Classmates.com 2003 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2003 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

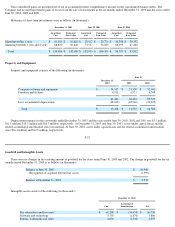

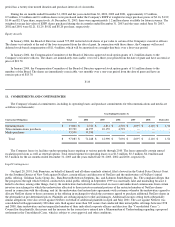

Notes Payable

During the year ended June 30, 2002, the Company repaid all of its notes payable obligations. The weighted average interest rate

associated with notes payable was 14% for the years ended June 30, 2002 and 2001.

F-24

Line of Credit

In December 2003, United Online obtained a one-year $25 million unsecured revolving line of credit from a bank that expires in

December 2004. This facility is available for general corporate purposes and the interest rates on borrowings are based on current market rates.

The line of credit contains covenants pertaining to the maintenance of a minimum quick ratio, minimum cash balances with the lender and

minimum profitability levels. The line of credit provides additional working capital to support the Company's growth and overall business

strategy. At December 31, 2003, a $0.7 million letter of credit in connection with one of the Company's leased facilities was outstanding,

reducing the amount available under the line of credit and restricted cash previously held as collateral.

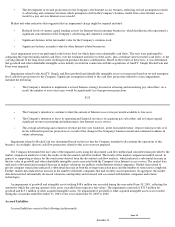

5. RELATED-PARTY TRANSACTIONS

In February 2002, the Company's Board of Directors authorized loans to five officers for a total of $700,000, which was used to exercise

572,000 stock options. In the June 2003 quarter, all five loans were repaid in full. The principal balance of the notes accrued interest at annual

rates ranging from prime plus 1% to prime plus 2%, which was payable at the end of each calendar quarter. The terms of the notes required the

principal balance of the notes to be paid in full on February 5, 2007. Additionally, under the terms of the notes, the entire principal balance and

any accrued interest were to become due and payable 90 days following the termination of employment with the Company. The notes, which

were classified as a component of stockholders' equity, were full recourse obligations and secured by the underlying shares.

During the year ended June 30, 1999, the Company loaned two officers a total of $1,029,000, which was used to exercise approximately

2,246,000 stock options. In the June 2003 quarter, both loans were repaid in full. The principal balance of the notes accrued interest at 4.83%

and 5.28% per annum, respectively, and the notes were to become due on March 20, 2004 and April 16, 2004, respectively, unless paid earlier.

The notes, which were classified as a component of stockholders' equity, were full recourse to the officers and secured by the underlying

shares.

During the year ended June 30, 2001, a shareholder of the Company and certain of its affiliates purchased $1.3 million in banner

advertisements.

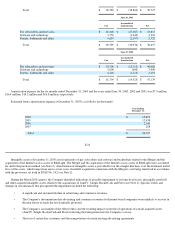

6. CAPITALIZATION

NetZero and Juno Merger

On September 25, 2001, each share of NetZero common stock issued and outstanding was converted into 0.2000 of a share of United

Online common stock, and each share of Juno common stock issued and outstanding was converted into 0.3570 of a share of United Online

common stock. Additionally, each outstanding stock option of NetZero and Juno was converted into an option to purchase that number of

United Online shares of common stock equal to the product of 0.2000 and 0.3570, respectively, multiplied by the number of shares of common

stock underlying the option. Given that NetZero is the Company's predecessor for financial reporting purposes, all prior period NetZero

numbers of shares and per share price amounts herein have been restated to account for the NetZero conversion ratio.

Stockholders' Rights Plan

On November 15, 2001, the Board of Directors declared a dividend of one preferred share purchase right for each outstanding share of its

common stock. The dividend was paid on November 26, 2001 to the stockholders of record at the close of business on that date. Each right

F

-

25

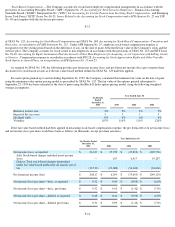

2003

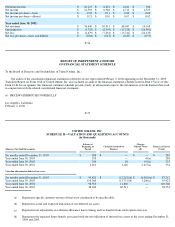

2003

2002

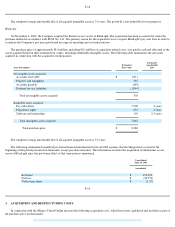

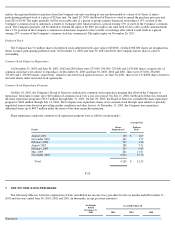

Employee compensation and related expenses

$

8,205

$

11,224

$

6,950

Subscriber referral fees

4,281

4,281

3,557

Other

1,542

1,568

705

Total $

14,028

$

17,073

$

11,212