Classmates.com 2003 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2003 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

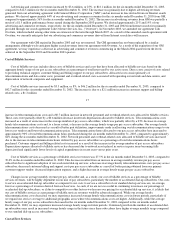

Interest income, net decreased by $0.8 million, or 15%, to $4.3 million for the year ended June 30, 2003, compared to $5.0 million for the

year ended June 30, 2002. The decrease in interest income was due to lower interest rates, partially offset by increased interest income due to

higher average cash, cash equivalent and short-term investment balances, and reduced interest expense as a result of a decrease in capital lease

and notes payable balances.

Other Income, Net

Other income, net for the year ended June 30, 2002 was $1.1 million. In August 2001, we sold substantially all of the assets of

RocketCash and recognized a gain of approximately $1.0 million.

25

Provision for Income Taxes

Our net deferred tax assets at June 30, 2003 and 2002 consisted primarily of federal and state net operating loss and tax credit

carryforwards. At June 30, 2002, our net deferred tax assets of $110.4 million were fully offset by a valuation allowance. At June 30, 2003, our

net deferred tax assets of $103.5 million were offset by a valuation allowance of $95.4 million. The change in the valuation allowance of

approximately $15 million was primarily due to the release of valuation allowance associated with actual and expected utilization of net

operating loss and tax credit carryforwards in 2003 and 2004, respectively.

Our effective income tax rate for the year ended June 30, 2003 differed from the statutory rate primarily as a result of the tax benefit

recognized from the release of a portion of the valuation allowance against deferred tax assets relating primarily to the actual and expected

utilization of net operating loss and tax credit carryforwards for the years ended June 30, 2003 and 2004 as discussed above, offset to a lesser

extent by state income taxes. We recorded a current provision for income taxes of $2.6 million for California state income tax purposes during

the year ended June 30, 2003. In September 2002, the State of California enacted legislation that suspends the utilization of net operating loss

carryforwards to offset current taxable income for a two-year period beginning in the year ended June 30, 2003, which required us to record a

California state income tax provision for the year ended June 30, 2003. For federal income tax purposes, current taxable income for the year

was fully offset by net operating loss carryforwards, the benefit of which had not been previously recognized. In the year ended June 30, 2002,

we generated pre-tax losses of $47.8 million, and as a result, we did not record a provision or benefit for income taxes.

At June 30, 2003, we had net operating loss and tax credit carryforwards for federal and state and local income tax purposes of

approximately $253 million and $267 million, respectively, which begin to expire in 2019 and 2006, respectively. These carryforwards have

been adjusted to reflect limitations under Section 382 of the Code resulting from the Merger and are also subject to annual usage limitations.

We have received income tax deductions resulting from the exercise of certain stock options and the related sale of common stock by

employees. Tax benefits resulting from these deductions are credited directly to additional paid-in capital. At June 30, 2003, approximately

$7.4 million of the valuation allowance for deferred tax assets was attributable to tax benefits received from the exercise of employee stock

options.

Year Ended June 30, 2002 Compared to

the Year Ended June 30, 2001

Revenues

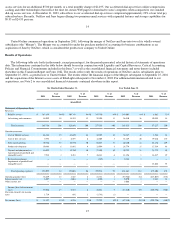

Billable Services Revenues

Billable services revenues increased by $134.3 million to $141.0 million for the year ended June 30, 2002, compared to $6.7 million for

the year ended June 30, 2001. The increase was a result of the Merger in September 2001, which increased our pay subscriber base by over

875,000 users, and the launch of NetZero's $9.95 per month billable service plan and limitations imposed on NetZero's free services during the

March 2001 quarter. At June 30, 2002 we had approximately 1.7 million pay subscribers compared to 210,000 pay subscribers at June 30,

2001. Our pay subscriber base also increased as a result of further limitations imposed on our free services during October 2001. Additionally,

our pay subscriber base increased as a result of a shift in our marketing strategy during the year ended June 30, 2002 to focusing on promoting

our pay services.

26

Advertising and Commerce Revenues

Advertising and commerce revenues decreased by $24.0 million, or 48%, to $26.5 million for the year ended June 30, 2002, compared to

$50.6 million for the year ended June 30, 2001. Advertising and commerce revenues decreased as a result of the termination of several