Classmates.com 2003 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2003 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our business could be severely impacted due to political instability in India.

A significant number of our employees are located in Hyderabad, India and a portion of our outsourced customer service is in Banglore,

India. Due to the current political instability between India and Pakistan, it is possible that our Indian operations could be disrupted. We rely on

our employees in India for product development, quality assurance and customer support. If communications or personnel are disrupted, it

could affect our ability to enhance our products or provide certain types of support to our users.

We cannot predict our future capital needs and we may not be able to secure additional financing.

We may need to raise additional funds in the future to fund our operations, for acquisitions of businesses or technologies or for other

purposes. Additional financing may not be available on terms favorable to us, or at all. If adequate funds are not available or not available when

required in sufficient amounts or on acceptable terms, we may not be able to devote sufficient cash resources to continue to provide our

services in their current form, acquire additional users, enhance or expand our services, respond to competitive pressures or take advantage of

perceived opportunities, and our business, financial condition, results of operations and cash flows may suffer.

We have anti-takeover provisions that may make it difficult for a third party to acquire us.

Provisions of our certificate of incorporation, our bylaws and Delaware law could make it difficult for a third party to acquire us, even if

doing so might be beneficial to our stockholders because of a premium price offered by a potential acquirer. In addition, our board of directors

adopted a stockholder rights plan, which is an anti-takeover measure that will cause substantial dilution to a person who attempts to acquire the

company on terms not approved by our board of directors.

Our stock price has been highly volatile.

The market price of our common stock has fluctuated significantly since our stock began trading on the Nasdaq National Market in

September 2001 and it is likely to continue to be volatile with extreme volume fluctuations. The Nasdaq National Market, where most publicly

held Internet companies are traded, has experienced substantial price and volume fluctuations. These broad market and industry factors may

harm the market price of our common stock, regardless of our actual operating performance, and for this or other reasons we could suffer

significant declines in the market price of our common stock.

49

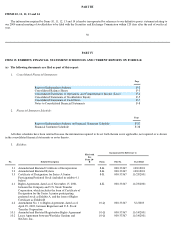

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We maintain a short-term investment portfolio consisting of U.S. commercial paper, U.S. Government or U.S. Government Agency

obligations and money market funds. Our primary objective is the preservation of principal and liquidity while maximizing yield. The

minimum long-term rating is A, and if a long-term rating is not available, we require a short-term credit rating of A1 and P1. Increases and

decreases in short-term interest rates could have a material impact on interest income from our investment portfolio.

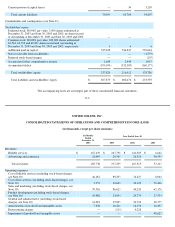

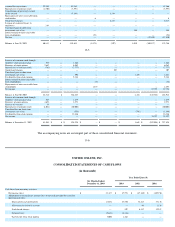

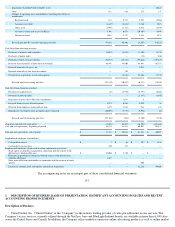

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

For financial statements, see the Index to Consolidated Financial Statements on page F-1.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

None.

ITEM 9A. CONTROLS AND PROCEDURES

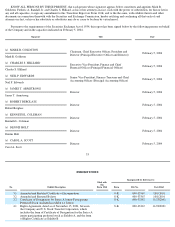

(a) Disclosure Controls and Procedures. Our management, with the participation of our Chief Executive Officer and Chief Financial

Officer, has evaluated the effectiveness of the Company's disclosure controls and procedures (as such term is defined in Rules 13a-15(e) and

15d-15(e) under the Securities Exchange Act of 1934, as amended (the "Exchange Act")) as of the end of the period covered by this report.

Based on such evaluation, our Chief Executive Officer and Chief Financial Officer have concluded that, as of the end of such period, the

Company's disclosure controls and procedures are effective.

(b) Internal Controls Over Financial Reporting. There have not been any changes in the Company's internal controls over financial

reporting (as such term is defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act) during our most recent fiscal quarter that have

materially affected, or are reasonably likely to materially affect, the Company's internal controls over financial reporting.