Classmates.com 2003 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2003 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

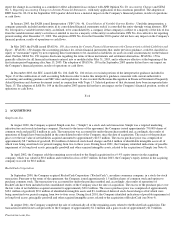

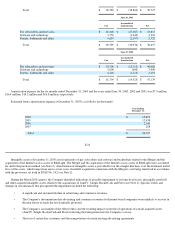

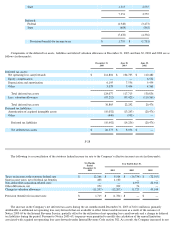

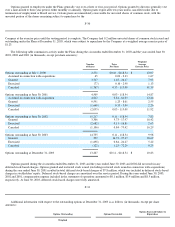

Components of the deferred tax assets, liabilities and related valuation allowance at December 31, 2003 and June 30, 2003 and 2002 are as

follows (in thousands):

F-28

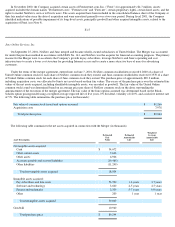

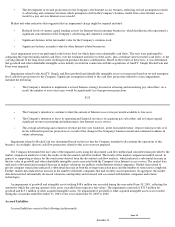

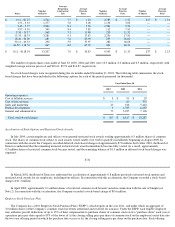

The following is a reconciliation of the statutory federal income tax rate to the Company's effective income tax rate (in thousands):

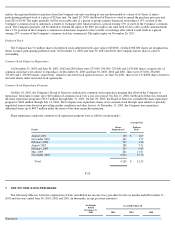

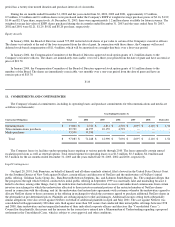

The increase in the Company's net deferred tax assets during the six months ended December 31, 2003 of $10.1 million is primarily

attributable to additional net operating loss carryforwards that are available to offset future taxable income as a result of the issuance of

Notice 2003

-65 by the Internal Revenue Service, partially offset by the utilization of net operating loss carryforwards and a change in deferred

tax liabilities during the period. Pursuant to Notice 2003-65, taxpayers were permitted to modify the calculation of the annual limitation

associated with acquired net operating loss carryforwards under Internal Revenue Code section 382. As a result, the Company increased its net

State

1,313

2,555

7,351

2,555

Deferred:

Federal

(4,948

)

(3,473

)

State

(684

)

(863

)

(5,632

)

(4,336

)

Provision (benefit) for income taxes $

1,719

$

(1,781

)

December 31,

2003

June 30,

2003

June 30,

2002

Deferred tax assets:

Net operating loss carryforwards

$

114,804

$

104,705

$

110,482

Equity compensation

—

—

6,532

Depreciation and amortization

6,195

7,556

9,454

Other

3,078

5,454

4,368

Total deferred tax assets

124,077

117,715

130,836

Less: valuation allowance

(87,212

)

(95,423

)

(110,360

)

Total deferred tax assets

36,865

22,292

20,476

Deferred tax liabilities:

Amortization of acquired intangible assets

(10,052

)

(13,243

)

(20,476

)

Other

(440

)

(993

)

—

Deferred tax liabilities

(10,492

)

(14,236

)

(20,476

)

Net deferred tax assets

$

26,373

$

8,056

$

—

Six Months

Ended

December 31,

2003

Year Ended June 30,

2003

2002

2001

Taxes on income at the statutory federal rate

$

12,266

$

9,104

$

(16,734

)

$

(72,015

)

State income taxes, net of federal tax benefits

408

1,100

—

—

Non

-

deductible acquisition

-

related costs

—

—

4,955

22,911

Other differences, net

252

222

54

—

Change in valuation allowance

(11,207

)

(12,207

)

11,725

49,104

Provision (benefit) for income taxes

$

1,719

$

(1,781

)

$

—

$

—