Cigna 2015 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2015 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PART II

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

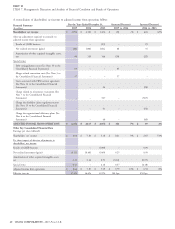

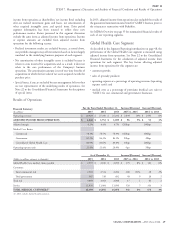

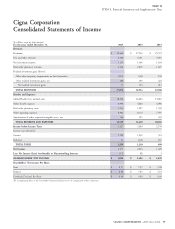

Adjusted income from operations increased in 2015 compared with and Medicaid business. These increases were partially offset by lower

2014, reflecting U.S. Commercial business growth, including revenue due to our exit from the limited benefits business.

increased contributions from pharmacy, stop loss and other specialty Medical care ratios. The Commercial medical care ratio decreased

products. Results in 2015 also reflect the impact of increased slightly in 2015 compared with 2014 primarily due to improved

investments in business initiatives. performance in our stop loss business. In 2014, the commercial

Adjusted income from operations increased in 2014 compared with medical care ratio decreased slightly compared with 2013 due to rate

2013. This growth was primarily driven by increased specialty increases to cover new taxes and fees mandated by Health Care

contributions, partially offset by lower earnings in our government Reform and improved performance in our specialty business, partially

segment. In addition, results included the impact of higher operating offset by a higher medical care ratio in the U.S. Individual business

expenses and lower margins in our U.S. commercial group risk and our exit from the limited benefits business.

business. The Government medical care ratio increased in 2015 compared with

Operating revenues. The increase in operating revenues in 2015, 2014 due to an increase in Medicare Part D utilization. In 2014, the

compared with 2014 is primarily due to a higher customer base in our Government medical care ratio increased slightly compared with 2013

government segment, as well as revenue growth in specialty businesses due to higher Medicare Part D pharmacy costs offset by improved

and higher premiums in the U.S. commercial segment reflecting rate per-member revenues in the Medicare Advantage business.

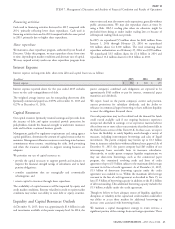

actions on most risk products primarily to recover underlying medical Operating expense ratio. The operating expense ratio was flat in

cost trends. 2015 compared with 2014, reflecting business-initiative investments

The increase in 2014 compared with 2013 was primarily driven by offset by higher revenue and disciplined expense management. The

growth in specialty businesses, higher premiums in the U.S. operating expense ratio increased in 2014 compared with 2013

commercial segment reflecting rate actions on most risk products to primarily due to the impact of Health Care Reform taxes and fees that

recover underlying medical cost trends and taxes and fees mandated became effective in 2014.

by Health Care Reform, and a higher customer base in our individual

Other Items Affecting Health Care Results

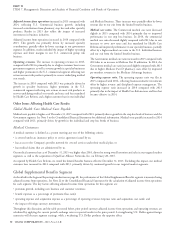

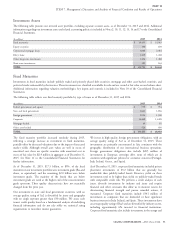

Global Health Care Medical Costs Payable

Medical costs payable is higher as of December 31, 2015 compared with 2014, primarily due to growth in the stop loss book of business and the

Government segment. See Note 5 to the Consolidated Financial Statements for additional information. Medical costs payable increased in 2014

compared with 2013, primarily driven by growth in the individual and stop loss books of business.

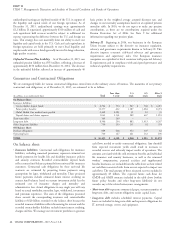

Medical Customers

A medical customer is defined as a person meeting any one of the following criteria:

is covered under an insurance policy or service agreement issued by us;

has access to the Company’s provider network for covered services under their medical plan; or

has medical claims that are administered by us.

Our medical customer base as of December 31, 2015 was higher than 2014, driven by strong overall retention and sales in our targeted market

segments, as well as the acquisition of QualCare Alliance Networks, Inc. on February 28, 2015.

As required by Health Care Reform, we exited the limited benefits business effective December 31, 2013. Excluding this impact, our medical

customer base increased in 2014 compared with 2013, primarily driven by continued growth in our targeted market segments.

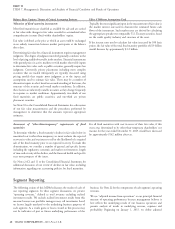

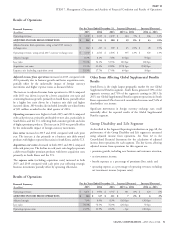

Global Supplemental Benefits Segment

As described in the Segment Reporting introduction on page 48, the performance of the Global Supplemental Benefits segment is measured using

adjusted income from operations. See Note 22 to the Consolidated Financial Statements for the calculation of adjusted income from operations

for each segment. The key factors affecting adjusted income from operations for this segment are:

premium growth, including new business and customer retention;

benefit expenses as a percentage of premiums (loss ratio);

operating expense and acquisition expense as a percentage of operating revenues (expense ratio and acquisition cost ratio); and

the impact of foreign currency movements.

Throughout this discussion and the table presented below, prior period currency adjusted income from operations and operating revenues are

calculated by applying the current period’s exchange rates to reported results in the prior period. A strengthening U.S. Dollar against foreign

currencies will decrease segment earnings, while a weakening U.S. Dollar produces the opposite effect.

50 CIGNA CORPORATION - 2015 Form 10-K

•

•

•

•

•

•

•