Classmates.com 2003 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2003 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

report the change in accounting as a cumulative-effect adjustment in accordance with APB Opinion No. 20, Accounting Changes and SFAS

No. 3,

Reporting Accounting Changes in Interim Financial Statements , with early application of this consensus permitted. The adoption of

EITF Issue No. 00-21 in the September 2003 quarter did not have a material impact on the Company's financial position, results of operations

or cash flows.

In January 2003, the FASB issued Interpretation ("FIN") No. 46, Consolidation of Variable Interest Entities . Until this interpretation, a

company generally included another entity in its consolidated financial statements only if it controlled the entity through voting interests. FIN

No. 46 requires a variable interest entity, as defined, to be consolidated by a company if that company is subject to a majority of the risk of loss

from the variable interest entity's activities or entitled to receive a majority of the entity's residual returns. FIN No. 46 is effective for reporting

periods ending after December 15, 2003. The adoption of FIN No. 46 in the December 2003 quarter did not have any impact on the Company's

financial position, results of operations or cash flows.

In May 2003, the FASB issued SFAS No. 150, Accounting for Certain Financial Instruments with Characteristics of both Liabilities and

Equity

. SFAS No. 150 changes the accounting guidance for certain financial instruments that, under previous guidance, could be classified as

equity or "mezzanine" equity by now requiring those instruments to be classified as liabilities (or assets in some circumstances) on the balance

sheet. Further, SFAS No. 150 requires disclosure regarding the terms of those instruments and settlement alternatives. SFAS No. 150 is

generally effective for all financial instruments entered into or modified after May 31, 2003, and is otherwise effective at the beginning of the

first interim period beginning after June 15, 2003. The adoption of SFAS No. 150 in the September 2003 quarter did not have any impact on

the Company's financial position, results of operations or cash flows.

In December 2003, the SEC issued SAB No. 104. SAB No. 104 revises or rescinds portions of the interpretative guidance included in

Topic 13 of the codification of staff accounting bulletins in order to make this interpretive guidance consistent with current authoritative

accounting and auditing guidance and SEC rules and regulations. It also rescinds the Revenue Recognition in Financial Statements Frequently

Asked Questions and Answers document issued in conjunction with Topic 13. Selected portions of that document have been incorporated into

Topic 13. The adoption of SAB No. 104 in the December 2003 quarter did not have any impact on the Company's financial position, results of

operations or cash flows.

F-16

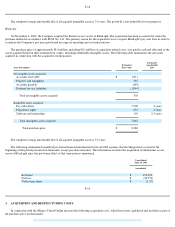

2. ACQUISITIONS

Simpli.com, Inc.

In August 2000, the Company acquired Simpli.com, Inc. ("Simpli") in a stock and cash transaction. Simpli was a targeted marketing

infrastructure and search technology company. Pursuant to the terms of the agreement, the Company issued approximately 750,000 shares of

common stock and paid $2.6 million in cash. The transaction was accounted for under the purchase method and, accordingly, the results of

operations of Simpli have been included in the consolidated results of the Company since the date of acquisition. The excess of the purchase

price over the fair value of net liabilities acquired amounted to approximately $23.5 million. The excess purchase price was comprised of

approximately $8.7 million of goodwill, $8.4 million of deferred stock-based charges and $6.4 million of identifiable intangible assets all of

which were being amortized over periods ranging from two-to-three years. During fiscal 2001, the Company identified indications of possible

impairment of its long-lived assets, principally goodwill and other acquired intangible assets, related to the acquisition of Simpli (see Note 4).

In April 2002, the Company sold the remaining assets related to the Simpli acquisition for a 9.9% equity interest in the acquiring

company, which was valued at $0.8 million and resulted in a loss of $0.7 million. In June 2003, the Company's equity interest in the acquiring

company was sold for $0.8 million.

RocketCash Corporation

In September 2000, the Company acquired RocketCash Corporation ("RocketCash"), an online commerce company, in a stock-for-stock

transaction. Pursuant to the terms of the agreement, the Company issued approximately 1.5 million shares of common stock and options to

purchase common stock. The transaction was accounted for under the purchase method and, accordingly, the results of operations of

RocketCash have been included in the consolidated results of the Company since the date of acquisition. The excess of the purchase price over

the fair value of net liabilities acquired amounted to approximately $30.2 million. The excess purchase price was comprised of approximately

$18.1 million of goodwill, $9.0 million of identifiable intangible assets and $3.1 million of deferred stock-based charges all of which were

being amortized over periods ranging from two-to-

four years. During fiscal 2001, the Company identified indications of possible impairment of

its long-lived assets, principally goodwill and other acquired intangible assets, related to the acquisition of RocketCash (see Note 4).

In August 2001, the Company completed the sale of substantially all of the remaining assets related to the RocketCash acquisition. The

transaction resulted in net cash proceeds to the Company of approximately $1.2 million and a gain on sale of approximately $1.0 million.

Freeinternet.com, Inc.