Classmates.com 2003 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2003 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

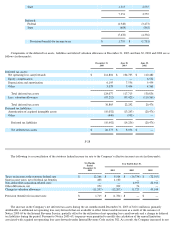

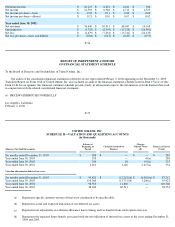

period has a twenty-four month duration and purchase intervals of six months.

During the six months ended December 31, 2003 and the years ended June 30, 2003, 2002 and 2001, approximately 0.5 million,

0.9 million, 0.3 million and 0.1 million shares were purchased under the Company's ESPP at weighted average purchase prices of $3.16, $1.99,

$1.44 and $2.93 per share, respectively. At December 31, 2003, there were approximately 1.2 million shares available for future issuance. The

weighted average fair value of ESPP shares purchased during the six months ended December 31, 2003 and the years ended June 30, 2003,

2002 and 2001 were $2.21, $1.29, $0.82 and $8.20 per share, respectively.

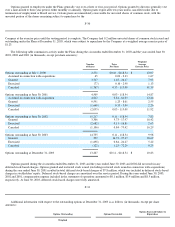

Equity Awards

In January 2004, the Board of Directors issued 575,000 restricted stock shares at par value to certain of the Company's executive officers.

The shares vest entirely at the end of the four-year period from the date of grant. In connection with these shares, the Company will record

deferred stock-based compensation of $11.4 million, which will be amortized on a straight-line basis over a four-year period.

In January 2004, the Compensation Committee of the Board of Directors approved stock option grants of 1.2 million shares to the

Company's executive officers. The shares are immediately exercisable, vest over a three-

year period from the date of grant and have an exercise

price of $18.70.

In January 2004, the Compensation Committee of the Board of Directors approved stock option grants of 0.1 million shares to the

members of the Board. The shares are immediately exercisable, vest monthly over a one-year period from the date of grant and have an

exercise price of $18.70.

F-33

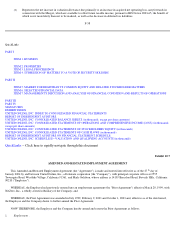

11. COMMITMENTS AND CONTINGENCIES

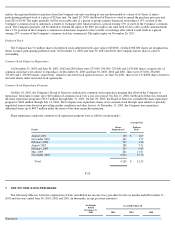

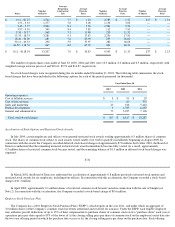

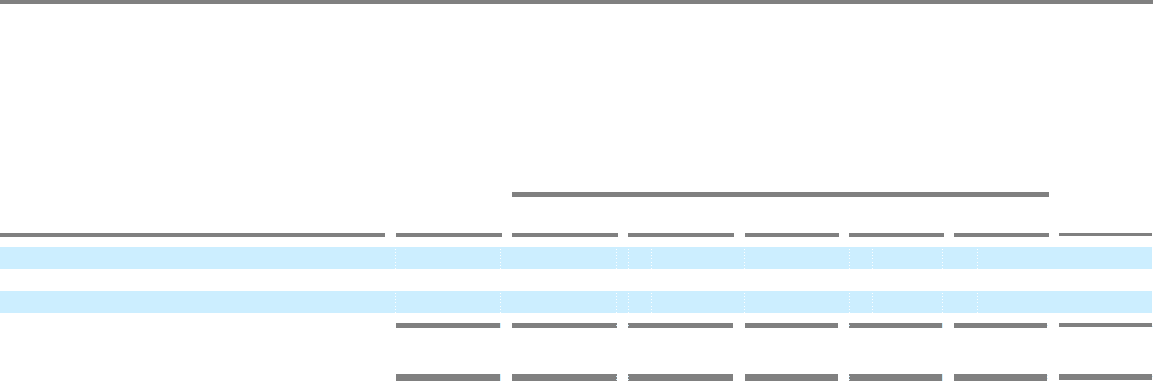

The Company's financial commitments, including its operating leases and purchase commitments for telecommunications and media are

as follows (in thousands):

The Company leases its facilities under operating leases expiring at various periods through 2010. The leases generally contain annual

escalation provisions as well as renewal options. Total rental expense for operating leases was $1.3 million, $3.3 million, $4.0 million and

$3.5 million for the six months ended December 31, 2003 and the years ended June 30, 2003, 2002 and 2001, respectively.

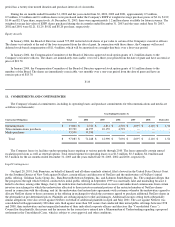

Legal Contingencies

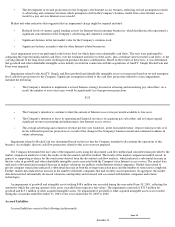

On April 20, 2001, Jodi Bernstein, on behalf of himself and all others similarly situated, filed a lawsuit in the United States District Court

for the Southern District of New York against NetZero, certain officers and directors of NetZero and the underwriters of NetZero's initial

public offering, Goldman Sachs Group, Inc., BancBoston Robertson Stephens, Inc. and Salomon Smith Barney, Inc. The complaint alleges that

the prospectus through which NetZero conducted its initial public offering in September 1999 was materially false and misleading because it

failed to disclose, among other things, that (i) the underwriters had solicited and received excessive and undisclosed commissions from certain

investors in exchange for which the underwriters allocated to those investors material portions of the restricted number of NetZero shares

issued in connection with the offering; and (ii) the underwriters had entered into agreements with customers whereby the underwriters agreed to

allocate NetZero shares to those customers in the offering in exchange for which the customers agreed to purchase additional NetZero shares in

the aftermarket at pre-determined prices. Plaintiffs are seeking injunctive relief and damages. Additional lawsuits setting forth substantially

similar allegations were also served against NetZero on behalf of additional plaintiffs in April and May 2001. The case against NetZero was

consolidated with approximately 300 other suits filed against more than 300 issuers that conducted their initial public offerings between 1998

and 2000, their underwriters and an unspecified number of their individual corporate officers and directors (the "Consolidated Cases.").

Counsel for the plaintiffs, the issuers and the insurers for the issuers have entered into a Memorandum of Understanding regarding a proposed

settlement in the Consolidated Cases, which is subject to court approval and other conditions.

Year Ending December 31,

Contractual Obligations

Total

2004

2005

2006

2007

2008

Thereafter

Operating leases

$

13,804

$

2,721

$

2,831

$

2,501

$

2,097

$

2,110

$

1,544

Telecommunications purchases

29,729

14,977

10,159

4,593

—

—

—

Media purchases

53,550

53,550

—

—

—

—

—

Total $

97,083

$

71,248

$

12,990

$

7,094

$

2,097

$

2,110

$

1,544