Cigna 2015 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2015 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PART II

ITEM 8. Financial Statements and Supplementary Data

liabilities are adjusted to reflect administrative charges and, for expected claim resolution rates may vary based upon the anticipated

universal life fund balances, mortality charges. In addition, this disability period, the covered benefit period, cause of disability,

caption includes: 1) premium stabilization reserves under group benefit design and the policyholder’s age, gender and income level.

insurance contracts representing experience refunds left with the The gross monthly benefit is reduced (offset) by disability income

Company to pay future premiums; 2) deposit administration funds received under other benefit programs, such as Social Security

used to fund non-pension retiree insurance programs; 3) retained asset Disability Income, workers’ compensation, statutory disability or

accounts; and 4) annuities or supplementary contracts without other group benefit plans. For offsets not yet finalized, the Company

significant life contingencies. Interest credited on these funds is estimates the probability and amount of the offset based on the

accrued ratably over the contract period. Company’s experience over the past three to five years.

The Company discounts certain unpaid claim liabilities because

L. Future Policy Benefits

benefit payments are made over extended periods. Substantially all of

these liabilities are associated with the group long-term disability

Future policy benefits represent the present value of estimated future business. Discount rate assumptions for that business are based on

obligations under long-term life and supplemental health insurance projected investment returns for the asset portfolios that support these

policies and annuity products currently in force. These obligations are liabilities and range from 4.4% to 5.7%. Discounted liabilities were

estimated using actuarial methods and consist primarily of reserves for $3.7 billion at December 31, 2015 and $3.9 billion at December 31,

annuity contracts, life insurance benefits, guaranteed minimum death 2014.

benefit (‘‘GMDB’’) contracts (see Note 7 for additional information)

and certain health, life and accident insurance products of our Global

Supplemental Benefits segment.

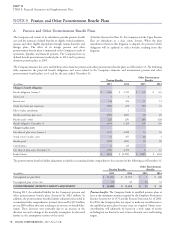

N. Global Health Care Medical Costs

Payable

Obligations for annuities represent specified periodic benefits to be

paid to an individual or groups of individuals over their remaining Medical costs payable for the Global Health Care segment include

lives. Obligations for life insurance policies and GMDB contracts reported claims, estimates for losses incurred but not yet reported and

represent benefits to be paid to policyholders, net of future premiums liabilities for services rendered by providers, as well as liabilities under

to be received. Management estimates these obligations based on risk-sharing and quality management arrangements with providers.

assumptions as to premiums, interest rates, mortality or morbidity, The Company uses actuarial principles and assumptions consistently

future claim adjudication expenses and surrenders, allowing for applied each reporting period and recognizes the actuarial best

adverse deviation as appropriate. Mortality, morbidity and surrender estimate of the ultimate liability within a level of confidence. This

assumptions are based on the Company’s own experience and approach is consistent with actuarial standards of practice that the

published actuarial tables. Interest rate assumptions are based on liabilities be adequate under moderately adverse conditions.

management’s judgment considering the Company’s experience and

The liability is primarily calculated using ‘‘completion factors’’

future expectations, and range from 0.1% to 9%. Obligations for the

developed by comparing the claim incurral date to the date claims

run-off settlement annuity business include adjustments for realized

were paid. Completion factors are impacted by several key items

and unrealized investment returns consistent with requirements of

including changes in: 1) electronic (auto-adjudication) versus manual

GAAP when a premium deficiency exists.

claim processing, 2) provider claims submission rates, 3) membership

and 4) the mix of products. The Company uses historical completion

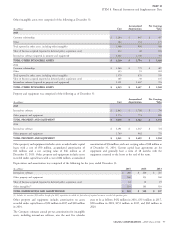

M. Unpaid Claims and Claims Expenses

factors combined with an analysis of current trends and operational

factors to develop current estimates of completion factors. The

Liabilities for unpaid claims and claim expenses are estimates of future

Company estimates the liability for claims incurred in each month by

payments under insurance coverages (primarily long-term disability,

applying the current estimates of completion factors to the current

life and health) for reported claims and for losses incurred but not yet

paid claims data. This approach implicitly assumes that historical

reported. When estimates of these liabilities change, the Company

completion rates will be a useful indicator for the current period.

immediately records the adjustment in benefits and expenses.

For the more recent months, the Company relies on medical cost

The Company consistently estimates incurred but not yet reported

trend analysis that reflects expected claim payment patterns and other

losses using actuarial principles and assumptions based on historical

relevant operational considerations. Medical cost trend is primarily

and projected claim incidence patterns, claim size and the expected

impacted by medical service utilization and unit costs that are affected

payment period. The Company recognizes the actuarial best estimate

by changes in the level and mix of medical benefits offered, including

of the ultimate liability within a level of confidence, consistent with

inpatient, outpatient and pharmacy, the impact of copays and

actuarial standards of practice that the liabilities be adequate under

deductibles, changes in provider practices and changes in consumer

moderately adverse conditions.

demographics and consumption behavior.

The Company’s liability for disability claims reported but not yet paid

For each reporting period, the Company compares key assumptions

is the present value of estimated future benefit payments over the

used to establish the medical costs payable to actual experience. When

expected disability period. The Company projects the expected

actual experience differs from these assumptions, medical costs

disability period by using historical resolution rates combined with an

payable are adjusted through current period shareholders’ net income.

analysis of current trends and operational factors to develop current

Additionally, the Company evaluates expected future developments

estimates of resolution rates. Using the Company’s experience,

68 CIGNA CORPORATION - 2015 Form 10-K