Classmates.com 2003 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2003 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be

contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this

Form 10-K or any amendment to this Form 10-K. 12

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Exchange Act). Yes 12 No 32

At June 30, 2003, the aggregate market value of voting stock held by non-affiliates of the registrant, based on the last reported sales price

of the registrant's common stock on such date reported by the Nasdaq National Market, was approximately $1,038,546,153 (calculated by

excluding shares beneficially owned by directors and officers). At January 31, 2004, there were a total of 63,971,175 shares of the registrant's

common stock outstanding.

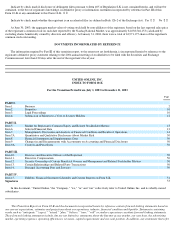

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this transition report, to the extent not set forth herein, is incorporated herein by reference to the

registrant's definitive proxy statement relating to the 2004 annual meeting of stockholders to be filed with the Securities and Exchange

Commission not later than 120 days after the end of the registrant's fiscal year.

UNITED ONLINE, INC.

INDEX TO FORM 10-K

For the Transition Period from July 1, 2003 to December 31, 2003

In this document, "United Online," the "Company," "we," "us" and "our" collectively refer to United Online, Inc. and its wholly-owned

subsidiaries.

This Transition Report on Form 10-K and the documents incorporated herein by reference contain forward-looking statements based on

our current expectations, estimates and projections about our operations, industry, financial condition and liquidity. Statements containing

words such as "anticipate," "expect," "intend," "plan," "believe," "may," "will" or similar expressions constitute forward-looking statements.

These forward looking statements include, but are not limited to, statements about the Internet access market, our user base, the advertising

market, operating expenses, operating efficiencies, revenues, capital requirements and our cash position. In addition, any statements that refer

Page

PART I.

Item 1.

Business

2

Item 2.

Properties

10

Item 3.

Legal Proceedings

10

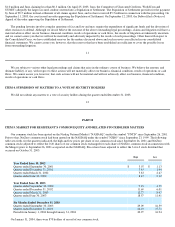

Item 4.

Submission of Matters to a Vote of Security Holders

12

PART II.

Item 5.

Market for Registrant's Common Equity and Related Stockholder Matters

13

Item 6.

Selected Financial Data

13

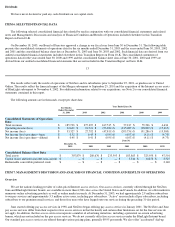

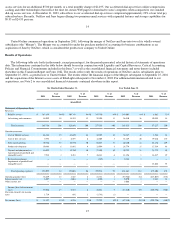

Item 7.

Management's Discussion and Analysis of Financial Condition and Results of Operations

14

Item 7A.

Quantitative and Qualitative Disclosures About Market Risk

50

Item 8.

Financial Statements and Supplementary Data

50

Item 9.

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

50

Item 9A.

Controls and Procedures

50

PART III.

Item 10.

Directors and Executive Officers of the Registrant

50

Item 11.

Executive Compensation

50

Item 12.

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

50

Item 13.

Certain Relationships and Related Party Transactions

50

Item 14.

Principal Accounting Fees and Services

50

PART IV.

Item 15.

Exhibits, Financial Statement Schedules and Current Reports on Form 8

-

K

51

Signatures

53