Classmates.com 2003 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2003 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

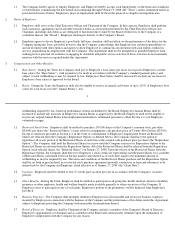

F-36

REPORT OF INDEPENDENT AUDITORS

ON FINANCIAL STATEMENT SCHEDULE

To the Board of Directors and Stockholders of United Online, Inc.:

Our audits of the consolidated financial statements referred to in our report dated February 2, 2004 appearing in the December 31, 2003

Transition Report on Form 10-K of United Online, Inc. also included an audit of the financial statement schedule listed in Item 15(a)(2) of this

Form 10-K. In our opinion, this financial statement schedule presents fairly, in all material respects, the information set forth therein when read

in conjunction with the related consolidated financial statements.

/s/ PRICEWATERHOUSECOOPERS LLP

Los Angeles, California

February 2, 2004

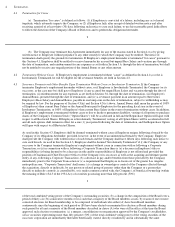

F-37

UNITED ONLINE, INC.

SCHEDULE II—VALUATION AND QUALIFYING ACCOUNTS

(in thousands)

(a)

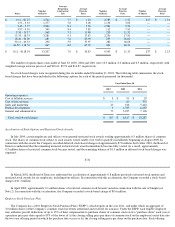

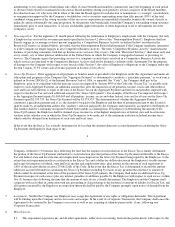

Operating income

$

10,223

$

6,631

$

4,161

$

706

Net income

$

14,594

$

6,962

$

4,711

$

1,525

Net income per share

—

basic

$

0.23

$

0.11

$

0.08

$

0.03

Net income per share

—

diluted

$

0.21

$

0.10

$

0.07

$

0.02

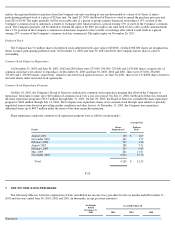

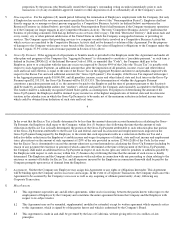

Year ended June 30, 2002:

Net revenues

$

54,449

$

50,911

$

48,047

$

14,108

Operating loss

$

(3,723

)

$

(8,394

)

$

(17,328

)

$

(24,501

)

Net loss

$

(2,679

)

$

(7,254

)

$

(15,742

)

$

(22,135

)

Net loss per share

—

basic and diluted

$

(0.04

)

$

(0.12

)

$

(0.27

)

$

(0.57

)

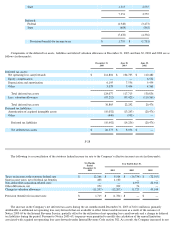

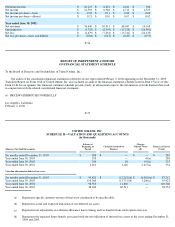

Allowance for doubtful accounts

Balance at

Beginning of

Period

Charged/(Credited) to

Expense

Charges

Utilized/ Write

offs

Balance at End of

Period

Six months ended December 31, 2003

$

288

$

—

$

—

$

288

Year ended June 30, 2003

333

—

45

(a)

288

Year ended June 30, 2002

354

98

119

(a)

333

Year ended June 30, 2001

1,651

1,120

2,417

(a)

354

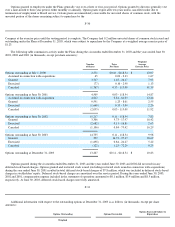

Valuation allowance for deferred tax assets

Six months ended December 31, 2003

$

95,423

$

(12,292

)(d)

$

(4,081

)(e)

$

87,212

Year ended June 30, 2003

110,360

(13,731

)(b)

1,206

(c)

95,423

Year ended June 30, 2002

98,554

11,806

—

110,360

Year ended June 30, 2001

38,043

60,511

—

98,554

Represents specific amounts written off that were considered to be uncollectible.

(b) Represents actual and expected utilization of net deferred tax assets.

(c) Represents net adjustments in valuation allowance due to timing and tax benefits from stock option exercises.

(d)

Represents the expected future benefit associated with the net utilization of deferred tax assets in the years ending December 31,

2004 and 2005.