Classmates.com 2003 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2003 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

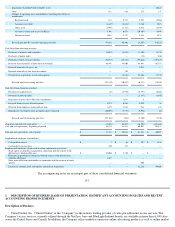

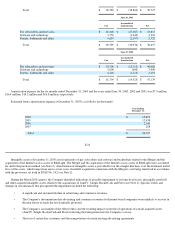

The weighted average grant-date fair value of options granted was $16.29, $13.04, $2.05 and $6.70 per share for the six months ended

December 31, 2003 and the years ended June 30, 2003, 2002, and 2001, respectively.

Comprehensive Income (Loss) —SFAS No. 130, Reporting Comprehensive Income, establishes standards for reporting comprehensive

income (loss) and its components in financial statements. Comprehensive income (loss), as defined, includes all changes in equity (net assets)

during a period from non-owner sources. For the Company, comprehensive income (loss) consists of its reported net income (loss) and the net

unrealized gains or losses on short-term investments.

Income Taxes —Income taxes are accounted for under SFAS No. 109, Accounting for Income Taxes . Under SFAS No. 109, deferred tax

assets and liabilities are determined based on differences between the financial reporting and tax basis of assets and liabilities and are measured

using the enacted tax rates and laws that will be in effect when the differences are expected to reverse. A valuation allowance is established

when necessary to reduce deferred tax assets to the amount expected to be realized. In determining the need for a valuation allowance, the

Company reviews both positive and negative evidence pursuant to the requirements of SFAS No. 109, including current and historical results

of operations, the annual limitation on utilization of net operating loss carryforwards pursuant to Internal Revenue Code section 382, future

income projections and potential tax-planning strategies.

Earnings Per Share —Basic earnings per share is computed using the weighted average number of common shares outstanding during

the period, net of shares subject to repurchase rights, and excludes any dilutive effects of options or warrants, restricted stock and convertible

securities. Diluted earnings per share is computed using the weighted average number of common and common stock equivalent shares

outstanding (including the effect of restricted stock) during the period. Common stock equivalent shares are excluded from the computation if

their effect is antidilutive.

Legal Contingencies —The Company is currently involved in certain legal proceedings (see Note 11). The Company records liabilities

related to pending litigation when an unfavorable outcome is probable and management can reasonably estimate the amount of loss. The

Company has not recorded liabilities for certain pending litigation because of the uncertainties related to assessing both the amount and the

probable outcome of those claims. As additional information becomes available, the Company continually assesses the potential liability

related to all pending litigation.

Segments —The Company operates in one principal business segment, a provider of Internet access services. Substantially all of the

Company's sales and related results of operations and identifiable assets are in the United States of America.

Stock Splits —On September 24, 2003, the Company announced that its Board of Directors had declared a 3-for-2 split of the Company's

common stock. The split was effected in the form of a stock dividend. The new shares were issued on October 31, 2003, and the shares began

trading on NASDAQ on a post-split basis on November 3, 2003. All prior period share and per share amounts herein have been restated to

account for the stock dividend.

In connection with the Merger completed on September 25, 2001, NetZero common stockholders received 0.2000 of a share of United

Online common stock for each share of NetZero common stock they owned, and Juno common stockholders received 0.3570 of a share of

United Online common stock for each share of Juno common stock they owned. All prior period share and per share amounts herein have been

restated to account for the NetZero share conversion.

Recent Accounting Pronouncements

In December 2002, the FASB issued SFAS No. 148. SFAS No. 148 amends SFAS No. 123 to provide alternative methods of transition for

an entity that voluntarily changes to the fair value based

F-15

method of accounting for stock-based employee compensation. It also amends the disclosure provisions of SFAS No. 123 to require prominent

disclosure about the effects on reported net income of an entity's accounting policy decisions with respect to stock-based employee

compensation. This Statement also amends APB Opinion No. 28, Interim Financial Reporting , to require disclosure about those effects in

interim financial information. SFAS No. 148 is effective for annual and interim periods beginning after December 15, 2002. The adoption of

the interim disclosure provisions of SFAS No. 148 in the March 2003 quarter did not have any impact on the Company's financial position,

results of operations or cash flows because the Company has elected not to adopt the fair value-based method of accounting for stock-based

employee compensation.

In January 2003, the EITF issued EITF Issue No. 00-21, Accounting for Revenue Arrangements with Multiple Deliverables . This

consensus addresses certain aspects of accounting by a vendor for arrangements under which it will perform multiple revenue-generating

activities, specifically, how to determine whether an arrangement involving multiple deliverables contains more than one unit of accounting.

EITF Issue No. 00

-

21 is effective for revenue arrangements entered into in fiscal periods beginning after June 15, 2003, or entities may elect to