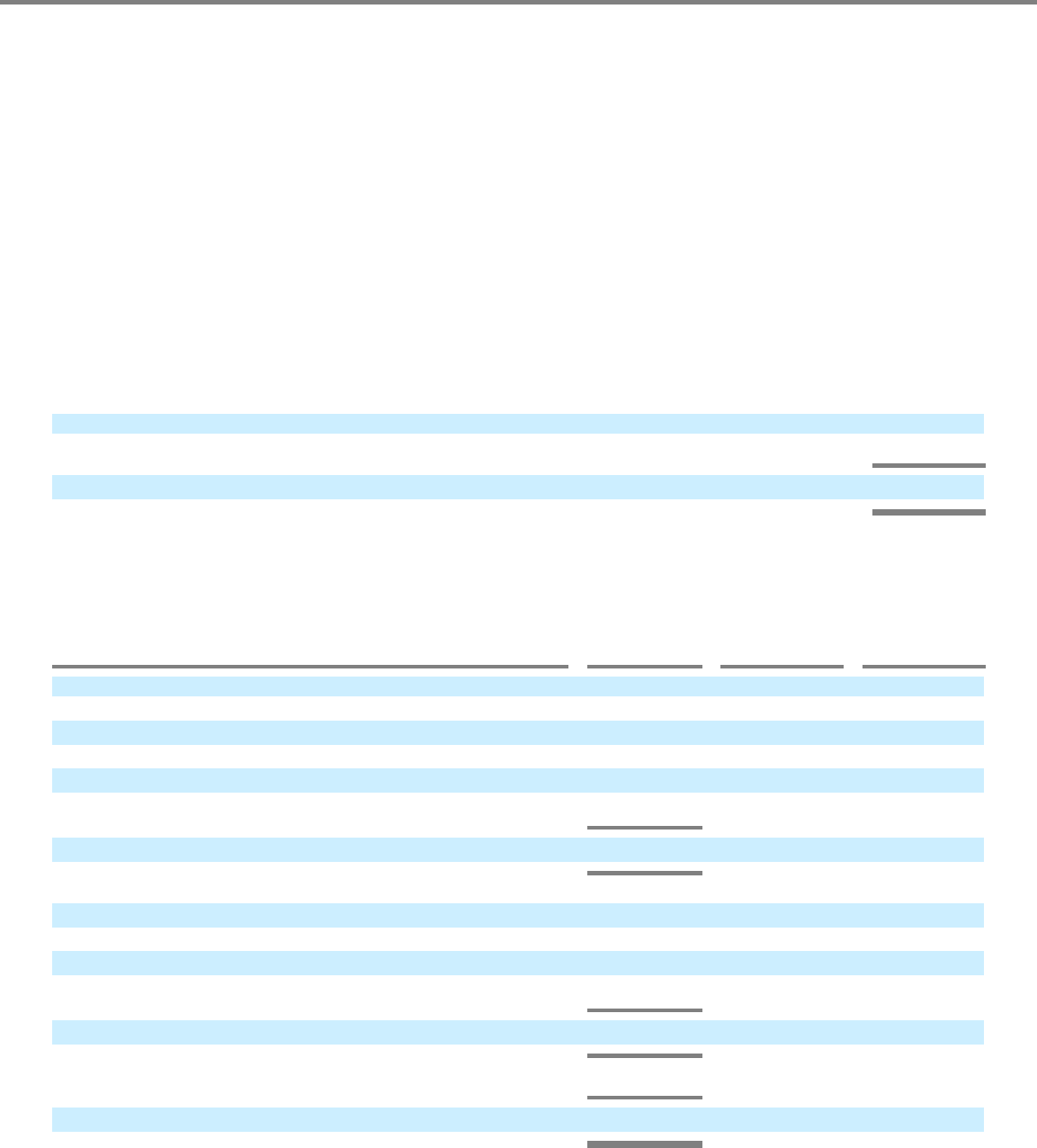

The following table summarizes the net assets acquired in connection with the Merger (in thousands):

Fair value of common stock issued and options assumed

$

81,266

Acquisition costs

7,978

Total purchase price $

89,244

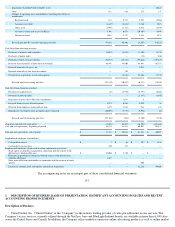

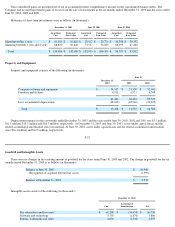

Asset Description

Estimated

Fair

Value

Estimated

Amortizable

Life

Weighted

Average

Amortizable

Life

Net tangible assets acquired:

Cash $

34,672

Other current assets

7,626

Other assets

6,906

Accounts payable and accrued liabilities

(19,460

)

Other liabilities

(11,240

)

Total net tangible assets acquired

18,504

Intangible assets acquired:

Pay subscribers and free users

53,700

1-

4 years

3.7 years

Software and technology

3,600

4-

5 years

4.5 years

Patents and trademarks

2,300

5-

7 years

6.0 years

Other

200

1 year

1 year

Total intangible assets acquired

59,800

Goodwill

10,940

Total purchase price $

89,244